Last updated on May 9th, 2021 at 08:08 am

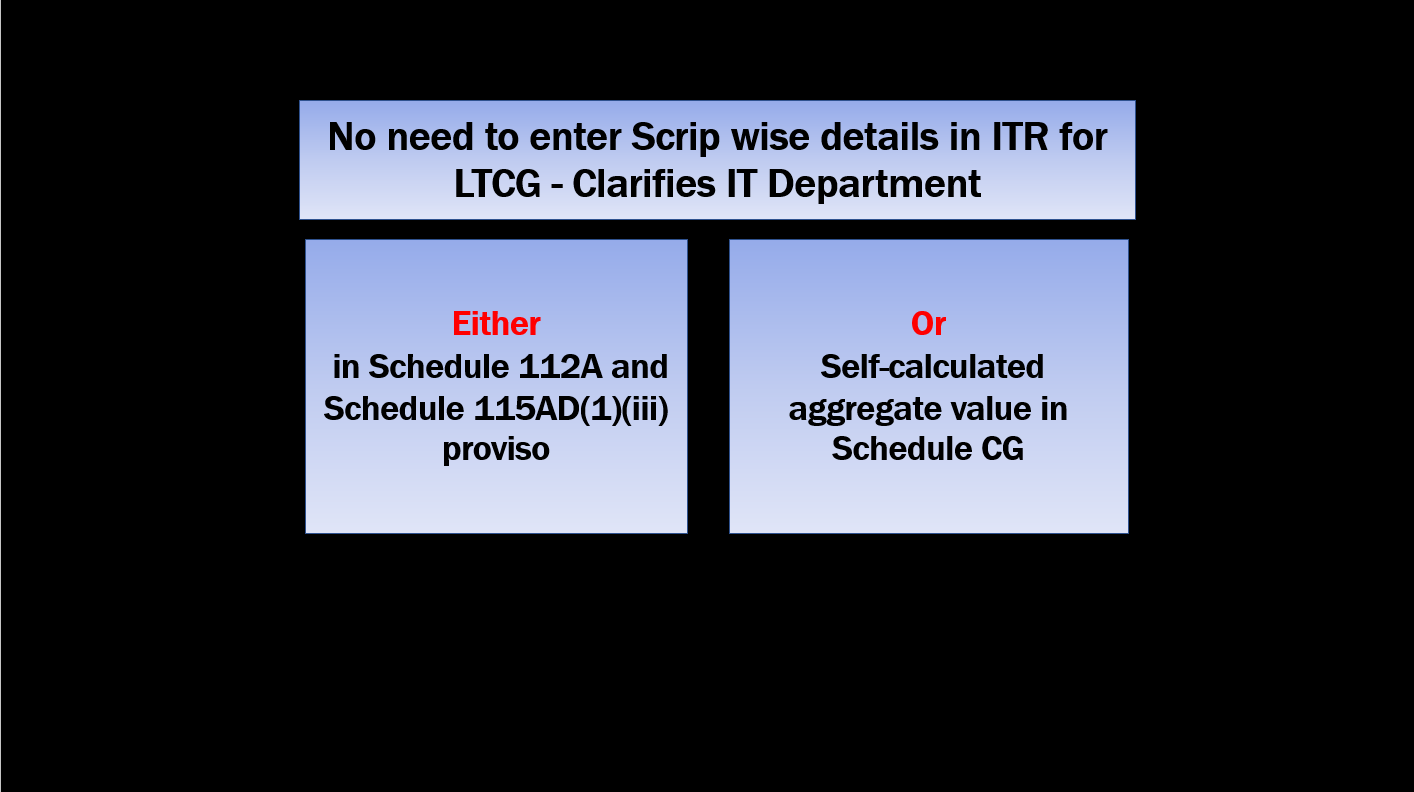

No need to enter Scrip wise details in ITR for LTCG- Clarifies IT Department

Latest >>> Due date to file ITR extended to 31st August 2019

31st August 2019 is the due date to file the Income Tax Returns (ITR) for certain individuals and HUFs for FY 2018-19. Currently, many Chartered Accountants and taxpayers are facing problems in filing tax returns due to the requirement of entering script-wise details of Long Term Capital Gains u/s 112A. This has led to the delays in filing returns making the process cumbersome. Many associations have submitted representations to the government to extend the deadline to file ITRs on this account.

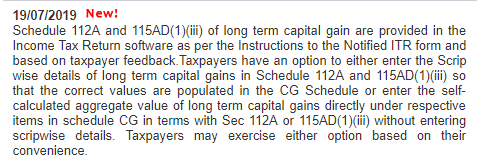

Today, on July 19, 2019, the Income Tax Department has issued a clarification that the taxpayers have an option to entre the aggregate value of long term capital gains or script-wise details whichever is preferred by them.

To arrive at Schedule CG, details of long term capital gain as per section 112A in Schedule 112A and 115AD(1)(iii) in Schedule 115AD(1)(iii) proviso needs to be provided. Based on the feedback of inconveniences faced by the taxpayers; the Government has issued a clarification for Taxpayers to give details of LTCG is either of the manners.

- Either enter the scrip-wise details of long term capital gains in Schedule 112A and 115AD(1)(iii) so that the correct values are populated in the CG Schedule

- Or enter the self-calculated aggregate value of long term capital gains directly under respective items in schedule CG in terms with Sec 112A or 115AD(1)(iii) without entering script-wise details.

Note: ITR 2, ITR 3, ITR 5 and ITR 6 have been updated to incorporate the above change. Please download the latest ITR forms available from the e-filing website for filing the ITRs. Due date is approaching soon, file your returns before the due date to avoid penalty.

To know details that will automatically get filled using the pre-filled XML – click here.

Conclusion

CBDT has relaxed the requirement and given an option to the taxpayers to exercise either of the options as per their convenience. This will help taxpayers to reduce the burden and help in quick filing of return. However, it is interesting to see if the department extends the due date of filing of returns.

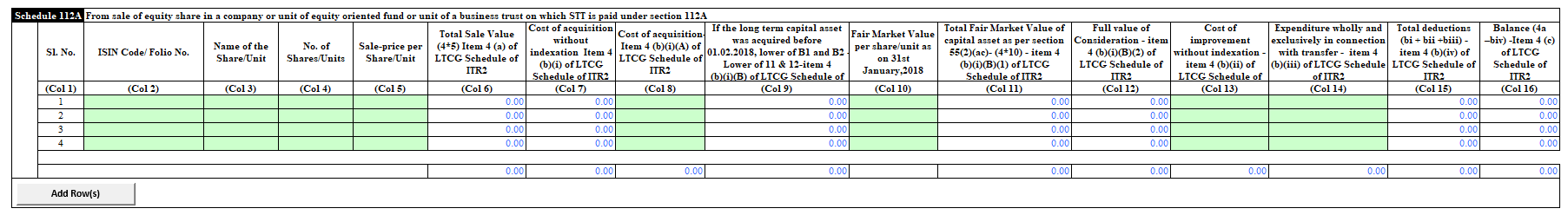

Specimen of Schedule 112A

From the sale of equity share in a company or unit of equity oriented fund or unit of a business trust on which STT is paid under section 112A

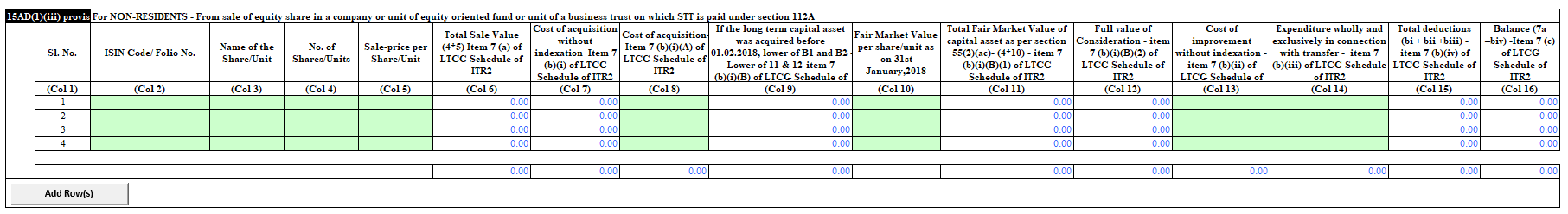

Specimen of Schedule 115AD(1)(iii)proviso

For Non-residents – From the sale of equity share in a company or unit of equity oriented fund or unit of a business trust on which STT is paid under section 112A

Specimen of Schedule CG

You may also like :

- TDS on cash withdrawal – Some Unanswered Questions

- Does this levy amounts to a kind of “double taxation?”

- Computation of Rebate u/s 87A

- FAQs on Rebate under section 87A

- Checklist for year-end tax planning

- How to do a transaction in Digital Rupee (CBDC-R)? – A Step by step Guide - 10/12/2022

- Can you rectify your 26AS? - 20/09/2022

- Tax implications on Cashback - 09/09/2022

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment