Last updated on June 3rd, 2021 at 11:03 pm

Interest on delayed payment on GROSS or NET under GST ???

After the retrospective amendment to section 50 – CGST Notification no. 16 dated 1st June 2021

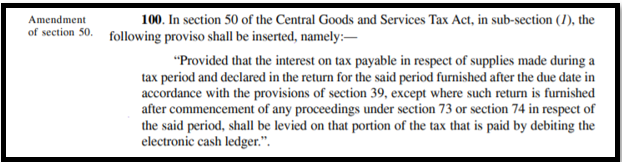

From 1st July 2017, the interest on delayed payment of GST is being charged only on the net cash tax liability. It is only on the portion of the tax liability which is to be paid by debiting the electronic cash ledger.

After the prospective amendment to section 50 – CGST Notification no. 63 dated 25th August 2020

From 1st September 2020, the interest on delayed payment of GST is being charged only on the net cash tax liability. It is only on the portion of the tax liability which is to be paid by debiting the electronic cash ledger.

Note: The recommendations for the amendment were first made in the 31st GST Council Meeting. (Refer to the press release dated 22.12.2018 )

Before the amendment to section 50

Interest on delayed payment of GST was charged on the entire tax liability without considering any set-off of the eligible input tax credit.

Click here to check whether Section 50 has reached its logical conclusion or not?

How is interest calculated after 1st September 2020?

If the payment of tax/part payment of tax is done after the expiry of the prescribed due date then interest was to be calculated on the net tax liability.

Interest was to be calculated on unpaid tax on outward supplies after considering set-off for the eligible input tax credit.

In simple words, it is to be calculated on tax payment required through an electronic cash ledger.

Interest on Net Cash Liability= [Unpaid amount from (Tax on outward supply- ITC on inward supply) x 18% x (date of payment – due date of payment)]

What is the rate of interest u/s 50 for delayed payment of tax?

18% is the rate of interest was prescribed by a CGST Notification no. 13/2107 dated 28.06.17

Interest is to be calculated from the succeeding day of the due date up to the date of payment. It is to be calculated based on the number of days.

Interest has to be paid through an electronic cash ledger only. It can not be paid by utilizing the electronic credit ledger.

In case of proceedings u/s 73 and u/s 74 have been initiated then interest will be calculated on gross tax liability and not on net tax liability.

How was interest calculated up to 31st August 2020?

⊗ As per section 50 of CGST Act,2017

If the payment of tax/part payment of tax is done after the expiry of the prescribed due date then interest was to be calculated on the gross tax liability.

Interest was to be calculated on unpaid tax on outward supplies without considering set-off for the eligible input tax credit.

In simple words, it was to be calculated on tax payment required to be set off through an electronic cash ledger and electronic credit ledger.

Interest on Gross Tax Liability= [Unpaid tax on outward supply x 18% x (date of payment – due date of payment)]

⊗ As per section 41 of CGST Act 2017

A taxpayer is entitled to take the credit of eligible ITC for payment of self-assessed output tax liability in the GST return. The date of making the credit entry in the electronic credit ledger is important as only upon the filing of the return on a self-assessment basis the credit becomes available to the electronic credit ledger for paying the output tax liability.

Refer amendments to Section 50 >> clause 112 on page 62 of Finance Bill 2021

Refer Press Release issued on 26th August 2020 and clarification issued on Twitter

Refer CGST Notification no. 63 dated 25th August 2020

Refer amendments to Section 50 >> clause 99 on page 29 of Finance Bill 2019

HC Judgments passed for interest on delayed payment

We will discuss two HIGH Court cases here, where different judgments have been passed.

⊗ Telangana High Court >> M/s. Megha Engineering & Infrastructures Ltd. vs. The Commissioner of Central Tax [18.04.19]

Refer Telangana High Court Order where interest on delayed payment on gross tax liability

The taxpayer did not file the GSTR 3B for the months’ Oct 2017 to May 2018. The delay in filing returns was not significant as per the assessee (The maximum delay was 29 days for the month of March 18).

The returns were not filed within due dates as there was a shortage of ITC for the completely setting-off of the tax liability. All the tax liability was cleared by the assessee in May 2018.

Facts of the case: Total tax liability was Rs. 1014,02,89,385/- and the ITC available Rs. 968,58,86,133/-

GST department demanded interest based on Section 41 and section 50 on gross tax liability but the assessee paid the same on net tax liability basis.

HC held that tax paid on inputs, input services, or capital goods become input tax credit only when the claim for the same is made while filing the return on the self-assessment basis.

Telangana set aside the writ petition filed and ordered that, If there is a delay in filing return, where the payment of tax liability is done partly in cash and partly by utilizing credit available then interest will be calculated on the gross liability.

⊗ Delhi High Court >> M/s LANDMARK LIFESTYLE vs. UNION OF INDIA & ORS. [27.05.19]

Refer Delhi High Court Order where interest on delayed payment on net tax liability

M/s LANDMARK LIFESTYLE stated that the calculation of the interest payable for delayed payment of GST was unreasonable and erroneous. As it was calculated on the amount of tax which in fact consists of ITC and needs to be adjusted against the tax liability.

Facts of the case: Total tax liability was Rs. 3.31 crores and interest liability were calculated as Rs. 8.19 crores.

Court has granted a stay on the recovery for the interest amount payable on gross GST liability up to 30th September 2019.

Order has been passed that no coercive action should be taken against the assessee for non-payment of interest until the next hearing takes place.

HC accepted the contention of the taxpayer and presumed that a notification for the same shall be passed soon as it was recommended by the GST Council.

Related Posts

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment