Last updated on October 31st, 2021 at 06:03 am

GSTR 4 the Quarterly Return

Note this is applicable for FY 17-18 & FY 18-19 (when GSTR 4 was a quarterly return)

Now GSTR 4 (Annual Return) is a yearly return to be filed by composition taxpayers>>>Due Dates, late fees Interest of GSTR 4 (Annual Return)

Overview of GSTR 4

GSTR 4 was the quarterly return which the taxpayer who has registered for composition levy u/s 10 had to file up to FY 2017-18 & FY 2018-19.

The last date to furnish the return in Form GSTR 4 was the 18th of the month succeeding the quarter.

Note: There is no provision to revise the quarterly return GSTR 4 filed by the composition taxpayer. If any amendments are required then that is to be done in the next quarter’s return.

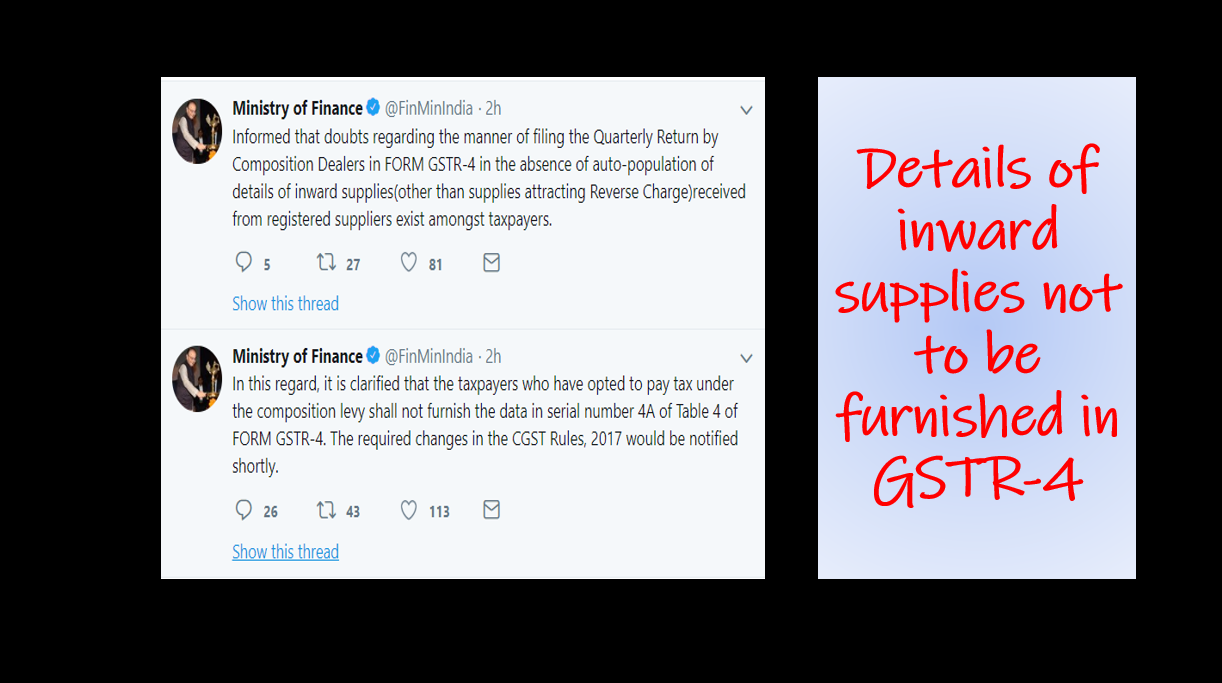

Details relating to outward supplies, inward supplies, taxes paid interest, late fees, etc. need to be furnished in Form GSTR 4.

As per section 39(2) of the CGST Act,2017

“A registered person paying tax under the provisions of section 10 shall, for each quarter or part thereof, furnish, in such form and manner as may be prescribed, a return, electronically, of turnover in the State or Union territory, inward supplies of goods or services or both, tax payable and tax paid within eighteen days after the end of such quarter.”

Can a taxpayer still file GSTR 4(Quarterly return) for FY 2017-18/ FY 2018-19?

If the taxpayer has failed to furnish the quarterly returns in Form GSTR 4 and the GSTIN is still active. Then GSTR 4 can be filed for FY 2017-18 or/and for FY 2018-19 along with late fees and applicable interest.

Due dates of GSTR 4 – QUARTERLY RETURN

For the Financial Year 2018-2019

For the quarter of January 2019 to March 2019

- One-time waiver/capping in late fees if filed between 22.09.2020 to 31.10.2020 – CGST notification no. 67/2020 dated 21st September 2020

- Due Date notified was 18th April 2019 – As per section 39(2) read with rule 62.

For the quarter of October 2018 to December 2018

- One-time waiver/capping in late fees if filed between 22.09.2020 to 31.10.2020 – CGST notification no. 67/2020 dated 21st September 2020

- Due Date notified was 18th January 2019 – As per section 39(2) read with rule 62.

For the quarter of July 2018 to September 2018

- One time waiver/capping in late fees if filed between 22.09.2020 to 31.10.2020 – CGST notification no. 67/2020 dated 21st September 2020

- One-time waiver in late fees if filed between 22.12.18 to 31.03.19 – CGST Notification no. 77 dated 31st December 2018.

- Due Date notified was 18th October 2018 – As per section 39(2) read with rule 62.

For the quarter of April 2018 to June 2018

- One-time waiver/capping in late fees if filed between 22.09.2020 to 31.10.2020 – CGST notification no. 67/2020 dated 21st September 2020

- One-time waiver in late fees if filed between 22.12.18 to 31.03.19 – CGST Notification no. 77 dated 31st December 2018.

- Due Date notified was 18th July 2018 – As per section 39(2) read with rule 62.

For the Financial Year 2017-2018

For the quarter of January 2018 to March 2018

- One-time waiver/capping in late fees if filed between 22.09.2020 to 31.10.2020 – CGST notification no. 67/2020 dated 21st September 2020

- One-time waiver in late fees if filed between 22.12.18 to 31.03.19 – CGST Notification no. 77 dated 31st December 2018.

- Due Date notified was 18th April 2018 – As per section 39(2) read with rule 62.

For the quarter of October 2017 to December 2017

- One-time waiver/capping in late fees if filed between 22.09.2020 to 31.10.2020 – CGST notification no. 67/2020 dated 21st September 2020

- One-time waiver in late fees if filed between 22.12.18 to 31.03.19 – CGST Notification no. 77 dated 31st December 2018.

- Due Date notified was 18th January 2018 – As per section 39(2) read with rule 62.

Note: Taxpayers were levied late fees even when they filed the return within the due date for the above quarter. CBIC had notified that the late fees shall be waived in such cases vide a CGST Notification no. 41 dated 4th September 2018

For the quarter of July 2017 to September 2017

- One-time waiver/capping in late fees if filed between 22.09.2020 to 31.10.2020 – CGST notification no. 67/2020 dated 21st September 2020

- One-time waiver in late fees if filed between 22.12.18 to 31.03.19 – CGST Notification no. 77 dated 31st December 2018.

- Due Date further extended to 24th December 2017 – CGST Notification no. 59 dated 15th November 2017.

- Due Date extended to 15th November 2017 – CGST Notification no. 41 dated 13th October 2017.

- Due Date notified was 18th October 2017 – As per section 39(2) read with rule 62.

Late Fees applicable to quarterly GSTR 4

⊗ Capping/Waving of late fees CGST notification no. 67/2020 dated 21st Sep 2020

Late fees payable as per section 47 for the delay in filing GSTR – 4

Return Period – July 2017 to March 2019

The prescribed period for filing – 22nd September 2020 to 31st October 2020

Tax payable > NIL: Late fees will be Rs 500 per quarterly return ( Rs. 250 towards CGST + Rs. 250 towards SGST/UTGST).

Tax payable = NIL: Late fees will be NIL per quarterly return.

Note: Late fees u/s 47 is waived off not the interest u/s 50 for non-payment or delayed payment.

⊗ Late fees waived vide CGST notification no. 77/2018 dated 31st December 2018

The decision to waive off the late fees for non-filers of GST return for the quarters from Jul 2017 to Sep 2018 was taken in the 31st GST council meeting held on 22nd Dec 2018

Late fees payable as per section 47 for the delay in filing GSTR – 4 were waived.

Return Period – July 2017 to September 2018

Prescribed period for filing – 22nd December 2018 to 31st March 2019.

Tax payable > NIL: Late fees will be NIL per quarterly return.

Tax payable = NIL: Late fees will be NIL per quarterly return.

Note: Late fees u/s 47 is waived off not the interest u/s 50 for non-payment or delayed payment.

⊗ Late fees as reduced vide notification no. 73/2017 dated 29th December 2017

Late fees payable as per section 47 for the delay in filing GSTR – 4 was reduced

Tax payable > NIL: Late fees will be Rs 50 per day up to the period of default

Tax payable = NIL: Late fees will be Rs 20 per day up to the period of default

Note: Only late fees have been waived off not the interest applicable for non-payment or delayed payment.

Related Posts

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment