Last updated on September 16th, 2022 at 02:47 pm

Refund Re-Issue Request

ITR filing and its processing

- You have filed the ITR but have not e-verified it (Read – How to e-Verify ITR? | Know the reduced time-limit for e-verification for AY 22-23 and onwards)

- You have filed the ITR and e-verified but it is yet to be processed (Wait for Government to process the ITR)

- You have filed the ITR, e-verified it and it is processed with no refund (Check the intimation)

- You have filed the ITR, e-verified it and it is processed with demand. (Check the outstanding demand in Pending Actions on Dashboard)

- You have filed the ITR, e-verified it and it is processed with the refund (Refund is awaited) (Check the status of the awaited refund in filed return forms)

- You have filed the ITR, e-verified it and it is processed with a refund (Refund has failed) (Raise a refund-reissue request)

What to do in case of Income Tax refund failure?

Income Tax Refund can be issued only when the bank account is pre-validated, nominated for refund and ECS is enabled. An email will be sent by CPC for communicating the failure of refund.

Email from : intimations@cpc.incometax.gov.in

Subject of E-mail : Your refund has failed, please raise a Refund Re-issue Request

What can be the probable reasons for the failure of a refund?

A list of some of the probable reasons why the refund fails are:

- Incorrect Bank Account Number

- Incorrect IFSC Code, MICR Code

- PAN is not linked to the Account

- KYC is pending for the bank account

- Incorrect type of account is selected i.e Current Account/Saving Account

- Incorrect description of account holder i.e Primary holder/secondary holder

- PAN name does not match with Account name etc.

The taxpayer has to raise a refund reissue service request on the e-filing portal.

Steps to raise “Refund Re-issue Request”

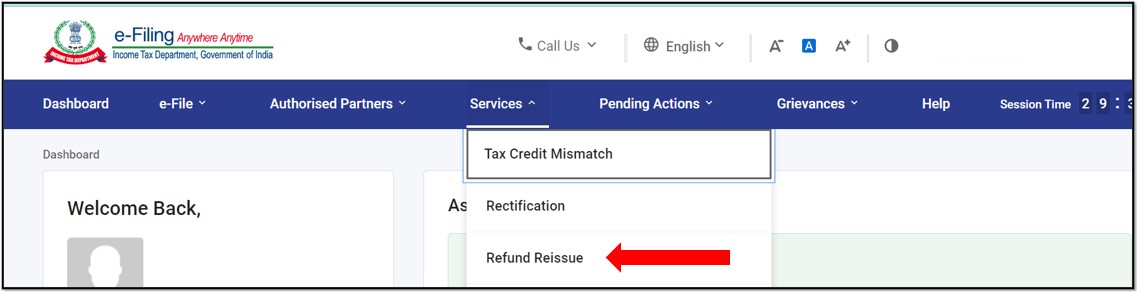

Login with valid credentials on the e-filing portal

On the dashboard go to “Service Menu”

From the drop-down list select “Refund Reissue”

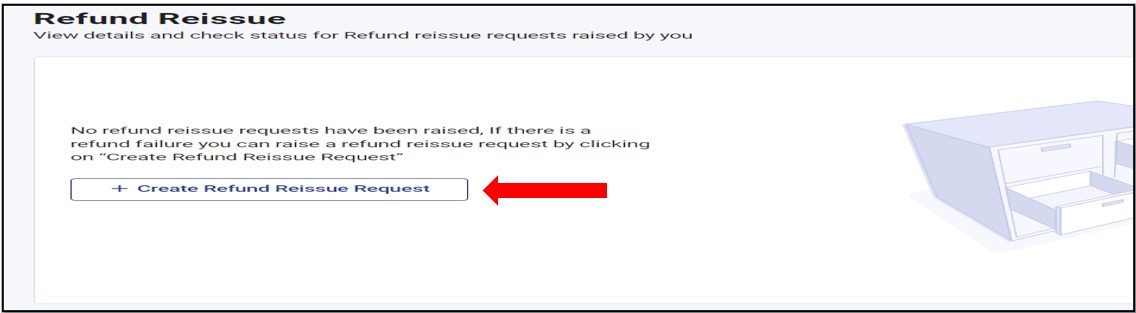

Click on “+ Create Refund Reissue Request” (Note: You will be allowed to create a refund reissue request only if the refund has failed and not for an unprocessed/awaited refund)

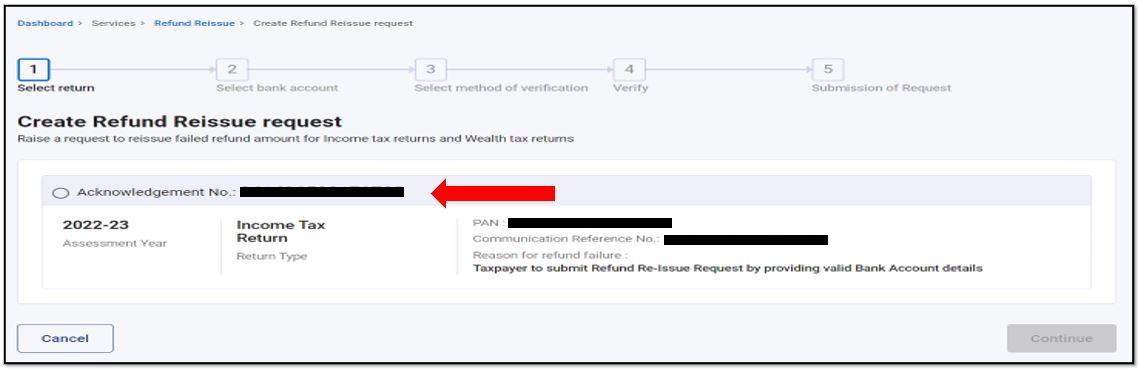

Upon clicking the “Create Refund Reissue Request“, first you will have to select the Assessment Year for which the refund has failed and then click “Continue“.

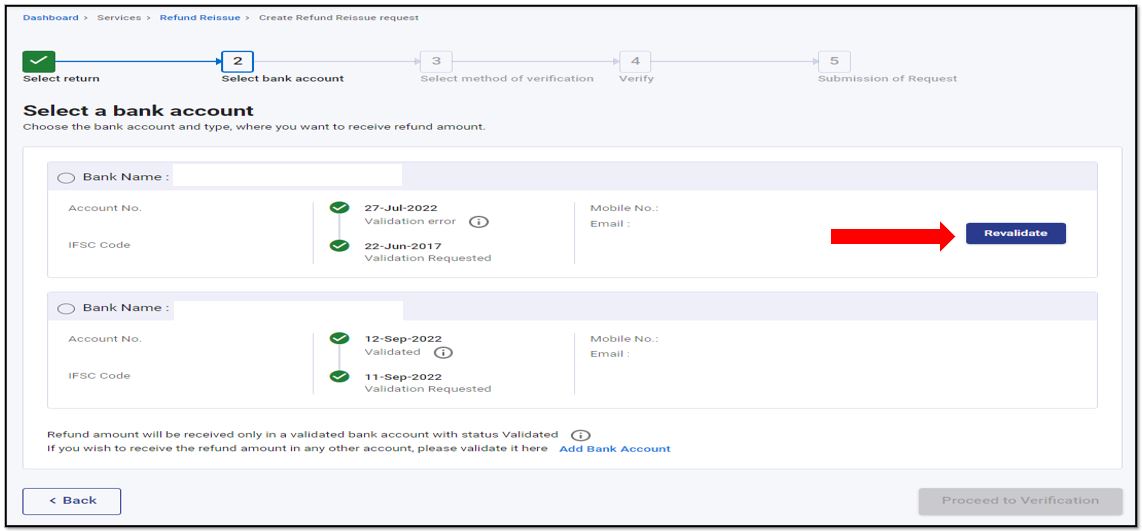

Now the list of bank accounts will be displayed. Refunds can be processed only if the bank account is validated, nominated for refund and EVC enabled. The taxpayer has to verify the details of the bank a/c no., IFSC code, mobile no. email id and then select any one of the bank accounts for a refund.

If you will select the bank account which is yet to be validated an error message shall be displayed “Refund amount cannot be received in the bank account with status “validation error”. Please select some other bank account.“

- If you wish to avail refund in the bank account which is validated please click on “proceed for verification“.

- But if you wish to avail refund in the bank account which is yet to be validated please click on “Revalidate“.

