Last updated on July 25th, 2022 at 08:15 pm

Section 269ST Restrictions on cash transactions

The government intends to promote the campaign “Digital India” and to curb tax evasion in the country. With an intent to stop the circulation of black money, the Government had announced Demonetization on 8th November 2016. Moving a step further, a new section 269ST was introduced with the intent to regulate the transactions in cash.

Section 40A (3) imposes restrictions on a person from making payments in cash but before the introduction of section 269ST, there was no provision in the Income Tax Act that restricted a person to receive cash.

FAQs of section 269ST of Income-tax

Section 269ST of the Income Tax Act restricts any person to receive an amount of more than Rs 2 lakhs in CASH

> From one person in a day (Limits receiving cash from one person in one day)

> For a single transaction (Limits receiving cash against one transaction by splitting the payment over the number of days)

> For one event or occasion from a person (Limits receiving cash for one occasion.)

Note: It imposes restrictions on the person receiving the cash and not on the one giving the cash. Contravention of the provisions of section 269ST will attract the penalty under section 271D.

Note: Installments of loan repayment to HFC or NBFC will not be clubbed as a single transaction if one installment is up to Rs 2 lakhs. (Refer to the CBDT circular 22 dated 3rd July 2017)

It was inserted vide Finance Act 2017 and made effective from 1st April 2017.

Section 269ST will be applicable to each and every person defined under section 2(31).

Following modes of payment are permissible u/s 269ST read with rule 6ABBA

A/c payee cheque

A/c payee bank draft

ECS

Credit Card

Debit Card

Net banking

NEFT

RTGS

IMPS

UPI

BHIM Aadhar Pay

If more than Rs. 2 lakhs are being received by the following provisions of section 269ST will NOT APPLY

As per section 269(i)

Government – Central Government, State Government, Local Government

Banking Company – Public Sector Bank, Private Sector Bank, Post Office Savings Bank & Co-operative Banks

As per section 269(ii) – Transactions of nature referred to in section 269SS (Refer which transactions)

As per section 269(iii) – Any other person/class of persons can be notified by the Central Government

Section 269ST will be applicable for both the receipts in the capital as well as revenue in nature.

If a person violates the provisions of section 269ST and receives money in excess of Rs 2 lakhs then a penalty will be equivalent to the amount received.

Penalty u/s 271DA shall not be imposed if the taxpayer has valid and sufficient reasons for the violation of section 269ST, provided the taxpayer proves it to the satisfaction of the Assessing Officer. Government should clarify or list down the reasons for a better understanding of what will constitute as good and sufficient reasons.

Note: Penalty u/s 271DA can be imposed by the Joint Commissioner of Income Tax.

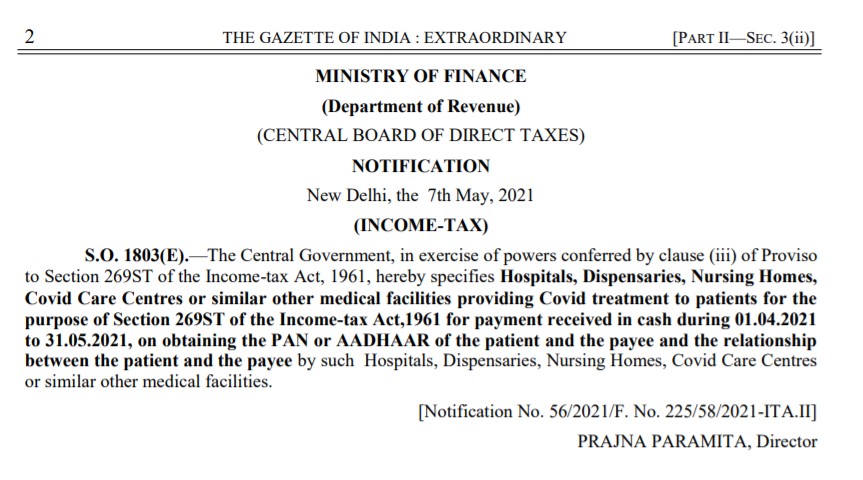

The Second-wave of the Novel Corona Virus had brought the country to a standstill. The number of positive cases in India requiring hospitalization had seen a significant rise in the months of April 2021 & May 2021. The government was seen taking steps proactively to meet the ends. The government has notified that if cash payment is received more than Rs 2 lakhs for the treatment of COVID patients by Hospitals, Dispensaries, Nursing Homes, Covid Care Centres, or similar other medical facilities then provisions of section 269ST will not be invoked.

Provided that cash payment is received in the period 1st April 2021 to 31st May 2021.

Provided that PAN or AADHAAR of the patient and the payer is obtained. (Refer to the CBDT Notification 56 dated 7th May 2021)

Conclusion

The restriction imposed by the provisions of the above section has considerably reduced the circulation of cash. India is slowly moving towards a digital economy.

Related Posts

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Great work and providing very useful tax knowledhe and info. Thank you Hod Bless.

Thank you for your appreciation.