ITC on CSR activities

India was the first country to make corporate social responsibility (CSR) mandatory for big corporates. CSR has always been a topic of debate be it the Companies Act, Income Tax Act, Service Tax Act, or Goods and Service Tax Act.

⊗ Will CSR activity qualify as a business expense or it is a non-business expense???

⊗ Whether expenses incurred on CSR activities will be tax deductible or not???

⊗ Whether input tax credit can be availed on expenditure incurred on CSR activities or not?

Considering the recent amendment made in Union Budget 2023 and we have tried to answer the contentious CSR spending.

Can you claim the ITC of GST paid for expenditure incurred on CSR activities?

Before the amendment

Input Tax Credit is NOT specifically disallowed or blocked or inadmissible for expenditure incurred for CSR activities.

Hence for the specified companies to meet a mandatory obligation and be compliant with the Companies Act,2013 will have to incur the expenditure on CSR activities. Expenditure incurred in this connection shall be treated as used or intended to be used for the furtherance of business. And taxes paid will be eligible as an input tax credit.

Favorable Advance Rulings where ITC has been allowed for CSR expenses

Adverse Advance Rulings where ITC has been disallowed for CSR activities

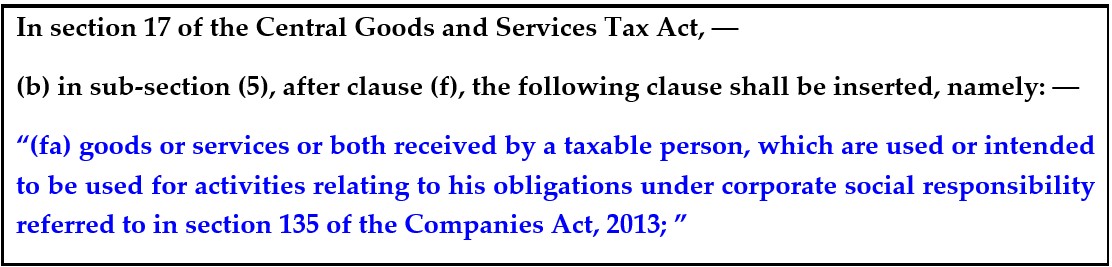

After the amendment

Input Tax Credit will be specifically blocked u/s 17(5)(fa) for expenditure incurred for CSR activities which is a mandatory obligation for specified companies under the Companies Act,2013.

[Note 1: Above insertion of clause (fa) is still a part of the Finance Bill, it will only be effective once it is included in the Finance Act and thereafter it is notified in the Official Gazette]

[Note2: Considering the insertion of the above clause NOW, it should be inferred that there was NO restriction on the availment of ITC on CSR expenses. Unless it is notified as a retrospective amendment which is not likely.]

A snapshot of sub-clause (fa) in sub-section (5) of section 17 of the Finance Bill 2023

Which companies have to incur CSR activities?

As per section 135(1) of the Companies Act 2013, Companies meeting any of the below criteria during the immediately preceding financial year will have to incur specified expenditures on CSR activities.

- Annual turnover of Rs 1000 crores or more

or

- Net worth of Rs 500 crores or more

or

- Net profit of Rs 5 crores and more

What is the minimum CSR expenditure requirement?

As per section 135(5) of the Companies Act 2013, Companies that are covered under section 135 of the Companies Act 2013 have to mandatorily spend at least 2% of the average net profit made during the immediately three preceding financial years.

Is CSR expenditure tax deductible under Income Tax Act,1961?

Expenditure incurred for CSR activities is the application of income and not for the purpose of carrying on business activities. Explanation 2 of Section 37(1) of the Income Tax Act,1961 specifically disallows any expenditure incurred on CSR activities to meet the obligation specified under section 135 of the Companies Act 2013 for arriving at the taxable income of the company.

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment