Last updated on May 9th, 2021 at 12:05 pm

ULIPs or Mutual Funds?

Where to invest? ULIPs or Mutual Funds? This is an age-old question and the answers to it are different depending on the market scenario. With the insertion of Sec 112A to the Income Tax Act 1961, the question is getting asked again. Many insurance companies are selling ULIP Plans aggressively saying that ULIPs rank better. Is this true? Let’s compare them on 3 main parameters:

Nature of Investment

Unit Linked Insurance Plans are popularly known as ULIPs. These are insurance plans in which the insurance companies invest our premium paid into the equity and money market through a mix of equity, debt or balanced schemes.

The premium can be paid either lump sum or annually or on monthly basis.

The lock-in period of ULIP schemes is for 5 years.

Insurance cover is an added benefit of these schemes.

Equity-oriented Mutual funds invest the money invested in the equity market.

Investment in mutual funds can be made only in the equity market in lumpsum / annually or monthly using the Systematic Investment Plan (SIP) option.

Equity mutual funds generally do not have a lock-in period except in an ELSS or Equity-linked savings scheme. The lock-in period of ELSS is 3 years after which the investor can redeem the funds.

Risk vs Rewards

Equity markets are highly volatile in nature but the returns on investment in the equity market have the potential to multiply exponentially. Many mutual funds have experienced returns more than the indices.

Debt/Money market, on the other hand, are less volatile and can offer positive returns, hence less risky. However, the returns earned in debt mutual funds are comparatively lower.

From the Risk and Reward perspective, ULIPs rank better. ULIP plans with allocation ratio offer the investors to decide their allocation percentage into the equity market and debt market. Using this facility, investors can switch the entire or certain percentage from equity funds to debt funds and vice versa. Additionally, it offers life insurance cover 10 times the annual premium for those aged below 45 years.

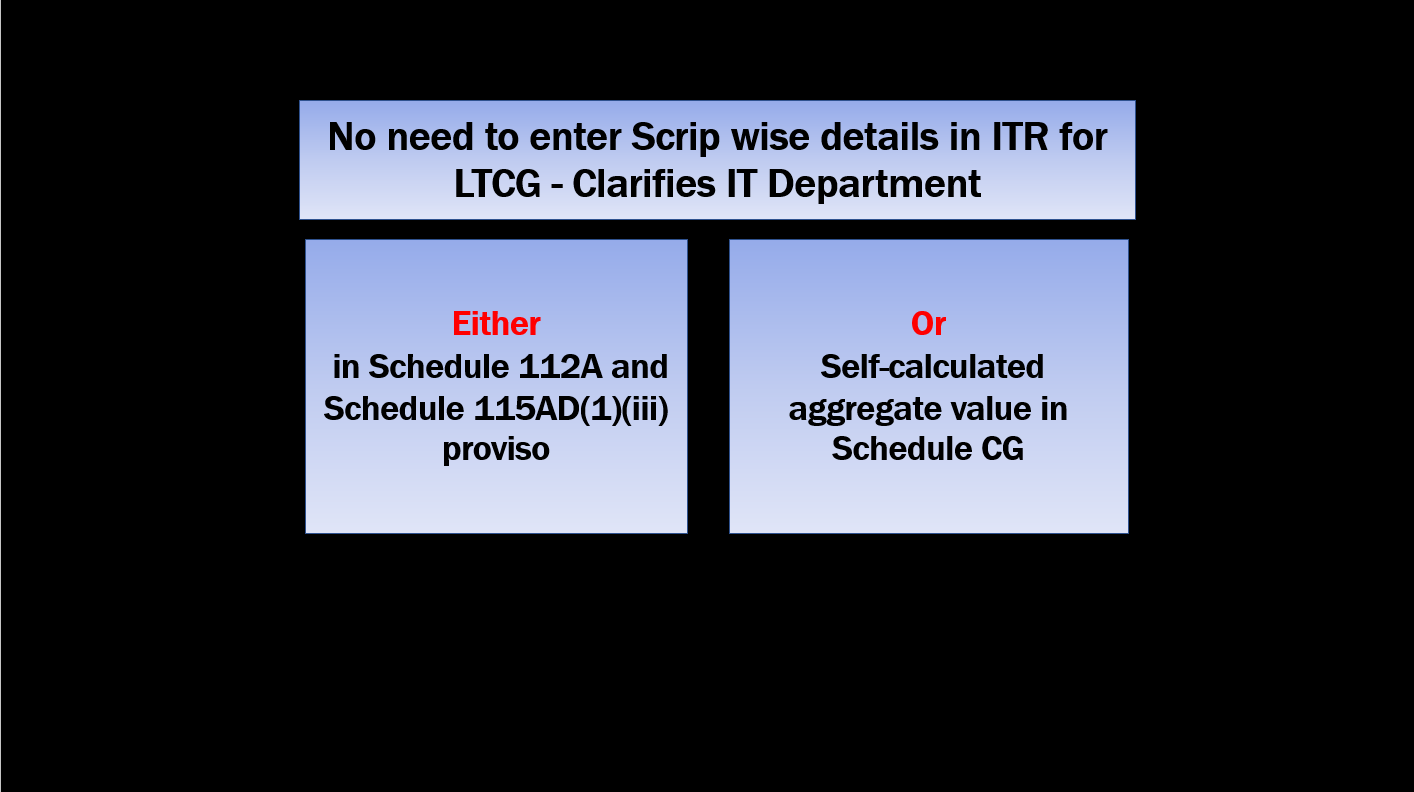

Tax Benefit

ELSS schemes offer tax benefit u/s 80C of the Income-tax Act. Hence an individual or HUF can claim a tax deduction of Rs 1.5 lacs p.a. However, with the introduction of Sec 112A in Finance Act 2018, the returns earned on the Equity oriented mutual funds are taxed at 10% as Long-Term Capital Gains

ULIPs, on the other hand, get the dual tax benefit. An individual can claim a tax deduction of Rs 1.5 lacs p.a u/s 80C. At the same time, the Finance Bill is silent about the taxation on the returns of ULIP. Hence there is no tax on the returns earned on ULIPs.

Conclusion

On the tax benefit and risk/reward criteria, ULIPs certainly rank better investment categories for individuals. However, before investing in ULIPs one should clearly understand the terms and conditions of the policy and make an informed decision. One should look at the flexibility to change the allocation, expense ratio of funds and ULIPs, long-term lock-ins, tax benefits, etc before making the investment.

Related Posts

- How to do a transaction in Digital Rupee (CBDC-R)? – A Step by step Guide - 10/12/2022

- Can you rectify your 26AS? - 20/09/2022

- Tax implications on Cashback - 09/09/2022

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment