Last updated on April 30th, 2022 at 05:31 pm

Good News for Composition Taxable Persons

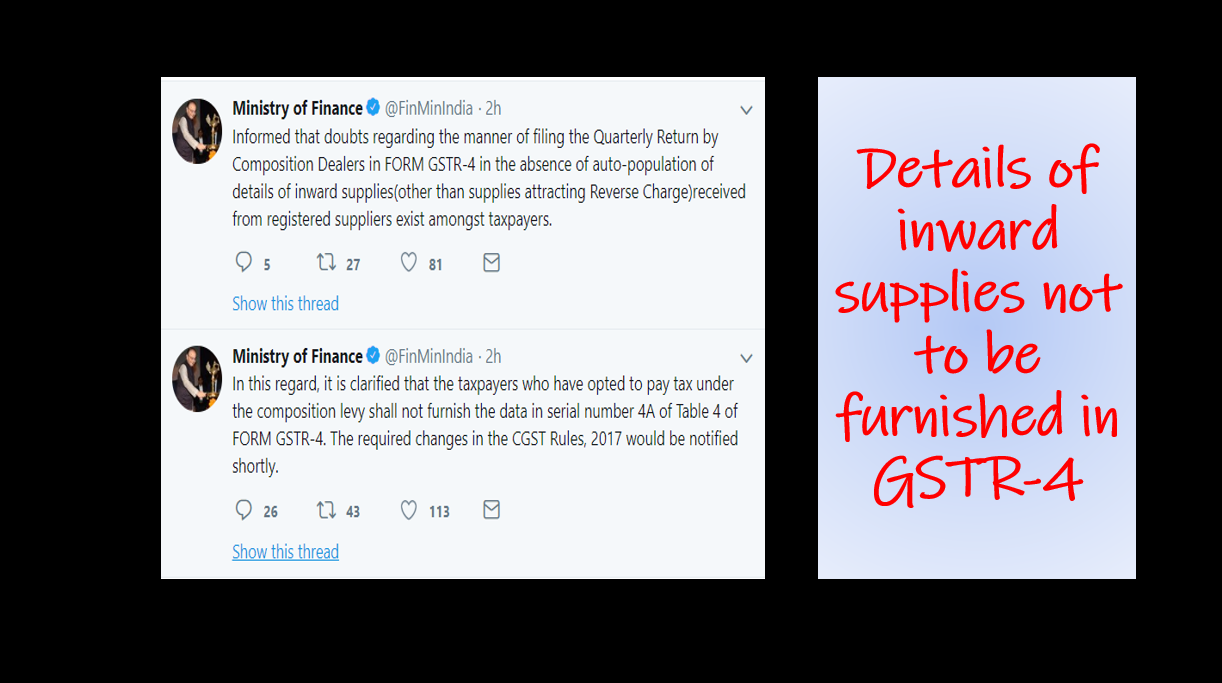

⊗ It will be applicable to suppliers of goods who are registered under composition taxable scheme u/s 10 of CGST Act,2017 as well as to service providers who are opting for paying tax by availing the benefit of composition taxable scheme as per Notification No. 02/2019– Central Tax (Rate), dated the 7th March 2019.

⊗ A person who is registered under the composition scheme under GST will now have to file only ONE return on an annual basis. This will be effective from the financial year 2019-20. The return needs to be filed in FORM GSTR – 4. The due date for such return is on or before 30th April following the end of such financial year.

⊗ While the payment of tax needs to be made based on self-assessment on a QUARTERLY basis. This will be effective from the financial year 2019-20. The statement containing the details of payment should be furnished in FORM GST CMP – 08. The due date for such payment is on or before the 18th day of the month succeeding such a quarter.

⊗ Latest due dates updated for composition taxpayers along with the official CGST notifications

⊗ FORM GST CMP – 08- Statement for payment of self-assessed tax would require the following basic details like GSTIN, Legal name, Trade name, ARN, Date of filing and the following details which states how the liability is assessed as per CGST Notification no. 20/2019 dated 23rd April 2019

Summary of self-assessed liability

(net of advances, credit and debit notes and any other adjustment due to amendments etc.)

[su_table]

|

Sr. No. |

Description | Value | Integrated Tax | Central Tax | State/UT Tax |

Cess |

|

1. |

2. | 3. | 4. | 5. | 6. |

7. |

|

1. |

Outward supplies (including exempt supplies) | |||||

|

2. |

Inward supplies attracting reverse charge including import of services | |||||

|

3. |

Tax payable (1+2) | |||||

|

4. |

Interest payable, if any | |||||

|

5. |

Tax and interest paid |

[/su_table]

Related Posts

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Composite scheme dealer(new composite scheme 6% tax rate not applicable dealer) April-June,2019 quater form gstr4 or gst cmp-08 return filed.

For a composition dealer, composition scheme u/s 10 will be applicable. 6% rate is for a person who provides services or services and goods. GSTR 4 is to be filed annually. CMP 08 is to be filed for every quarter by 18th. The due date for the same will be extended for the first quarter i.e April-June 2019 will be extended as the form is still not available (replied on 18.07.19 at 6 pm)