Last updated on April 14th, 2021 at 05:11 pm

What details will be pre-filled in ITR?

The government wants to make the process of income tax compliance easy for the assessees. In order to do this, earlier the process of return filing was made easy for the individuals who were salaried employees and had to file ITR-1. To encourage all the individual assessees to file IT returns, Government has come up with a scheme of Pre–filled XML.

This pre-filled XML will auto-fill the personal information, information relating to TDS, TCS, taxes paid, salary income, interest income, etc. in the ITR. This will make it easy as a lot of information will be pre-filled and all remaining information will be required to be furnished.

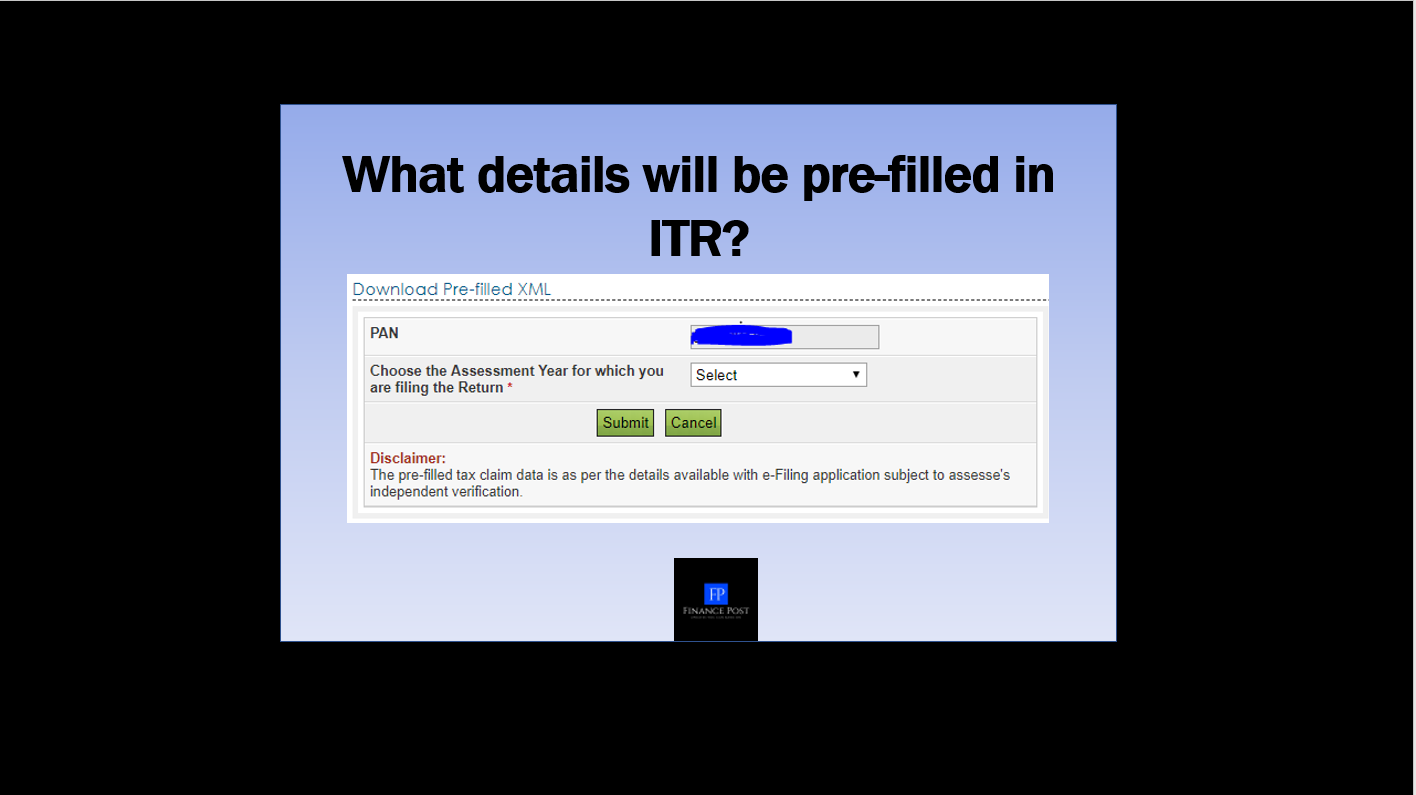

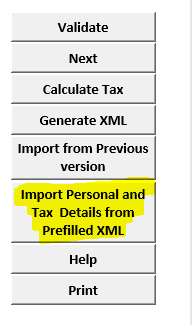

One can download the pre-filled XML file after logging in on the e-filing website using valid login credentials. This downloaded .xml file can be used to prefill the data in offline JAVA as well as Excel utilities of ITR. It is advisable to download the latest ITRs.

Note: The ITR form no. (i.e ITR-1/ITR-2/ITR-3 etc.) should be the same for prefilled XML file and the excel or java utility which will be used.

Note All the pre-filled personal, income, and tax details should be verified and cross-checked in the pre-filled ITR before filing the return.

Let’s understand what details will be pre-filled in ITR & the source for the detail

The following details will be automatically filled in ITR when the downloaded pre-filled XML file when it is imported.

Using the database from PAN

- PAN

- Name: First Name, Middle Name, and Last Name

- Date of Birth

Note: All these details will be prefilled in Part A – General Information of ITR

Using the data from the e-profile on the e-filing website

Address:

- Flat/Door/Block no.

- Name of Premises/building/Village

- Road/Street/Post office

- Area Locality

- Town/City/District

- State

- Country

- Pincode

Aadhar Number

Mobile Number

Email address

Note: It will only get pre-filled if your e-profile is updated on the Income-tax e-filing portal. So it is advisable to keep the e-profile complete and updated.

Using the database from FORM 26AS

Details of Tax Payments

- Advance tax paid (if any)

- Self-assessment tax paid (if any)

Details of TDS

- Details of tax deducted at source from salary (Form 16 – issued by employer/ employers)

- Details of tax deducted at source from income other than salary (Form 16A – issued by deductor/deductors)

- Details of tax deducted at source (Form 16C-furnished by payer/payers)

Details of TCS

- Details of tax collected at source (Form 27D – issued by collectors)

Note This is applicable only for the assessee who is a salaried employee.

Using the database from previous years ITR and e-profile on e-filing portal

Details of Bank Account held in India at any time during the previous year(it should not be a dormant account)

- Bank Account Number

- Name of the Bank

- IFSC Code

Related Posts

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment