Last updated on July 24th, 2023 at 08:36 pm

Form GSTR 4 (Annual Return) is a summary return to be filed by composition taxpayers. It will give details regarding the outward supplies, inward supplies, import of services, and inward supplies attracting reverse charge, tax payable, etc.

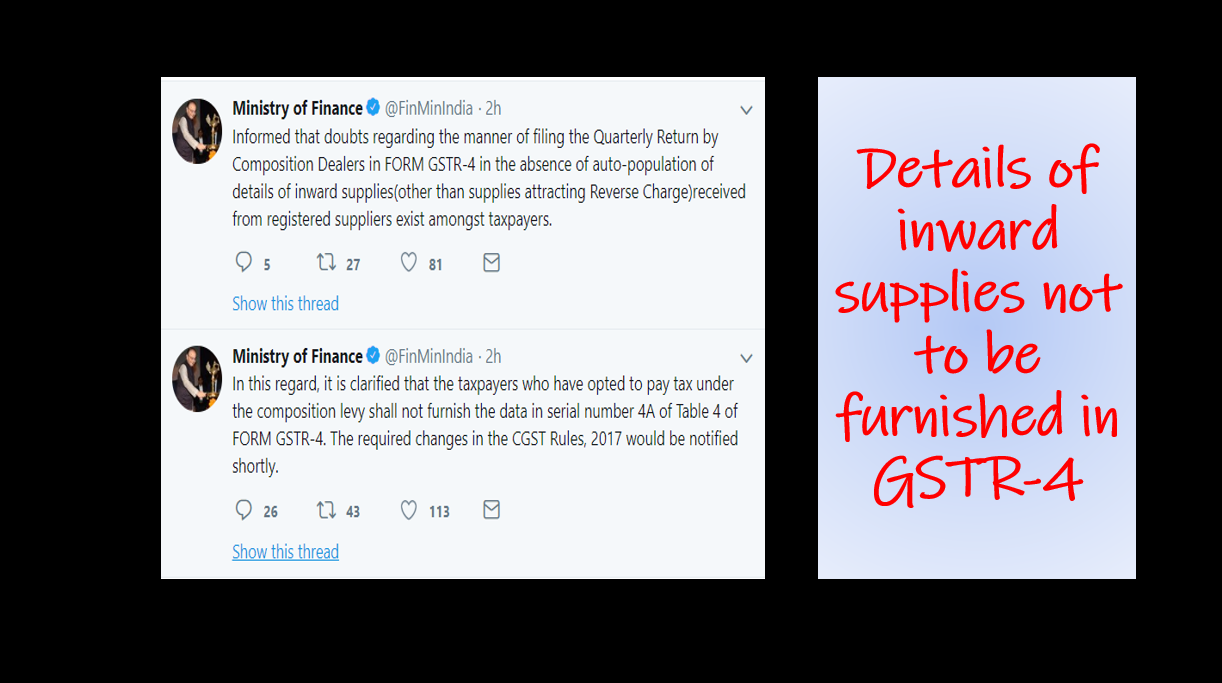

Read more about – Inward Supplies in GSTR 4

GSTR 4 will be applicable to all the composition taxpayers including service providers who have opted for the composition scheme as per CGST(R) Notification no. 2/2019 dated 7th March 2019.

Note: With the amendment of GST Rule 62 taxpayers who were availing the benefit of CGST(R) Notification no. 2/2019 dated 7th March 2019 will not be permitted to furnish the returns in Form GSTR 4 and make payments in Form CMP 08.

Composition taxpayers were notified to file a yearly return in Form GSTR-4 (Annual Return) from the financial year 2019-2020 and onwards vide a CGST Notification no. 21 dated 23rd April 2019.

GSTR 4 needs to be filed by the person who was registered as a composition taxpayer for any period (even for a single day) during the financial year.

⇒ who were composition taxpayers at the beginning of the year but have opted out during the year.

⇒ who was registered under the composition scheme during the year and has not opted out during the financial year.

⇒ who were registered under the composition scheme at the beginning of the year and have never opted out subsequently.

Form GSTR 4 can be filed using the online as well as offline utility.

⇒ The Online Utility of Form GSTR 4 can be accessed on the dashboard only after logging in with valid credentials on the GST portal.

⇒ The Offline Utility of Form GSTR 4 can be accessed under the downloads section of the GST portal.

Form GSTR 4 (Annual Return) cannot be revised once it is filed.

As per section 47 of CGST Act 2017, a delay in furnishing the GST return in Form GSTR-4 will attract a late fee of Rs 200 per day (CGST+SGST/UTGST) subject to the maximum

⇒ If there is tax liability – Rs 2,000/- (CGST+SGST/UTGST).

⇒ If there is no tax liability – Rs 500/- (CGST+SGST/UTGST).

Note: The decision was taken in the 43rd GST Council Meeting and notified vide a CGST notification no. 21 dated 1st June 2021.

For the Financial Year 2023-24

⇒ Due Date was notified as 30th April 2024 – CGST Notification no. 21 dated 23.04.2019

For the Financial Year 2022-23

⇒ Due Date was notified as 30th April 2023 – CGST Notification no. 21 dated 23.04.2019

For the Financial Year 2021-2022

⇒ Decision to further extend the period of late fees waiver up to 28th July 2022 in furnishing the annual return for FY 2021-22 was taken in the 47th GST Council meeting on 29th June 2022 and the same was notified vide a CGST Notification no. 12 dated 05.07.2022

GSTN had removed the negative balance from the cash ledger for the composition taxpayers. Still, for certain taxpayers, the issue has not been resolved must raise a grievance/ticket for a quick resolution.

⇒ Late fees for delay in furnishing the annual return for FY 2021-22 shall not be levied up to 30th June 2022 vide CGST Notification no. 7 dated 26.05.2022 was issued for waiver of late fees for returns furnished in the period 1st May 2022 to 30th June 2022.

⇒ Waiver from late fees was due to the issue of negative liability in GSTR 4 faced by composition taxpayers. Negative liability was reflected for the taxpayers who utilized the amount in the negative liability statement instead of depositing the cash while filing GST CMP 08 for the next financial year or years.

⇒ Due Date was notified as 30th April 2022 – CGST Notification no. 21 dated 23.04.2019

For the Financial Year 2020-2021

⇒ Due Date extended to 31st July 2021 – 43rd GST Council Meeting

⇒ Due Date extended to 31st May 2021 – CGST notification no. 10 dated 01.05.2021

⇒ Due Date was notified as 30th April 2021- CGST Notification no. 21 dated 23.04.2019

For the Financial Year 2019-2020

⇒ Due Date further extended to 31st October 2020 – CGST Notification no. 64 dated 31.08.2020

⇒ Due Date further extended to 31st August 2020 – CGST Notification no. 59 dated 13.07.2020

⇒ Due Date extended to 15th July 2020 – CGST notification no. 34 dated 03.04.2020

⇒ Due Date was notified as 30th April 2020 – CGST Notification no. 21 dated 23.04.2019

Note: Due Date which has been extended twice so far has been extended as Form GSTR 4 was not made available for taxpayers for filing.

Quarterly payments are to be made on or before the 18th day from the end of the quarter in Form GST CMP 08.

⇒ Apr to Jun – 18th July

⇒ Jul to Sep – 18th October

⇒ Oct to Dec – 18th January

⇒ Jan to Mar – 18th April

Read more about – Quarterly payments in Form GST CMP 08

Thought to ponder – If GSTR 4 (Annual Return) is a yearly return being filed by composition taxpayers then what is the relevance of the Annual Return(Form GSTR 9A) notified for composition taxpayers? Though the composition taxpayers have been granted relaxation from filing Annual Return in Form 9A.

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Thank you for the due date reminder

Glad it helps you to file your returns timely.