Last updated on May 9th, 2021 at 11:24 pm

5% TDS on Net Receipts from Life Insurance Policy

Budget 2019 has brought in some important amendments. One of them is the amendment of Sec 194DA providing that TDS applicable on “income” from incurance company and not the gross proceeds. Let us understand this in detail.

Old Provision:

As per the provision prevalent till 2019, any sum received under a life insurance policy, including the sum allocated by way of bonus on such policy, was exempt under section 10 (10D) other than—

“(a) any sum received under sub-section (3) of section 80DD or sub-section (3) of section 80DDA; or

(b) any sum received under a Keyman insurance policy; or

(c) any sum received under an insurance policy issued on or after the 1st day of April 2003 but on or before the 31st day of March, 2012 in respect of which the premium payable for any of the years during the term of the policy exceeds twenty per cent of the actual capital sum assured; or

(d) any sum received under an insurance policy issued on or after the 1st day of April, 2012 in respect of which the premium payable for any of the years during the term of the policy exceeds ten per cent of the actual capital sum assured:“

As observed in (c) and (d) above, if a sum received during the year, under an insurance policy issued after 1st April, 2003

where the premium paid for any of the years exceeds 20% of the sum assured in respect of the policy and

in respect of policy issued after 1st April, 2012 the premium paid for any of the years exceeds 10% of the sum assured

Then it is not exempt.

Tax Deduction at Source (TDS) Applicability and Mismatch

Accordingly, as per the TDS provision of section 194DA, at the time of payment by the insurance company on such policy, the insurance company is required to deduct tax at source at the rate of 1% on the total amount being paid under the policy including bonus.

However, this TDS was to be deducted on the total amount including premium paid by the policyholder. Whereas the taxpayer in the Income Tax Return was disclosing. a net of the amount received and the premium paid. This resulted in a mismatch of the amount reported in Form 26AS which is a gross amount vis-à-vis amount reported by a taxpayer.

This also created confusion in the minds of few taxpayers on whether to tax the proceeds at the net or gross receipts.

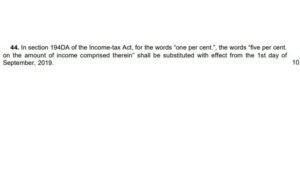

Amendment in Budget 2019 to Sec. 194DA

The Finance (No.2) Bill, 2019 proposed the following amendments to section 194DA which removed all the confusion and mismatch,

- the TDS will be deducted only on “the income component” and

- increase the rate of TDS from the existing rate of 1% to 5% w.e.f. 1st September, 2019

Accordingly, TDS will be applied on the net of the amount being paid by the insurance company including a bonus if any and the premium paid by the policyholder and not on the gross amount.

Further, it has been proposed to increase the rate of TDS from the existing rate of 1% to 5% w.e.f. 1st September, 2019. Accordingly, payment made by an insurance company on or after 1st September, 2019 will be liable for TDS at the rate of 5% on the net amount.

After this amendment, there will be no difference in the income reported by the taxpayer in the return vis-à- vis the amount deducted by deductor reflecting in Form 26AS.

The amendment also clears the confusion prevailing earlier whether the entire amount received under an insurance policy is chargeable to tax or the net amount is chargeable to tax.

Related Posts

- How to do a transaction in Digital Rupee (CBDC-R)? – A Step by step Guide - 10/12/2022

- Can you rectify your 26AS? - 20/09/2022

- Tax implications on Cashback - 09/09/2022

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment