Last updated on May 11th, 2023 at 11:03 am

E-invoicing under GST

Wherever e-Invoice is applicable, an invoice issued in any other manner shall not be treated as a valid invoice.

E-invoicing is applicable to whom? |What is the turnover limit for e-invoices?

The government has implemented e-invoicing in a phased-out manner. If the annual aggregate turnover crosses the threshold limit in any of the financial years starting from 2017-18 then the taxpayer will be expected to issue e-invoices.

For eg. If the AATO for FY 2018-19 was Rs 11 Crores, then e-invoicing shall be applicable from 1st Oct 2022.

|

Phase |

Turnover Threshold | Effective Date |

| Phase I | AATO > Rs 500 Crores |

1st Oct 2020 |

|

Phase II |

AATO > Rs 100 Crores | 1st Jan 2021 |

| Phase III | AATO > Rs 50 Crores |

1st Apr 2021 |

|

Phase IV |

AATO > Rs 20 Crores | 1st Apr 2022 |

| Phase V | AATO > Rs 10 Crores |

1st Oct 2022 |

|

Phase VI |

AATO > Rs 5 Crores |

1st Aug 2023 |

How to verify whether e-invoicing is applicable to you?

Go to the E-invoicing Portal (Link)

Go to the “Search” menu

Select “e-invoice Status of the taxpayer” from the drop-down list

Enter the “GSTIN of the taxpayer” & “Captcha code”

Click on “Go” to check whether you or any particular GSTIN is supposed to issue an e-invoice or not.

Link – https://einvoice1.gst.gov.in/Others/EinvEnabled

What to do if you are enabled for e-invoicing but you are NOT supposed to generate e-invoices?

Taxpayer’s enablement on the e-invoice portal is based on the turnover declared in GSTR-3B. If by virtue of your business transactions or exemption if you are not supposed to generate e-invoices then ignore the enabled status on the e-invoice portal.

What to do if you are NOT enabled for e-invoicing but you are supposed to generate e-invoices?

If a taxpayer is supposed to generate e-invoices but the status is not enabled on the e-invoice portal. Then a request can be made for enabling the e-invoice portal. [Home page>Registration Menu>e-Invoice Enablement]

How can one generate an e-invoice?

There are three possible ways of generation of e-invoices:

- Integrate your accounting software i.e. API integration

- Use the bulk upload option on the e-Invoice portal

- Generate e-invoices through GePP Portal (Understand the detailed procedure of generating e-invoices on GePP Portal)

Is it mandatory to have a digital signature/DSC for generating e-invoices? | Do I need a DSC for generating e-invoices?

No, a digital signature is not required/not mandatory to generate an e-invoice.

Is e-invoice mandatory for all transactions? | For which transaction e-invoices are not to be issued?

NO

E-invoices should be generated for the following transactions

⇒ For B2B supplies (includes debit note/ credit note/ outward supplies attracting RCM)

⇒ For SEZ supplies

⇒ For Exports (includes Deemed Exports)

E-invoices should not be generated for the following transactions

⇒ For import Bills of Entry

⇒ For high sea sales

⇒For bonded warehouse sales

⇒ For nil-rated supplies

⇒ For wholly exempt supplies

⇒ For non-GST supplies

⇒ For B2C supplies

What is the threshold value for generating an e-invoice?

There is NO threshold value for generating an e-invoice for a B2B transaction. (Like e way bill is mandatory only for movement of goods whose value exceeds Rs 50,000/-)

How many e-invoices can one generate in a month?

There is NO limit for generating an e-invoice for a B2B transaction.

Who is exempted from issuing e-invoices?

E-invoicing will not be mandatory for the following class of taxpayers

⇒ Special Economic Zone unit [includes Free Trade & Warehousing Zones (FTWZ)]

⇒ Goods Transport Agency [GST on GTA w.e.f. – 18.07.2022]

⇒ Passenger Transport Service

⇒ Supplying Services by way of admission to the exhibition of cinematograph films on multiple screens

⇒ An insurance company or a banking company or a financial institution, including a non-banking financial company.

⇒ A government department that is not registered under the GST

⇒ A local authority that is not registered under the GST

⇒ Input Service Distributors

⇒ A registered taxpayer whose annual aggregate turnover does not exceed Rs 20 Crores ( Rs 10 Crores w.e.f. 1st October 2022)

Relevant Rule: Sub-rules (2),(3),(4) & (4A) of CGST Rule 54

Relevant Notification: No. 13/2020, No. 61/2020 & No. 23/2021

Will a tax invoice without IRN be considered valid?

As per Rule 48(4), only a document issued containing an IRN will be considered a valid tax invoice for the taxpayers who are required to issue e-invoices on the Invoice Registration Portal. Non-issuance of e-invoices may also result in blockage of ITC for the recipient.

Note: As per Rule 48(6), An e-invoice need not be issued in triplicate/duplicate.

What is the time limit for generating IRN/e-invoice?

The time limit has specifically not been defined under the provision of the Act or Rules made there under. However, as per Rule 48(5), an invoice will be considered valid only after its registration on IRN.

Can an e-invoice be modified/amended?

An E-invoice cannot be modified/amended once it is generated. If any modification is required it can be done while filing Form GSTR 1.

Note: Information about the amendment/modification shall be flagged to the proper officer.

Can an e-invoice be canceled?

An e-invoice can be canceled within 24 hours of its generation. If any cancellation is required after 24 hours then it can be done while filing Form GSTR 1.

Which document number is to be entered in Table 13 of GSTR 1?

You have to enter the document number (Serial number invoice no.) as per accounting records in the same manner as it was being done before the applicability of e-invoicing. It is practically not possible to enter the IRN(64-digit alphanumeric number).

What declaration needs to be added to the tax invoice for not issuing e-invoices?

Taxpayers who are not issuing e-invoices should add the declaration as per Rule 46(s) in the tax invoice. What declaration needs to be added?

Relevant Rule: Sub-rule (s) of CGST Rule 46

Relevant Notification: No. 14/2020 effective from 5th July 2022

Can I generate an e-Invoice after a few days/months of generating the tax invoice?

Ideally NO. e-Invoice should be generated soon after generating the tax invoice manually or through accounting software. But as of now, the system is not restricting if you generate e-invoices for the previous period also.

What are the penal provisions for the non-issuance of invoices in compliance with provisions applicable for e-invoicing?

Penal provisions as per section 122 shall be levied for non-issuance of invoices in compliance with applicable provisions of the Act & Rules.

As per proviso to Section 122(1) – The taxpayer shall be liable to pay a penalty of Rs 10,000/- or an amount equivalent to the tax evaded or tax not deducted, short paid, short deducted whichever is higher.

As per Section 122(3)(e) – A penalty that may extend up to Rs 25,000/- can be levied.

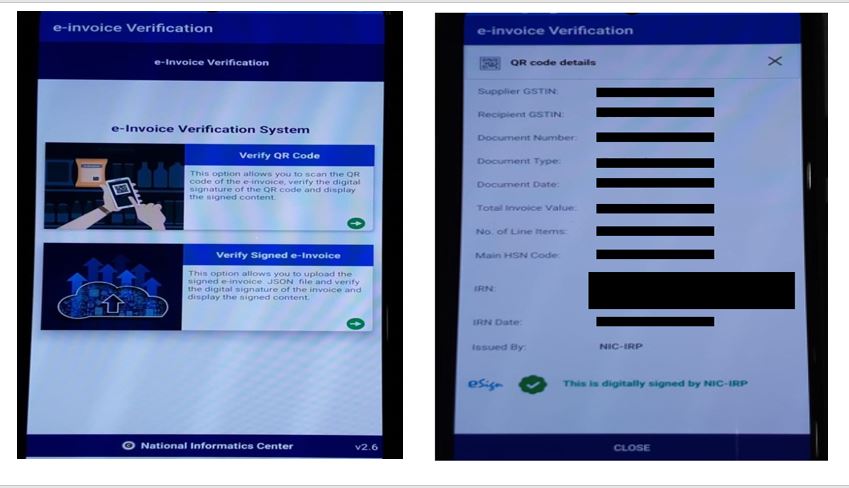

What details can you retrieve by scanning the QR code on the e-invoice? |How can you verify whether the E-invoice issued to you is genuine or not?

Download the QR Code Verification App developed by NIC. The link to download the application will be sent as a text message to your mobile number once you e-verify your number on the E-invoice portal. (Link to verify your mobile number on the e-invoice portal)

The following details of the invoice will be displayed upon scanning the QR code:-

- Supplier’s GSTIN

- Recipient’s GSTIN

- Document No.

- Document Type

- Document Date

- Total Invoice Value

- No. of line items

- HSN

- IRN

- IRN Date

- Issued by

- e-Sign

You may also like

- All the relevant notifications issued by CBIC for the implementation of e-invoicing

-

Declaration for non-applicability of e-invoicing from vendors

- Rule 46(s) declaration in tax invoice for non-applicability of e-invoicing

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment