Income Tax

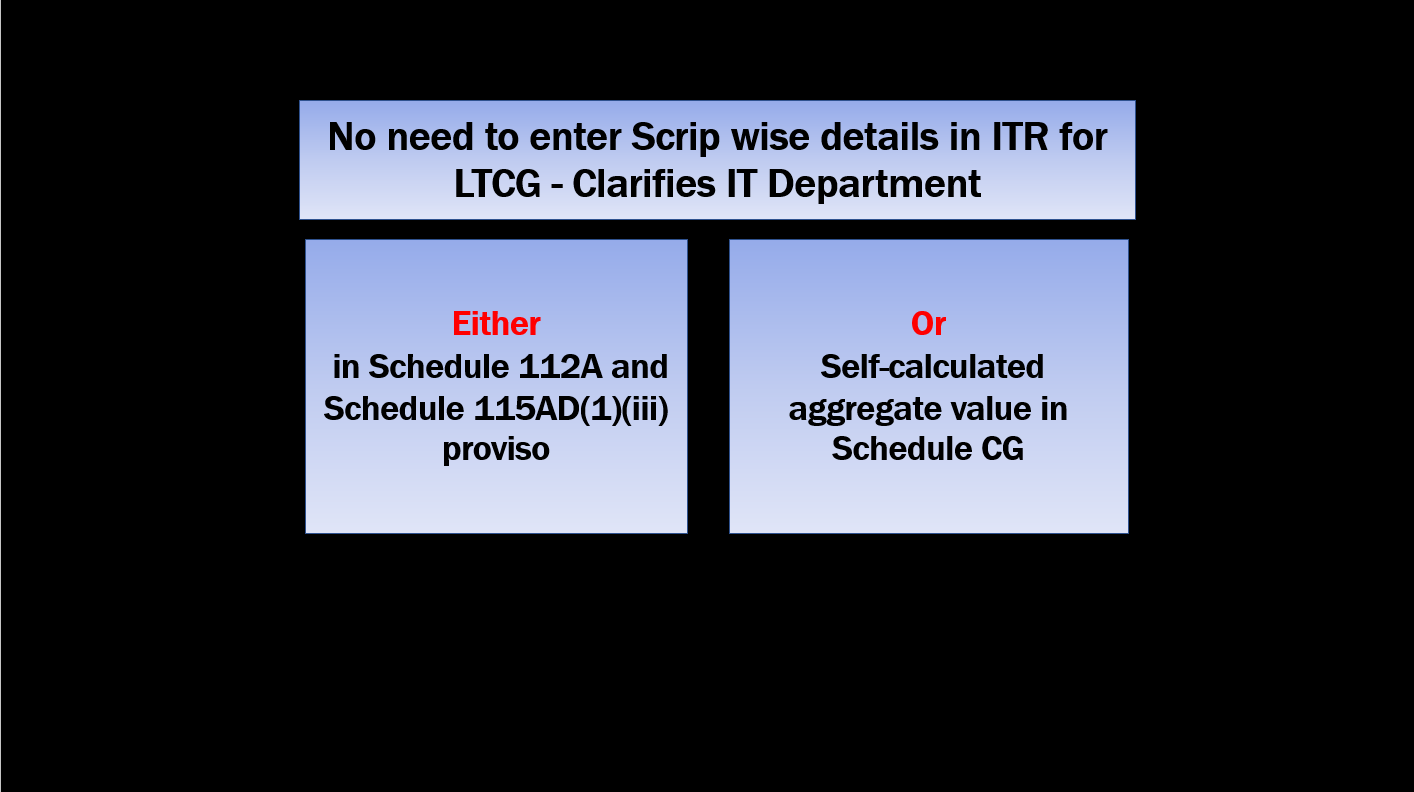

No need to enter Scrip wise details in ITR for LTCG

Last updated on May 9th, 2021 at 08:08 amNo need to enter Scrip wise details in ITR for LTCG- Clarifies IT Department Latest >>> Due date to file ITR extended to 31st August 2019 31st […]