Income Tax

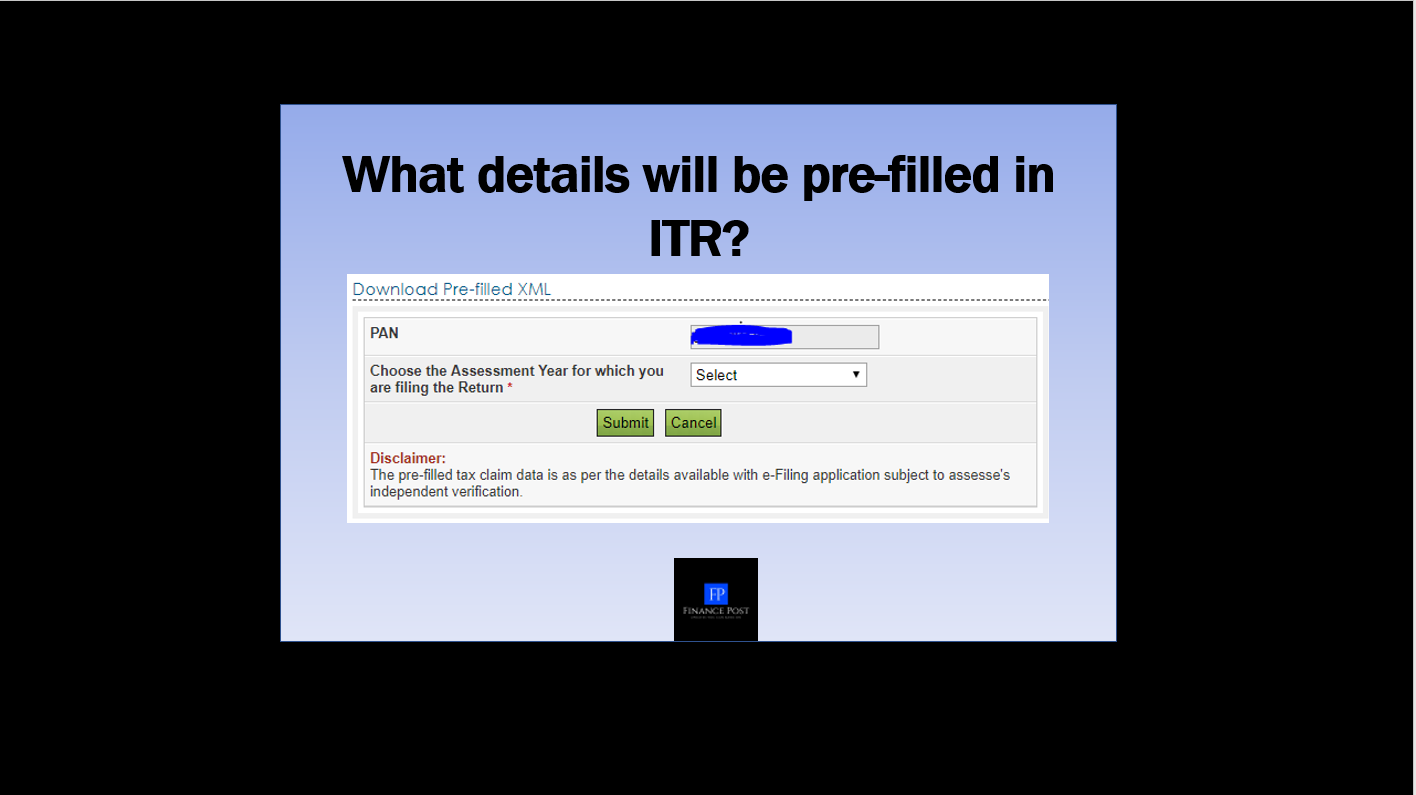

What details will be pre-filled in ITR?

Last updated on April 14th, 2021 at 05:11 pmWhat details will be pre-filled in ITR? The government wants to make the process of income tax compliance easy for the assessees. In order to do this, […]