Last updated on January 3rd, 2023 at 09:36 pm

GST on Rent of Residential Property

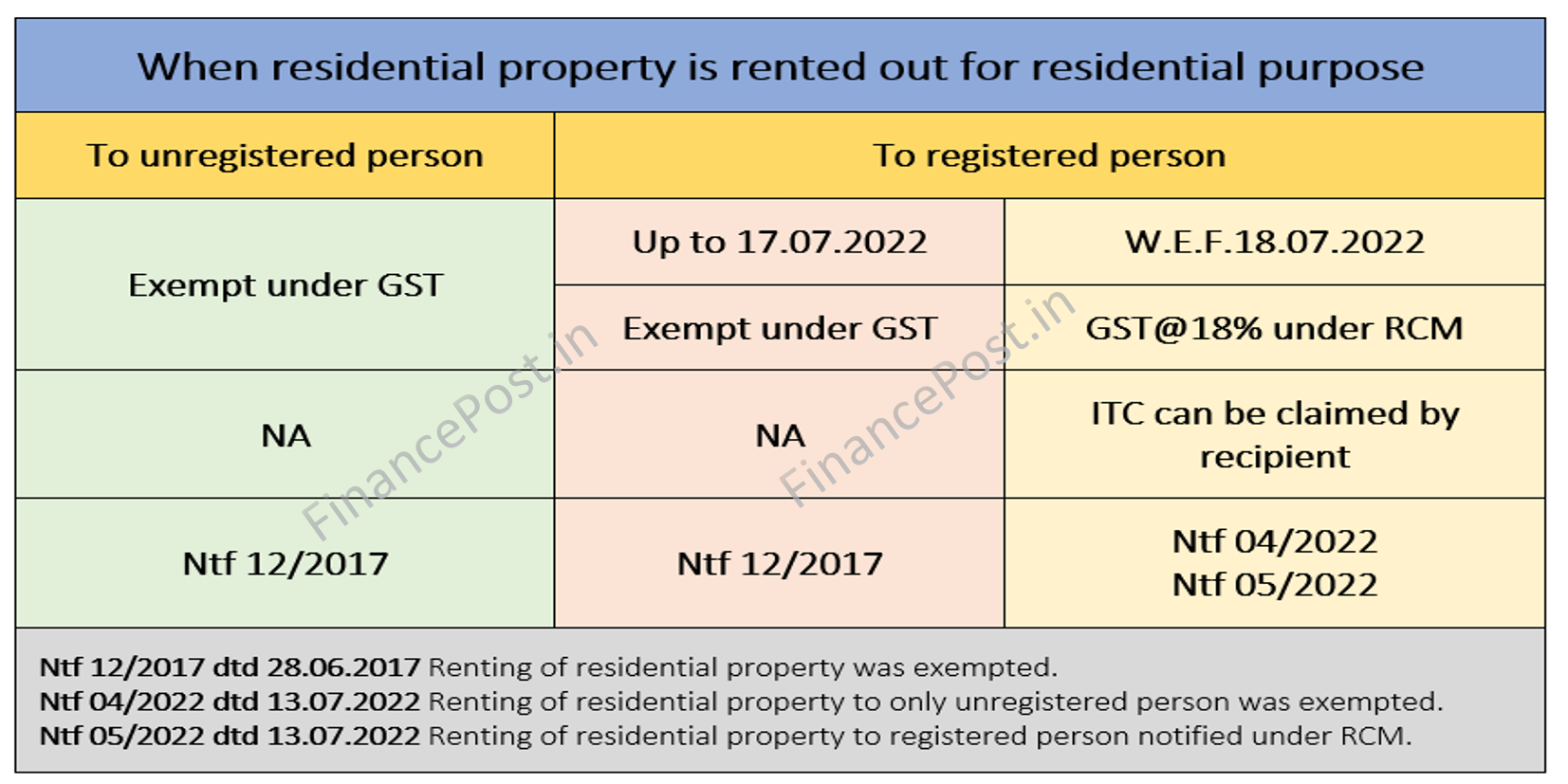

The dynamics of renting residential property under GST have changed from 18th July 2022. The decision to bring the renting of residential dwellings under the tax net was taken in the 47th GST Council Meeting. Renting an immovable property is considered a supply of service and it attracts GST @ 18% (SAC Code – 9963/9972).

Applicability of GST on residential property up to 17th July 2022

GST was not applicable/exempted if the residential property was rented out to any person (whether a registered or unregistered person under GST) up to 17th July 2022.

- Liability to pay GST did not arise as it was specifically exempted vide CGST (Rate) Notification no. 12/2017 dated 28.06.2017

Applicability of GST on residential property w.e.f. 18th July 2022

GST will be applicable if the residential property is rented out to a registered person under GST w.e.f. 18th July 2022.

- Liability to pay GST @ 18% under the reverse charge mechanism will arise on the recipient(tenant).

- The exemption has been withdrawn vide CGST(Rate) Notification no. 04/2022 dated 13.07.2022.

- Same has been notified under RCM vide CGST(Rate) Notification no. 05/2022 dated 13.07.2022.

GST will continue to be exempted (not applicable) if the residential property is rented out to an unregistered person under GST w.e.f. 18th July 2022.

- Liability to pay GST will not arise as it continues to be specifically exempted vide CGST (Rate) Notification no. 12/2017 dated 28.06.2017

Impact on Landlord of Residential Property [If the tenant is registered under GST]

If the supplier (landlord/lessor) is registered under GST, then rent income will be shown as outward supplies liable to be taxed under the reverse charge mechanism. Liability to pay GST is on the recipient(tenant/lessee) hence no additional GST liability. As per section 17(2), there arises no question of availing of the input tax credit as the outward supply is liable to be taxed under RCM.

Note: Earlier the same was shown as an exempted supply in Table 8 but w.e.f. 18th July 2022 it will be shown as B2B supply attracting RCM in Table 4.

If the supplier (landlord/lessor) is not registered under GST, the Liability to pay GST is on the recipient(tenant/lessee) hence no additional GST liability or any compliance under GST.

Impact on Tenant of Residential Property [If the tenant is registered under GST]

When a tenant is registered and takes a residential property on rent from any person (registered or unregistered person) GST will be applicable under RCM. Liability to pay GST @ 18% will be of the recipient (tenant/lessee) of service. The recipient will also be able to claim the ITC of the GST paid under reverse charge as the payment of rent will be a business expenditure and the same is not included in the list of blocked ITC u/s 17(5).

Scenario 1 – When a company, LLP, Firm, AOP, BOI, etc takes a residential dwelling for the purpose of residence on rent for employees it will be considered as an item of business expenditure. GST will be paid under RCM and the ITC of the GST paid under reverse charge can be claimed.

Scenario 2 – When a composition dealer who is registered under GST takes a residential dwelling for the purpose of residence on rent then it will be considered as an item of business expenditure. GST will be paid under RCM but the ITC of the GST paid under reverse charge cannot be claimed as per section 10(4) by a composition dealer.

Scenario 3 – When an individual who is registered under GST as a proprietorship concern takes a residential dwelling for the purpose of residence on rent for himself/herself/family then it will be considered as an item of personal expenditure and not the business expenditure of a proprietorship concern. GST will be paid under RCM but the ITC of the GST paid under reverse charge cannot be claimed as it is blocked per section 17(1). It is advisable for individuals to not take residential property on rent in the name of the business (proprietorship concern) to avoid GST liability.

Refer – Delhi High Court Order in the case of Seema Gupta vs Union of India dated 27.09.2022

If an individual takes it for its own purpose on his own account and not for the furtherance of the business(who is proprietor) it will not be covered by the RCM provision.

Scenario 4 – When a residential dwelling is taken by a registered person on rent for commercial purposes it will be treated at par with the commercial unit. If the landlord is unregistered then GST shall not be levied and paid by either the landlord or the tenant. If the landlord is registered GST will be charged on a forward charge basis and the recipient can take the ITC of the same.

Gist of GST on Rent of Residential Property

Renting of Residential dwellings for residential use |

|||

|

Landlord |

Tenant | GST |

ITC |

|

Unregistered |

Unregistered | No GST |

NA |

|

Unregistered |

Registered | GST under RCM |

ITC can be claimed if the property is taken on rent for the furtherance of business |

|

Registered |

Unregistered | No GST | NA |

| Registered | Registered | GST under RCM |

ITC can be claimed if the property is taken on rent for the furtherance of business |

|

Composition taxpayers shall not be allowed to take ITC as they pay tax at prescribed lower rates. |

|||

|

Taxpayers who have opted for special concessional rates where ITC is not allowed For e.g. GTA @ 5%, Restaurant @5%, Bricks business @6% etc |

|||

|

Taxpayers where inverted duty structure is applicable. |

|||

|

If the taxpayer is registered as a proprietorship concern and used it for personal residential use then ITC shall not be allowed. But if the proprietor takes it on rent for its employees that would be considered as furtherance of business and hence shall be allowed to take credit of taxes paid under RCM. |

|||

|

Whether a registered taxpayer will be allowed to take the credit of taxes paid under reverse charge will depend upon the rent agreement, actual usage of the property, type of taxpayer etc |

|||

Excerpt from notifications for your ready reference

Notification 15/2022 dated 30th December 2022

|

Sr. No. |

HSN/SAC | Description of services | Rate | Conditions |

|

12. |

Heading 9963 or Heading 9972 |

Services by way of renting of residential dwelling for use as a residence except where the residential dwelling is rented to a registered person. Explanation. – For the purpose of exemption under this entry, this entry shall cover services by way of renting of residential dwelling to a registered person where, – (i) the registered person is the proprietor of a proprietorship concern and rents the residential dwelling in his personal capacity for use as his own residence, and (ii) such renting is on his own account and not that of the proprietorship concern. |

Nil |

Nil |

Notification 05/2022 dated 13th July 2022

|

Sr. No. |

Category of Supply of Services | Supplier of service |

Recipient of Service |

|

5AA |

Service by way of renting of a residential dwelling to a registered person | Any person |

Any registered person |

Notification 04/2022 dated 13th July 2022

|

Sr. No. |

HSN/SAC | Description of services | Rate | Conditions |

|

12. |

Heading 9963 or Heading 9972 | Services by way of renting of residential dwelling for use as a residence except where the residential dwelling is rented to a registered person | Nil |

Nil |

Notification 12/2017 dated 28th June 2017

|

Sr. No. |

HSN/SAC | Description of services | Rate | Conditions |

|

12. |

Heading 9963 or Heading 9972 | Services by way of renting of residential dwelling for use as a residence | Nil |

Nil |

Author’s Note

For me, it is difficult to understand, how the above amendment of taxing of renting of residential dwellings when used by a registered person going to benefit the Government. When tax is paid under reverse charge it is given from one hand and taken back from another hand nothing actually goes into Government’s kitty. In my opinion, unless the reporting by the recipient paying tax under RCM changes, the Government is not going to reap any fruits/ or say curb tax evasion.

You may also like:

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

the recipient will also be able to claim the ITC of the GST paid under reverse charge as the payment of rent will be a business expenditure.

How the payment of rent of residential house for personal use of the proprietor a registered dealer, will be considered as business expenditure

In my opinion, no proprietor will take a residential unit for residential purpose in the name of a proprietorship business.

It will always be taken in the individual’s capacity (unregistered) and will not be shown as a business expenditure too. Hence there arises no question of paying GST under RCM and taking ITC on the rent paid.

Sorry to say but it’s not written any where in the notification that in the name of proprietorship firm it’s for any registered person.

We agree with the fact that it is not specifically mentioned in the notification. But it is our interpretation of the statute, it may have ambiguities.

I am having a pagdi system flat on rent in mumbai which is name of my father who is deceased 23 years back,I am not regd in gst as no business but self employed individual,does gst have to be paid or charged by landlord

No

It will be considered as personal expenditure

I gave my shops and building for hospital purpose for rent. I am a GST registered person.

Shall I have to pay GST or tenant will pay.

It is a commercial property and used for commercial purposes. You have to charge 18% GST on rent to the tenant and pay the same to Govt.

I, am registered with gst as a proprietor of my firm, i hv given on rent,my flat, my tenant is not registered with gst, do i hv to collect gst fr tenant & pay to govt.

If its a residential property and given for residence to an unregistered person. GST on rent will not be applicable.

Thanks, for yr guaidence, regards

You are welcome.

I am registered as a consultant in GST in my individual capacity as a consultant providing engineering consultancy.I am alone without any company or staff.

My business address is own house.I don’t own any commercial property anywhere.

Now if I go to another city to work as a consultant and take a house on rent there for my own stay/ Residential purpose for a short duration of 6 months, am I liable to pay GST on the rent paid?

I have no company( no propreitorship) as such,only in my individual name I have registered for GST.

Also is a propreitor same as an individual name registered under gst?

In my opinion, it will be a personal expenditure. And you will not have to pay GST on the same provided you are taking it on rent without providing your GST number.

I have get home on rent from last three years the owner of property is NRI

I have to pay gst

If you are registered under GST and have taken the home on rent in the name of your business providing GST number. Yes you will have to pay GST under RCM and you will not be able to claim the ITC.

I believe you would have taken it on your personal name. In that case you there is no GST liability. Hope that clears your doubt.

If a person is registered as a consultant with GST, then if he takes a house on rent for self residential stay,then what is the gst treatment? The person is gst registered but doesn’t have a company or staff.

In our opinion, if you take as a GST registered consultant providing your GST number – Yes you will have to pay GST under RCM and note you cannot claim the ITC too.

if you take in your individual capacity (unregistered person) then that is specifically exempted under notification 12/2017

I have just asked question, my name patel d. K at 11.49 a. M, pls just add their my flat is on my personal name & not on my proprietor firm.thks, regards

No GST will not be applicable.

A GST registered company has taken a house on rent/lease for residence of his employee @ Rs 31,000 per month payable on 1st date of each month in advance. The lease agreement was executed on 01.03.2022 i.e. before 18.07.2022. Rent is being paid in advance on 1st date on monthly basis.

Whether GST is applicable on the company as the house was taken on rent before 18.07.2022 (which is applicability date of the GST on rent).

If GST still applicable, then how much GST to be paid for July 2022 – i.e. on entire monthly rent (Rs. 31,000) or for period from 18.07.2022 to 31.07.2022 (Rs 14,000) or not at all for July month ‘s rent.

It may be noted that rent for July month was already paid on 1st July i.e. 18.07.2022.

So 2 questions:

1) Whether GST applicable at all for house taken on rent by company by executing rent agreement before 18.07.2022.

2) If answer of above question is ‘yes’, then GST applicable for July month’s rent.

1. Yes GST will be applicable and the company will have to pay GST@18% on RCM. The date of execution of the rent agreement is not relevant.

2. If July’s months invoice and rent has already been paid then GST shall not apply to July’s rent. But going forward i.e from August ABC Company will have to pay GST@ 18% under RCM.

Hope that clarifies your doubt. If you have any further query you can write here or alternatively reach out to us at info.financepost@gmail.com

Thanks for reply. Could you please further clarify whether the Company can claim Input Tax Credit for the GST on the lease accommodations for employees.

Yes they can

Property ki spelling to theek likh lo iss website par

Thank you for drawing our attention the mistake has been rectified.

Sir,

I am a proprietor of XXXXX industries and my GST no. XXXXXXXXXXXXX and doing of business of manufacturing of corrugated boxes,gum,and commercial building rent.I have 4 commercial building,and 5 residential houses,Now I am raising b2b invoices for mfg products and commercial buildings all are havings gst.I did not raise any invoice to unregistered house tenants.

Please clarify wheather can I raise exempted invoices for house tenants those not having GST

Awaiting your reply

Thanks

RAJENDRAN A

XXXXXX

Hello Rajendra Ji,

As this is a social platform, your personal details have been marked with XXXX is your query above for safety concerns.

Yes, you can raise exempt invoices for residential property rent given to unregistered tenants.

Hope that answers your question.

Does boy/girls hostel and PG accomodation comes under this GST

It is a commercial activity on a residential property. So if the landlord is registered they ll charge you on FCM @18% on rent. If the landlord is not required to be registered then no GST.

Sir, in our case, the landlord is not registered person, His residential property is taken on Rent for office, and we deduct TDS on Rent as applicable. What is the status on GST now. Shall we have to pay GST under RCM?

Sir in our opinion the transaction shall not be taxable under RCM.

But there are multiple opinions claiming that if a residential property is taken on rent by a registered person irrespective of use it will be taxed under RCM. A legal clarification from Govt on the above will help the taxpayers at large.

It is better if the GST on rents is kept at 1% or less. It can be used for cross verification.

1% slab does not exist.

If the rent is reimbursed to the employees( not HRA), instead of direct payment to the landlord, is RCM applicable?

It depends upon your agreement with the landlord. Based on the limited information provided above GST will not be applicable.

I am a retired person owning a house. Iam not registered under gst. There are some shops in the front which I have let out. Will I have to collect gst and remit it to govt.

It is a commercial activity. If your aggregate turnover exceeds Rs 20 lakhs then you are required to register and charge GST from the tenants collect and remit it to the Govt.

In Scenario 2 you have written that if a person registered as a composition dealer takes a residential property on rent it will be a business expenditure, how is taking a residential property on rent a business expenditure ?

If we can avoid paying GST under reverse charge on Residential Property just by not stating our business name though the individual is registered then why would the government would have brought such a ludicruos amendment ? My interpretation is that if the individual is registered under GST and he takes Residential property on rent then he will be liable to pay GST irrespective of whther he has taken in individual or business name ?

Respect your opinion.

Litigation is caused by different interpretations of the same law.

rent agreement (residential property for commercial purpose) registered on 17th july. will GST be applicable on future rent payables ? or agreements registered from 18th july will have the gst liability?

Residential property given for commercial purposes becomes a commercial transaction and will attract GST @18% on the forward charge basis if the landlord is registered under GST.

in case landlord of commercial property is not registered , is GST applicable ?

In our opinion, No it will not be applicable.

Government simply wants to show GDP growth with such kind of steps…

This Govt is just trying to create a fake picture of Growth in the country.

Disgusting

If we are operator, managing property on behalf of the owner. The agreement is between tenant and owner but rent is collected by operator. Amount is then divided between owner and opertor based on share. in that case will the gst has to be paid on full amount

Depends upon how your rent agreement is structured and actual facts of the case.

Hi, I have taken two floors on rent for my own personal family purpose… and both the rental agreements are in my name and my wife’s name… however we do have an individual proprietor firm’s registers under GST… but our rent agreements are on our personal names so in that case do we need to pay the GST to our Landlord

No.

I am a central govt employee and live in a rented house. I pay my rent via online transaction into the owner’s bank account. I also avail of IT exemption for the rent paid using the owner’s PAN and rent agreement with my office. The owner is a businessman and registered under GST. Now he is saying that I have to pay him in cash and can’t avail the tax exemption. As per him, If I continue to pay him in his bank account and claim IT exemption on HRA, then I have to pay 18% GST to him also. Is he right? And if yes, what do I have to do in this scenario?

No GST applicability is only when the tenant is registered under GST and is renting a residential dwelling for residential purposes.

There is a lot of confusion in the market, owners and landlords need not worry at all, there is no GST applicability to them. It is the tenant who has the GST impact if at all.

I have one commercial property for which GST registration was done and paying 18%GST for this Commercial property, apart from this I also have another residential property, which is given to an individual, earlier it was not subject to GST. I have two GST registrations now one for individual in my name for rent purpose and second one jointly for partnership business firm. What will be its effect now?

One commericial property on rent – GST @ 18% on FCM

One residential property on rent

> If to a registered person – GST @ 18% on RCM

> If to an unregistered person – No GST

Thank you so much for clarifying

Glad we were able to help you. For any queries, you can reach out to us at info.financepost@gmail.com

Govt. Wants many landlord are eligible for income tax but they hide and not paid may be for these trying to Landlords under incometax net.

If Landlord is individual ( not registered underGST) and give his commercial property as office to Bank or PSU or to shop on rent if tentant is registered Under GST what will be effect,Landlord has to collect GST@18% and pay to Govt. Or Tenent has to direct pay GST and get reverse movate against paid GST?

Here Landlord having other business income as director of their company landlord income is more then 20 Lakh ( but rent income is not exceed 20 Lakh) what will be GST effect on landlord and Tenant who had registered Lease agreement?

If company ( GST Registered) give resi. Facility to Employer and enter in lease agreement and pay lease direct to individual Landlord of resi. Property what will be GST effect on Landlord and company who has get resi.glat for their employee accommodation as home.

Yes the intention of Govt would be to bring landlords collecting rent under the tax ambit. But unless the registered person reports in the GST return with PAN details in case of unregistered and with GSTIN in case of registered which is not possible in the current format of GST returns.

If a commercial property is given by an unregistered person then GST will not be applicable (if the threshold does not exceed required for registration in the case of the landlord). So if you take a commercial property on rent from an unregistered person you pay only rent. If you take it from the registered person you pay rent+gst and claim the ITC of GST paid.

If a registered company takes a residential property for its employees then the company will have to pay under RCM and the GST paid can be claimed as ITC. (Landlord is registered or unregistered doesn’t affect the GST liability of the tenant(company in your example).

Hi.. If a LLP firm registered under GST takes an residential property on rent from a Unregistered individual person for its office purpose at a monthly rent of Rs. 16000 then what is the position of GST under old vs new scenario wef 18.07.2022

Residential property for residential purposes is covered by the latest amendment.

Residential property for commercial purposes will be chargeable to GST under forward charge if the landlord is registered and if the landlord is not required to obtain registeration then there will not be any GST applicability.

Hi, I have a residential property which I am leasing out to a registered company. Will I have to charge GST if my income exceeds 20 lakhs per annum?

Hello if your income falls under the definition of aggregate turnover as per GST. Then you would be required to obtain GST registration and file GST returns. In case of residential property on rent to a registered person, GST liability is on the tenant and not the owner/landlord.

Can the Registered Person (Pvt. Company) claim GST Input credit for Residential premises obtained by it on a contract for its particular employee ? This seems to get covered under specific disallowance under Section 17(5) of the CGST Act viz Personal consumption.

For a Pvt. Company, it is not a personal expenditure.

WHAT IS THE SCENARIO ON COMERCIAL PROPERTY RENT

IF WE TAKE COMMERCIAL PROPERTY ON RENT AND OUR LANDLORD IS UNREGISTED , HIS TUROVER IS LESS THAN 20 LACS , IS RCM APPLICABLE IN THIS CASE

No

Hey,

I am a gst registered for a pvt ltd company, the company address is registered under rented home address. Owner is not a gst registered.

Does the GST is applicable?

Residential property has been taken on rent for commercial purposes. In that case, GST will be applicable on forward charge, only when the landlord is registered under GST

I am a salaried person have leased my residencial property to a salaried person will i have to charge him the gst and pay it to the government

No, you need not charge GST on it. Nor the tenant in your case will have to pay GST under RCM. I am assuming you both are only salaried employees and not registered under GST.

Whether GST applicable on rent agreements executed before 18.07.2022?

If yes, whether GST applicable for July month, which was paid on 01.07.2022 (I e. before 18.07.2022. If yes, then GST applicable on rent of entire July month or on proportionate rent for 18 July to 31 July 2022.

Hi. I am registered person in Maharashtra but not registered place of business in other state say Karnataka. Now, im planning for renting of residential property in Karnataka (bangalore). So, in this case i’ll be considered as Registered person or unregistered for purpose of paying GST under RCM?

Could you elaborate on your query?

You are taking property on rent in Bangalore for residential purposes right??

I am living in a co-living property but I am an unregistered person as per GST law(salaried person). Do I need to pay GST on top of my rent?Kindly confirm

No, you don’t have to pay GST.

What is the maximum amount is GST for Residential property rent is applicable for owner

There is no threshold for levying GST on the rent of the residential property. If the applicability of GST is established then GST shall be levied even if the rent is 1000 rs

For example if a residential property is taken on lease or rented out by a business entity/registered person and they sub rent it to an unregistered person for residential purpose. Who is liable to pay the GST in this scenario? Or are they even liable to pay GST?

Thanks for the article! There is still very much ambiguity in the notification but your article portrayed a clear picture of it.

If a residential property is rented out for residential use/purpose to a registered person, GST will be payable by the registered person(tenant) under RCM.

i will have income of 15 lakhs in FY22-23 from renting of residential property to unregistered company for sub leasing to individuals for residential use . i will also have rental income of 15 lakhs from commercial property from registered company in FY 22-23 . shall i need to get registered in gst .

Your total income exceeds Rs 20 lakhs you will be required to obtain GST regsitration.

Great article with helpful information.

Thank you so much. Glad that you liked the information

Hi.. If a Pvt. Ltd. (OPC ) company registered under GST takes a residential property on rent from a Unregistered individual person for its office purpose at a monthly rent of Rs. 1000, then what is the position of GST under old vs new scenario wef 18.07.2022?

Post 18.07.2022 – If a registered person takes a residential property on rent from an unregistered person for residential use. GST is to be paid on RCM basis.

If it is for office purpose (commercial use not for residential use) then GST is not to be paid on RCM basis.

If it is for residential use then 180 rs is to be paid for GST on RCM basis as the landlord is unregistered.

Hello ma’am! A CA Final student, here.. The provision is rather small, but the intricacies involved in it are very complex and tricky.. Just like GTA, this is one of the trickiest provisions and yet, you have managed to break it down in a much simpler way. Thanks!!

This is my understanding of the provision on the basis of the article. Please do rectify, if there are any mistakes in them.

1) A regd. Person (Company) takes a residential property on rent for providing residential accomodation to employees – RCM shall apply here. And it can also avail ITC on the same.

2) A regd. Person (Company) takes a residential property on rent for office premises, which is to be treated as a commercial property – So GST shall be payable by the landlord under FCM (provided he exceeds the turnover limits) and the company can also avail ITC.

3) A regd. Person who is an individual, takes a residential property on rent for providing residential accomodation to employees – RCM shall apply here and ITC can also be availed.

4) A regd. Person who is an individual, takes a residential property exclusively for his personal purpose. So, since it is not in the furtherance of business – no RCM shall apply and also no FCM shall apply here.

5) But the most confusing part is w.r.t registered persons who are individual proprietors such as CAs, service professionals and consultants who take the residential property on rent in their own name and use it both as their residence and also for commercial purposes. Request you to please throw light on what would happen here.. And also how would ITC be taken here..

Thanks!!

Glad you have inferred all correctly that means it is self-explanatory.

For 5th point – I totally understand how proprietors take residential property on rent which they use for residential purposes as well as for commercial purposes. Especially after the concept of work from home, everyone who takes residential property for residential purposes will be using it for both commercial as well as residential purposes. It will defer from case to case basis, there cannot be one plain answer for this we need to look into many factors like a rent agreement, electricity meter, etc.

Thank you ma’am! So, if he uses it both for his personal purpose and also as his office premises, but claims the entire rent paid as a business expenditure, Will he be liable to pay GST under RCM? Or will it be in the nature of a commercial property? The landlord, of course would’ve let it out, purely for residential purposes and would rather want the recipient to pay GST under RCM, than show it as a commercial property, even though, it isn’t one. What would happen here ma’am, from the legal POV? Where both of them are reluctant to pay GST either under RCM or FCM. And in either case, how would ITC be availed by the recipient, ma’am?

When you use it for both purposes despite the rent agreement stating it is for residential purposes then legally you are not allowed to claim it as business expenditure. And that answers all your questions.