Last updated on April 14th, 2021 at 05:31 pm

How expired medicine will be treated under GST?

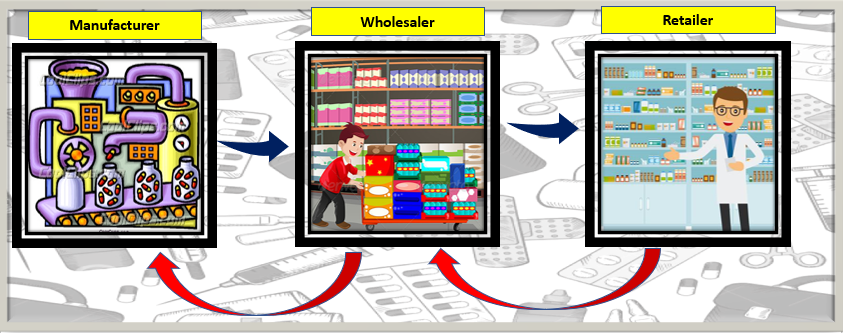

In the pharmaceutical sector, the goods (drugs or medicines) have a defined term of life that is mandatory to be printed and it is called the date of expiry/expiry date. It is illegal to sell the drug or medicine after the expiration date. It is considered that a drug or medicine loses its potency after the expiry date. Generally, the goods (drugs or medicines) in the pharmaceutical sector are sold by manufacturer> wholesaler>retailer. It is common to trade practice to return the expired goods back to the manufacturer.

Supply Chain in the Pharmaceutical Sector

Following questions/concerns have been raise by the pharma industry from time to time after the implementation of GST law.

- What happens of the GST paid on the expired goods?

- Does the input tax credit also expire with the expiry of goods?

- Who is supposed to take the credit of GST paid on goods returned?? (manufacturer/wholesaler or retailer)

- What is the amount of ITC allowed on expired goods?

- Do you need to show the return of expired goods in return?

Circular no. 72 dated 26th October 2018 for GST on Pharma Sector

The retailer/wholesaler can follow either of the procedures for returning the expired goods

(A) Return of time expired goods to be treated as fresh supply:

- Return of such expired goods will be treated as a fresh supply.

- The retailer/wholesaler must return the same by issuing an invoice.

- The value for such goods shall be derived from the value of goods from the original invoice.

⊗ If the person is a registered person(other than a composition dealer)

- A registered person(other than a composition taxpayer) may return the expired goods by issuing a tax invoice.

- Pay tax at the rate applicable as if it were a normal sale transaction.

- The input tax credit of the taxes paid on return supply will be available to the recipient (wholesaler/ manufacturer) if conditions specified in Section 16 of the CGST Act are fulfilled.

⊗ If the person is a composition dealer

- The composition dealer may return the expired goods by issuing a bill of supply.

- Pay tax at the rate applicable under the composition scheme.

- Input tax credit for the taxes paid on return supply will not be available to the recipient (wholesaler/manufacturer).

⊗ If the person is an unregistered person

- An unregistered person may return the expired goods by issuing any commercial document.

- As the person returning the goods is not a registered person, there is no question of tax or input tax credit.

(B) Return of time expired goods by issuing Credit Note:

- Return of such expired goods will be treated as a sales return.

- The manufacturer/wholesaler must acknowledge the receipt by issuing a credit note.

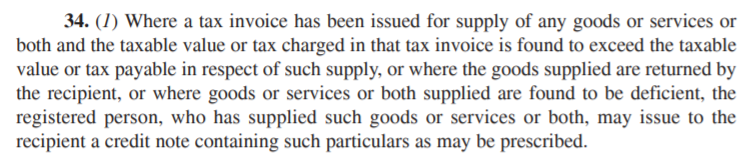

- The credit note can be issued as per provisions of section 34(1) of the CGST Act.

- The retailer/wholesaler must return the same by a delivery challan.

- The value for such goods shall be derived from the value of goods from the original invoice.

- There may be a predetermined fixed time limit up to when such expired goods can be returned which is an understanding between the seller and buyer.

- But as per law, there is no time limit for the issuance of a credit note for such time expired goods.

Adjustment of tax liability depends upon when the goods are returned

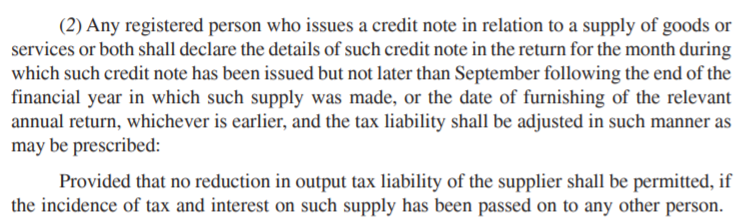

As per section 34(2) of the CGST Act, if the goods are returned back against a credit note, then details of such credit note shall be declared & tax liability will be adjusted in the return of the month in which such credit note is issued.

Such adjustment to tax liability is allowed only

- Due date of September’s month’s return following the end of the financial year in which supply was made or Due date of annual return, whichever is earlier.

- If the incidence of tax and interest on such supply has not been passed on to any other person.

⊗If returned within time frame u/s 34(2)

If the retailer/wholesaler(original recipient) returned the expired goods against a credit note to the wholesaler/ manufacturer(original supplier) tax liability will be adjusted ONLY the retailer/wholesaler (original recipient) had

- Either not availed the input tax credit in respect on such goods or

- If availed has reversed the input tax credit in respect of such goods.

⊗If returned after time frame u/s 34(2)

If the retailer/wholesaler(original recipient) returned the expired goods to the wholesaler/manufacturer (original supplier) then issuance of a credit note is a must.

As the time has elapsed, there is no requirement of declaring the details of the credit note in the return. And no adjustment in tax liability will be permitted.

Section 34(1) & (2) of CGST Act for reference

What does the manufacturer do with the goods returned?

The manufacturer is supposed to destroy such expired goods returned by the retailer/wholesaler. To prevent the misuse/resale of such expired medicines or drugs, they are destroyed as per the guidelines issued by the Ministry of Health and Family Welfare.

How to adjust the ITC of the expired goods?

The manufacturer has to reverse the input tax credit availed as per section 17(5)(h) of the CGST Act for such returned goods(expired medicine & drug).

The amount of ITC to be reversed is the ITC availed from the taxes levied by retailer/wholesaler on such return supply.

Section 17(5)(h) of CGST Act for reference

Note: Amount of reversal is not the ITC that is attributable to the manufacture of such time expired goods. It is the amount of GST which is levied by the retailer/wholesaler on the return of such expired goods.

For e.g., If the manufacturer had availed an ITC of Rs. 20/- at the time of manufacture. At the time of the return of the same goods(but in the expired form) which will come with a fresh invoice having GST of Rs. 15/- from a wholesaler or retailer. So, the manufacturer will have to reverse the ITC of Rs. 15/- when the goods are destroyed.

Related Posts

None found

- Can you buy Immovable Property outside India? - 18/09/2022

- Major Highlights of the Union Budget 2022 - 23/02/2022

- Availing Instant Loans made easy - 05/10/2021

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment