Last updated on May 9th, 2021 at 03:39 pm

File your ITR by 31st August 2019 to avoid penalty

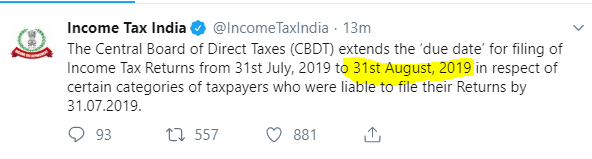

The due date for filing the income tax return for the Financial Year 2018-19 i.e the Assessment Year 2019-20 has been extended by one month to 31st August 2019. It was announced on the official Income Tax India twitter handle.

It is extended for all the assessees who are required to file their Income-tax return by 31st July 19.

Order of extension dated 23rd July 2019

The reasons quoted in the order of extension is that Form 16 was furnished late as the due date for Form 16 was extended for this year. The other reason may also be the requirement of filing scrip wise details for LTCG as per section 112A and section 115AD(1)(iii). Even the requirement of filing scrip-wise details was relaxed by govt on 19th July 2019. Click here to refer the same. The government also added a new feature of pre-filled XML to file ITRs in a quick and easy manner. Click here to know how pre-filled XML helps to file the return.

The extension order mentions it is extended only for a certain category of taxpayers. That means the due date has been extended for all those taxpayers who are required to file returns by 31st July after the end of Financial Year. Due date extension will be applicable to all those assessees who are not required to

- Get books of accounts audited u/s 44AB as the due date is 30th September 2019,

- To whom provisions of transfer pricing are not applicable as the due date is 30th November 2019

Note: Interest u/s 234A is levied for the delay in filing the tax return. Though the tax return filing date has been extended, the specific extension of date for payment of Self Assessment tax has not yet come from CBDT. Hence some people argue that the date of payment remains the original due date i.e. 31st July 2019 and interest u/s 234A will be applicable from 1st August 19. (It is calculated @ 1% simple interest per month or part of the month of the tax amount which is outstanding from the due date till the date you actually file the ITR.)

As there is no specific mention in the order, the interest u/s 234A will be calculated after the extended due date and not the original due date.

Note: Fees/Penalty u/s 234F which is applicable for default in furnishing the return of income within the due date will also be applicable from the extended due date and not 31st July 2019.

Note: Interest u/s 234B and u/s 234C will be applicable as the interest under these sections pertain to the default in payment of Advance Tax and Advance Tax installments respectively.

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment