Last updated on April 5th, 2021 at 10:50 pm

CGST Fourteenth Amendment Rules, 2020

CGST Notification 94/2020 dated 22nd Dec 2020 – Applicable from 1st January 2021

Increase in Time Limit of Approval of Registration

At the time of registration under GST, earlier when a taxpayer had applied for registration and no query was raised from the department, then he would get deemed registration within 3 days or 21 days (in case of non- Aadhar Authentication).

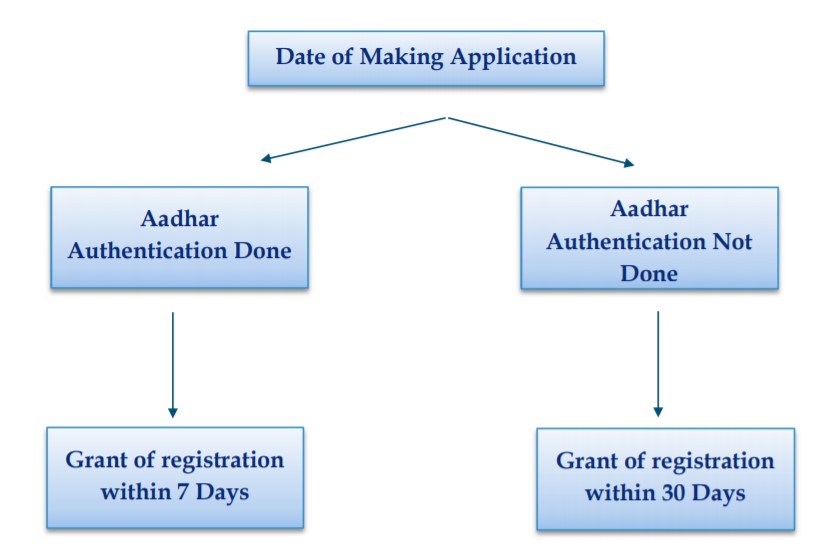

Now, registration shall be granted within a period of 7 working days from the date of making an application.

But in the case where the applicant does not opt for Aadhar authentication or where the department feels to carry out physical verification, then the registration shall be granted within a period of 30 days from the date of making an application.

Additional Grounds for Cancellation of GST Registration

The following additional grounds are added under Rule 21 where the registration shall be cancelled: –

- Taxpayer claims Input Tax Credit (ITC) in contravention to Section 16.

- Taxpayer violates Rule 86B.

- Taxpayer furnishes Details of Outward Supplies in GSTR-1 and Details of ITC in GSTR-2B are having significant deviation/ abnormalities in

comparison to GSTR-3B for one or more tax periods.

Note: – It is important to note that the word “Opportunity of being heard” has been omitted from Rule 21A which means that if the proper officer has reasons to believe that the registration is liable to be cancelled then he may take action without giving an opportunity of being heard to the taxpayer.

This has been one of the biggest setbacks in GST. Cancellation of GST without giving an opportunity of being heard is taking away all the rights from the taxpayer. Principle of natural justice is the backbone of any adjudication proceedings.

Significant Differences between GSTR-1, GSTR-2B and GSTR-3B – Liable for Cancellation of registration

(Sub-rule 2A after Rule 21A(2) of CGST Rules, 2017)

Another ground for Cancellation GST registration is a mismatch between GSTR1 vs. GSTR-3B and GSTR-3B vs. GSTR-2A/2B.

A new sub-rule has been inserted by way of this notification where GST registration can be cancelled in the following cases: –

- If the outward supplies filed in GSTR-1 does not match with the Outward supplies declared in GSTR-3B.

- If the Input Tax Credit (ITC) claimed in GSTR-3B does not match with the ITC auto-populated in GSTR-2A/ 2B.

In such cases, the GST registration shall be held suspended and notice shall be given electronically in Form GST REG-31.

Limit of claiming ITC as per Rule 36(4) reduced

One of the most debated and controversial topics under the GST law is of Rule 36(4) and Government is making this rule stringent day by day.

Rule 36(4) imposes another restriction on the availment of credit in GSTR-3B. As per this notification, a taxpayer can claim ITC up to 105% of the figure auto-populated in GSTR2A.

The journey of Rule 36(4) is: –

Rule 86B: Restriction to use the amount in Credit Ledger

Applicability: – This rule is applicable to those having a taxable value of supplies (other than exports) of more than 50 Lakhs. This value of Rs. 50 Lakhs has to be seen every month.

As per this rule, taxpayer has to pay 1% of total output liability of the month mandatorily in Cash i.e. he cannot pay more than 99% of the output liability using the credit ledger.

Non- Applicability

This provision is not applicable: –

- If the proprietor, any of the partner, any director, Karta has paid more than Rs. 1 Lakh of Income Tax in each of the 2 Financial Years.

- If the registered person has received a refund of Rs. 1 Lakh or more in the preceding Financial Year under GST (Export under LUT or Inverted Duty Structure).

- If the registered person has discharged 1% of his output tax liability using electronic cash ledger up to the current month.

- If the registered person under concern is any of the following:

- Government department

- Public sector undertaking

- Local authority

- Statutory Authority

Blocking of GSTR-1 in case of non-filing of GSTR-3B

(Sub-rule 5 to Rule 59 of CGST Rules, 2017)

The notification has notified Rule 59(5), where the taxpayer would not be allowed to file GSTR-1 in the following cases: –

- If the taxpayer has not filed GSTR-3B for the preceding 2 months, then he will not be able to file GSTR-1 (Applicable for monthly GSTR-1 filers).

- If the taxpayer has not filed GSTR-3B for the preceding 1 month, then he will not be able to file GSTR-1 (Applicable for Quarterly GSTR-1 filers).

- If the taxpayer has not filed GSTR-3B for the preceding 1 month, then he will not be able to file GSTR-1 (Applicable for Rule 86 filers).

This is a good move by the government to curb fake invoicing and fake credit of GST. This rule along with the matching of GSTR3B and GSTR-1 will help the department to increase their revenue collection and tax frauds.

Reduction in Validity of E-way Bill

(Amendment in Rule 138(10) of CGST Rules, 2017)

The validity of the E-way bill has been reduced w.e.f. 01.01.2021. Below is the table containing the Validity of the E-way Bill after and before the amendment.

[su_table]

| Validity Period | Before Amendment | After Amendment |

| One Day | 100 K.M. | 200 K.M. |

| Additional One Day | For every 100 K.M. or part thereof | For every 200 K.M. or part thereof |

[/su_table]

Also, if GSTR-1 of the preceding 2 tax period is not filed then the taxpayer will not be able to generate an E-way bill.

Related Posts

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment