Last updated on April 5th, 2021 at 09:43 pm

Glittering Gold

Gold is the most appreciated metal in India and nowadays it’s hitting a new high every day. In this period of the pandemic, many people might think that gold buying is virtually Nil in India. Then the rising gold prices put forth questions like why the demand for Gold is Growing? Is this one-way rise in the price of Gold sustainable? And last but not least is it still a Good investment option even at these prices??

Let us try to get the answers to all these questions by understanding the gold price determination, movements, its relationship with other economic factors, and some basic reasons behind current rise in gold prices.

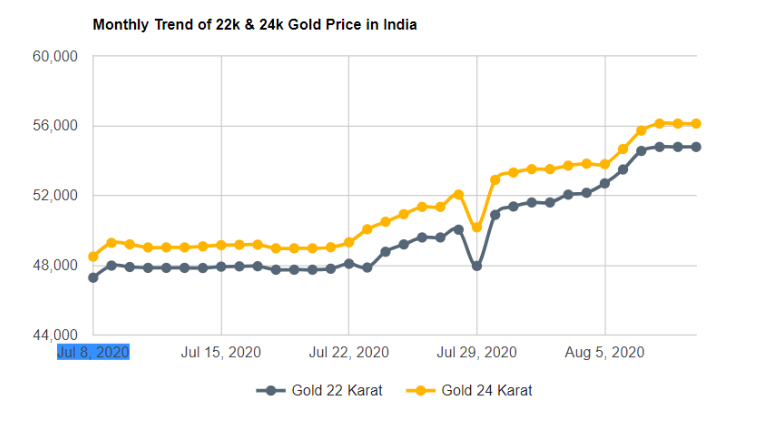

(Ref: Paisabazar.com)

Let us understand how gold prices are determined in India.

If you believe that there is some authority in India which determines a daily gold price, then you are wrong. Gold rate is determined in India by just translating its International Value in Rupee terms.

In other words, when you multiply today’s gold rate determined in International Markets by the current exchange rate of INR /US dollar, you will arrive at the current gold rate going on in the Indian Markets.

On MCX, the International Gold Rate per Troy Ounce is converted into per 10 grams and then multiplied by the exchange rate.

So, two primary factors that clearly and directly impact the gold prices in India are:

- International Gold demand supply and

- Foreign Exchange Rate

As we can see, Gold prices have moved from approx… Rs. 40,000 to Rs 58,000 between Mar 2020 to Aug 2020. However, INR is rangebound between Rs 74.3 to Rs 75.3 during the same period. This clearly signifies that the international gold rate is increasing primarily owing to increasing demands.

Now let us understand why there is growing international demand for gold and its rise in prices during this pandemic.

- All the countries hold a part of their reserves in Gold. So it is in demand worldwide.

- Safe Heaven: Historically, gold has never seen a drastic fall in its prices, on the other hand, it is witnessing a regular upward trend. So, gold is always considered as a Safe heaven option. When the equity markets are falling or are uncertain, investors tend to park their funds in Gold rather than equity markets. From March 20 to August 20 there has been a positive correlation for the first time as the equity market as well as the gold prices are increasing. This is primarily due to a large number of investors continuing to park their funds in Gold rather than equity due to uncertainties in the equity market.

- Inflation Hedge: Gold is also considered as an inflation hedge due to its increasing rates. In this pandemic when the situations are likely to increase the inflation, the demand and simultaneously prices for gold go up.

- Interest Rates and Gold: Theoretically, whenever there is a hike in interest rates, the gold rates fall whereas reducing interest rates lead to rising gold prices. Though this theory perfectly fits in this pandemic, such correlation was not always evident historically.

In the nutshell, “Uncertainties” and “Safe Heaven” are the two major factors that are causing this everyday rising demand and gold prices internationally.

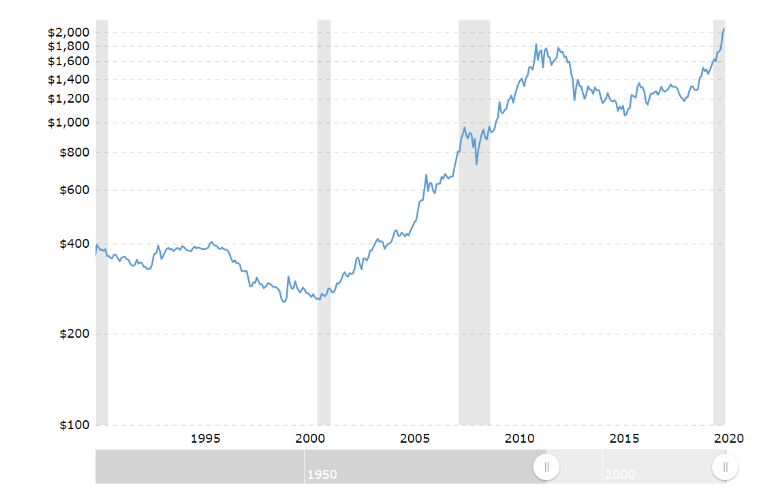

(Ref: https://www.macrotrends.net/)

Is this one-way rise in the price of Gold sustainable? And is it still a good investment?

The question arises at this juncture is, should I “Buy gold” now? Or Will this northward gold movement sustain?

As I have mentioned above, the gold prices historically has been always rising. This is evident from the chart above. This gives good confidence that for the long-term investors Gold prices will be northbound.

In my opinion, on a short-term basis, the gold prices might see slight fluctuations but owing to uncertainty in the USA over presidential elections, the investment in gold will be considered safe against equity markets.

So, as long as the growth is subdued, and equity markets are highly uncertain, gold rates look promising. As the growth rates pick up and the economies will open-up and start improving, demand for gold on a personal level will also increase. This will improve the gold prices in India.

The only catch here is

- The Exchange rate: If INR improves significantly against the dollar, and the gold rate remains stagnant, only in such instance we might see a fall in gold rates in India though this looks quite unlikely. and

- As the economies will start recovering, there can be some amount of outflows that can be negative for gold prices.

Conclusion:

One should certainly look at diversifying the portfolio by investing a certain portion in “Gold”. Better to invest in gold bonds or SIP in funds, especially for long-term investment and as a hedge. In history, gold has never seen a significant downfall… Hence, looking at technicals “Gold will keep glittering”. And if this bull run of Gold turns bearish, then it will create History!!!

Related Posts

None found

- How to do a transaction in Digital Rupee (CBDC-R)? – A Step by step Guide - 10/12/2022

- Can you rectify your 26AS? - 20/09/2022

- Tax implications on Cashback - 09/09/2022

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment