Last updated on April 9th, 2021 at 08:07 pm

GST rate on alcohol-based hand sanitizers

After an advance ruling passed in the case of Springfields (India) Distilleries, Raia Salcete by AAR GOA, the GST rate on Alcohol-based hand sanitizers had become the topic of discussion everywhere.

Report of Central Economic Intelligence Bureau, New Delhi

It was CEIB, New Delhi which firs raised concerns that manufacturers of alcohol-based hand sanitizers have been evading tax by miss classifying the hand sanitizer (alcohol-based) from the inception of GST July 2017. Based on the ingredients of the product they have classified it relying upon the classification opinion of WCO (World Customs organization). (Click here to read the letter of CEIB)

Product description in question in case of Sugar Mills & Distilleries

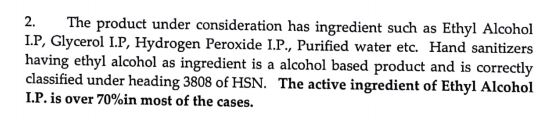

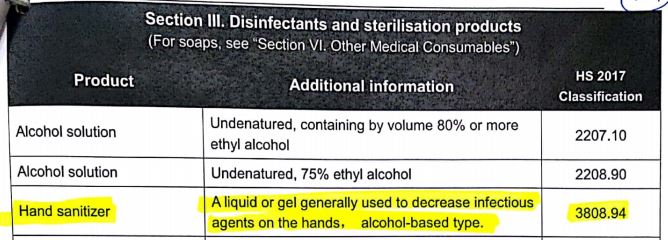

Classification opinion of World Customs Organization prepared jointly with WHO for COVID 19 medical supplies

⇒ Considering the ingredients of alcohol-based hand sanitizer (70% ethyl alcohol) which is being sold in India should be rightly classified under the heading 2208.90 (75% ethyl alcohol). Though the HSN 2208 has not been adopted by India.

(Click here to view the HSN Classification done by WCO jointly with WHO)

Advance Ruling by AAR, GOA dated 29th June 2020

Applicant’s view

- The applicant was of the opinion that alcohol-based hand sanitizers should be classified under heading 30049807 of HSN and the applicable GST rate was 12%.

- The applicant also sought clarification whether alcohol-based hand sanitizer can be exempt from levy of GST as it was included in the essential commodity by the Ministry of Consumer Affairs, Food & Public Distribution.

AAR’s view & order

AAR passed an order for the advance ruling based on provisions of law and submissions from the applicant. (Click here to read the Advance Ruling)

- AAR denied that alcohol-based hand sanitizer without any curative or preventive ingredients cannot be considered as a medicament (HSN 3004). To classify as a medicament following five factors needs to be considered :

- Curative effect of the product (therapeutic use),

- Preventive effect of the product (prophylactic use),

- Period of usage i.e. to be used for a limited period or regularly,

- The product contains curative/preventive ingredients,

- Trade parlance, i.e. how it is known in the market.

- The applicant was manufacturing an alcohol-based hand sanitizer and the same shall be classified under heading 3808 of HSN and the applicable GST rate is 18%.

- GST rate for the above tariff entry was notified by CBIC vide a CGST(R) Notification no. 1 dated 28th June 2017.

AAR also clarified that mere inclusion of hand sanitizers in the essential commodity by the Ministry of Consumer Affairs, Food & Public Distribution would not tantamount to exemption from levy of GST.

- The notification issued by the Ministry of Consumer Affairs, Food & Public Distribution on 13th March 2020 also stated that it would remain effective up to 30th June 2020.

- The goods or services which are exempted from the purview of GST were separately notified by CBIC vide a CGST(R) Notification no. 2 dated 28th June 2017.

Tarif item and corresponding GST rates for reference

|

Chapter / Heading / Subheading / Tariff item |

Description of Goods | Rate | |

| CGST |

SGST |

||

|

3004 |

Medicaments (excluding goods of heading 30.02, 30.05 or 30.06) consisting of mixed or unmixed products for therapeutic or prophylactic uses, put up in measured doses ( including those in the form of transdermal administration systems) or in forms or packings for retail sale, including Ayurvedic, Unani, homeopathic siddha or bio-chemic systems medicaments, put for retail sale |

6% |

6% |

|

3808 |

Disinfectants and similar products |

9% |

9% |

Tweet by official twitter handle of CBIC dated 15th July 2020

- GST rate on alcohol-based hand sanitizers will attract GST @ 18% as it should be classified as disinfectant soaps, anti-bacterial liquids, Dettol, etc.

- Government further clarified that inputs used for manufacturing the hand sanitizers attract GST @ 18%.

- To substantiate that GST rate on alcohol-based sanitizers could not be reduced, the Government gave the following explanations

- It would lead to an inverted duty structure.

- It would put domestic manufacturers at disadvantage vis-à-vis importers. This would lead to cheaper imports which would be against AatmaNirbhar Bharat.

(Click here to read the Press Release issued by CBIC)

Thoughts to ponder

- Inverted Duty Structure – Is alcohol-based hand sanitizer the only product that would have come under the threat of inverted duty structure as claimed by the Government? Is it justifiable to not reduce the GST rate for the same? If so, why has the Government not taken similar active steps in reducing the rate for input to sort out the issue relating to inverted duty structure?

- Domestic Manufacturers – How will a reduction in rate lead to a threat to domestic manufacturers from importers? The same rate of GST will be applicable whether you import or manufacture it in India, if it is possible to import at a cheaper price then it will continue to remain as a threat to domestic manufacturers.

- Export of alcohol-based hand sanitizer – If at all it was being exported earlier or now, is it being exported and classified under the HSN 3808.94 or HSN 2208.94? (Note: HSN codes adopted by India, does not have any good classified against the heading 2208.94).

- Commissioner Of Central Excise vs M/S. Wockhardt Life Science Ltd – I would like to draw attention in a similar case where Revenue intended to classify the product as a detergent instead of medicament. But the verdict was given in favor of assessee (Wockhardt) by Tribunal first and then upheld by Supreme Court. Click here to read the verdict.

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment