50th GST Council Meeting

Last updated on October 7th, 2023 at 03:38 pm50th GST Council Meeting The 50th GST Council Meeting was held on 11th July 2023 in New Delhi under the Chairmanship of Finance Minister Nirmala Sitharaman. The […]

Last updated on October 7th, 2023 at 03:38 pm50th GST Council Meeting The 50th GST Council Meeting was held on 11th July 2023 in New Delhi under the Chairmanship of Finance Minister Nirmala Sitharaman. The […]

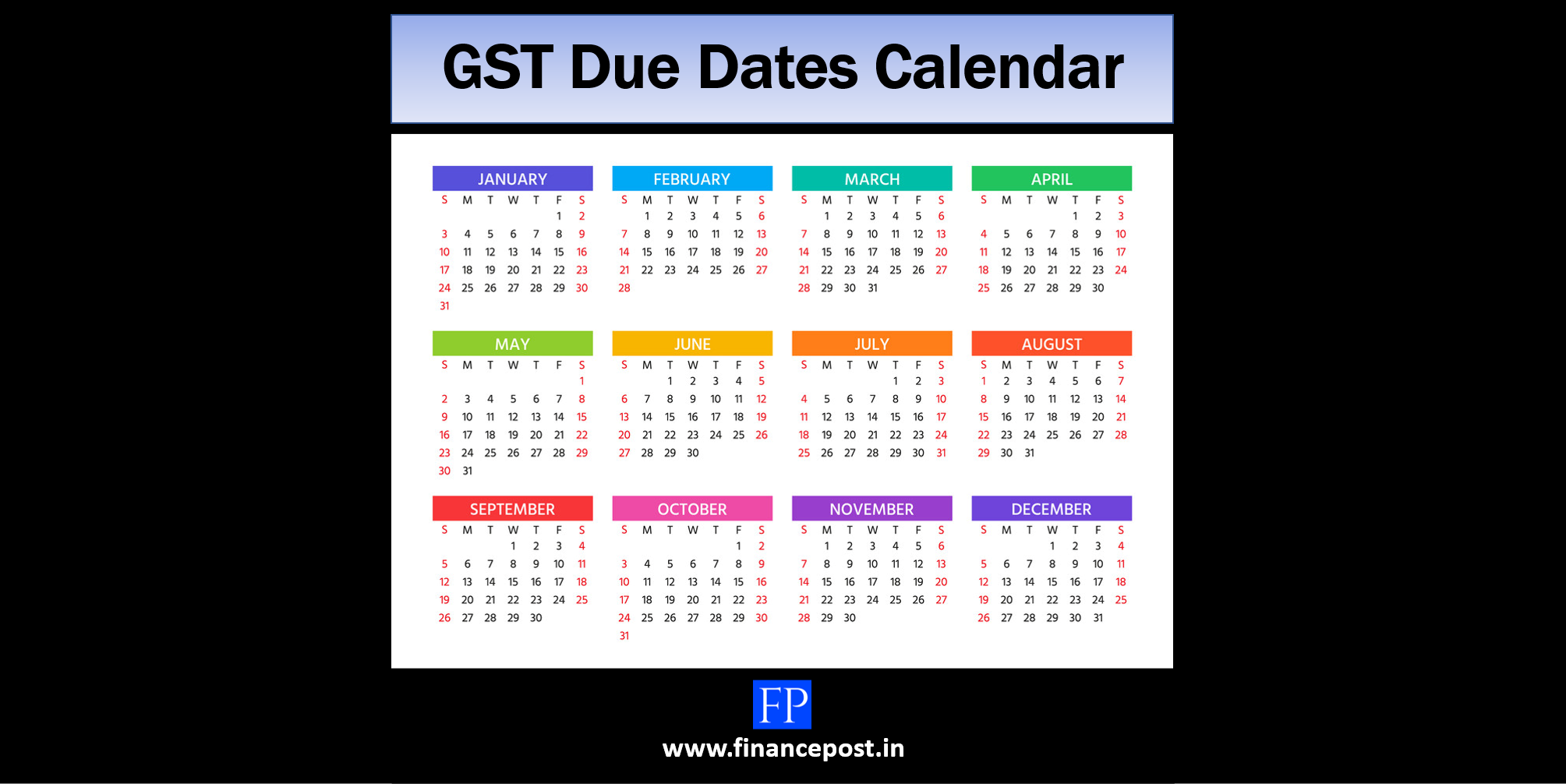

Last updated on September 24th, 2023 at 07:55 pm GST Due Dates Calendar Compliance calendar for the month of October 2023 [su_table] Date GST Return & Payments 10.10.2023 Monthly GSTR 7 for September 2023 (TDS deductor) […]

Last updated on April 13th, 2023 at 01:38 pmGST sections amended in Finance Act 2023 Around 27 amendments in the GST Acts which include omissions, insertions, and substitutions were made through Finance Bill 2023 and […]

Last updated on March 29th, 2023 at 04:31 pmGST checklist with the onset of FY 2023-24 Based on provisions and rules under the GST regime, there are certain to-dos that need every taxpayer’s attention before […]

Last updated on April 4th, 2023 at 03:54 pmGSTR 10 Final Return (Form GSTR 10) GSTR 10 is the Final Return to be filed by the person who has surrendered the registration or registration has […]

Last updated on March 1st, 2023 at 03:59 pm49th GST Council Meeting The 49th GST Council Meeting was held on 18th February 2023 in New Delhi under the Chairmanship of Finance Minister Nirmala Sitharaman. This […]

ITC on CSR activities India was the first country to make corporate social responsibility (CSR) mandatory for big corporates. CSR has always been a topic of debate be it the Companies Act, Income Tax Act, […]

Last updated on February 7th, 2023 at 04:10 pmGentle reminder! Apply for fresh LUT for FY 2022-23 Option for renewal of LUT for FY 2023-24 has been activated on the GSTN portal A letter of […]

Last updated on December 22nd, 2022 at 03:12 pm48th GST Council Meeting The 48th GST Council Meeting was held on 17th December 2022 via video conferencing under the Chairmanship of Finance Minister Nirmala Sitharaman. The […]

Last updated on December 3rd, 2022 at 07:12 pmGST Annual Return Due Dates Financial Year 2021-22 The due date for furnishing GST Annual Return in FORM GSTR-9 & self-certified reconciliation statement in FORM GSTR-9C for […]

Copyright © 2024 | MH Magazine WordPress Theme by MH Themes