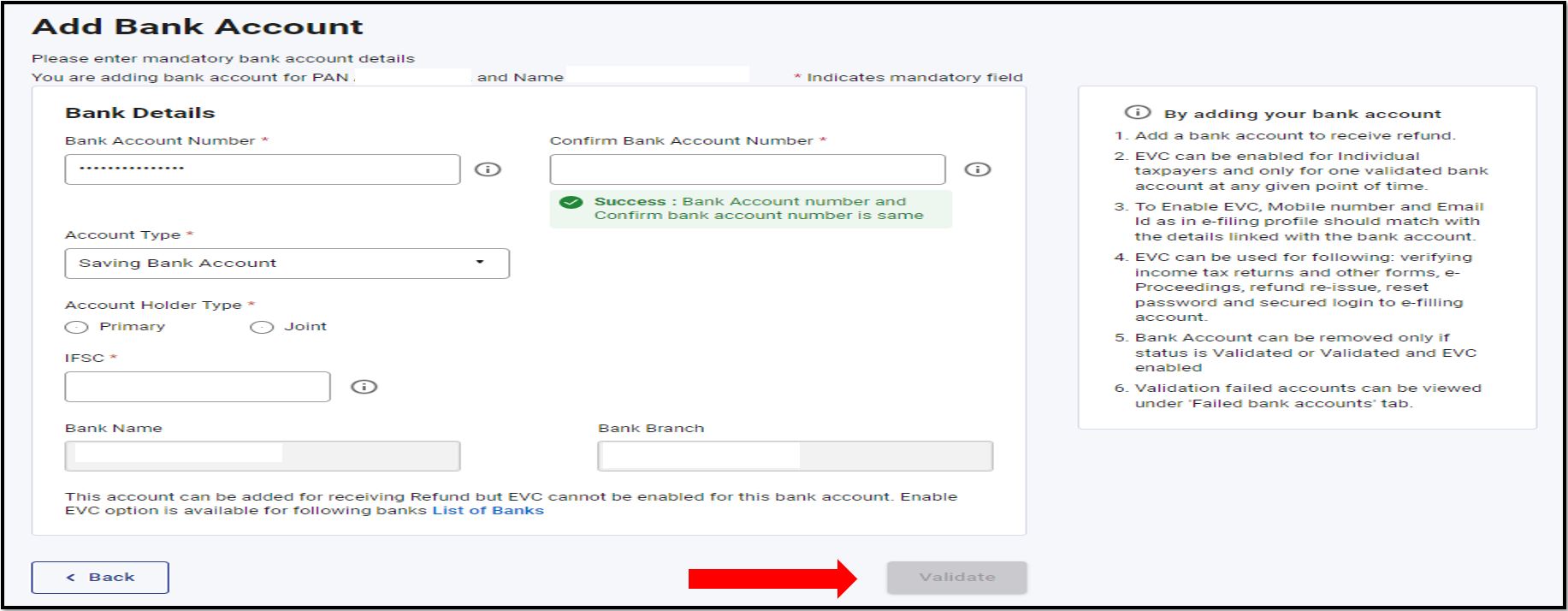

When you click on “revalidate”, a new window named “Add Bank Account” with the available details shall appear. Please provide and verify the details and click on “validate”

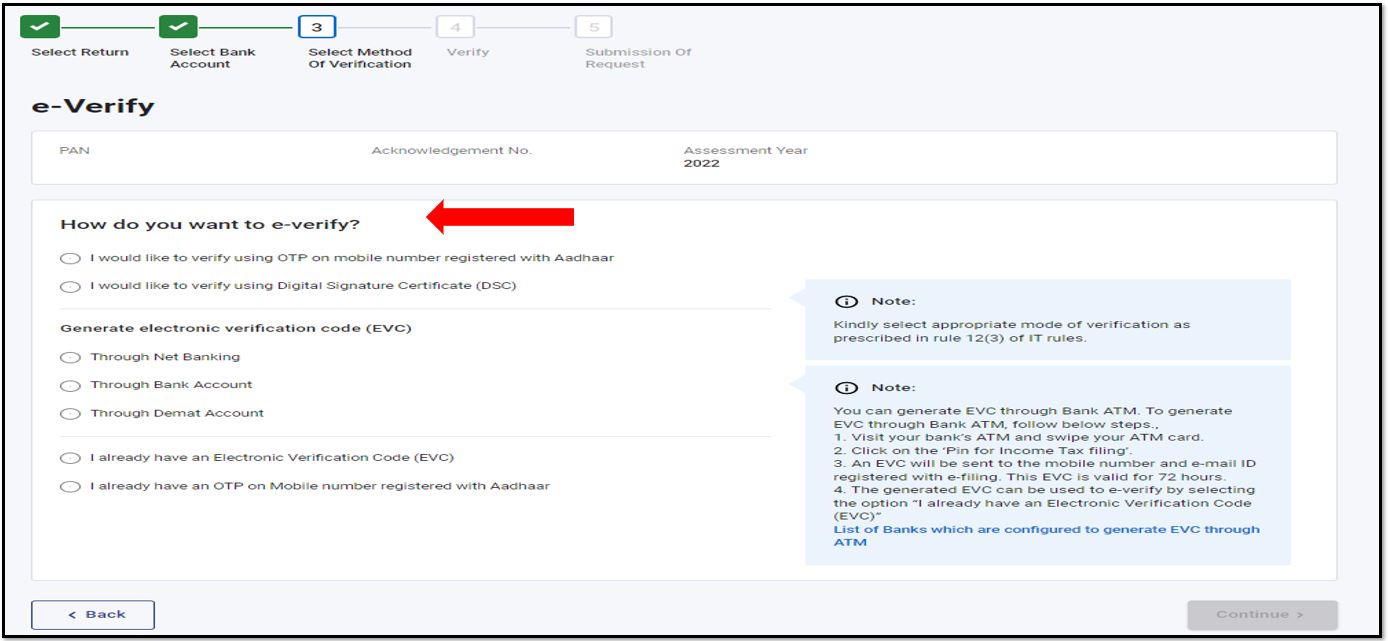

After the bank account is validated or an already validated bank account is selected, the taxpayer should select the bank account in which Government should issue the refund and click on “proceed for verification”. A new window for e-verification shall appear.

To submit the refund re-issue request, the taxpayer will have to “e-Verify” by choosing the appropriate mode of e-verification i.e Aadhaar OTP/EVC/DSC, and then click on “continue” to submit the request.

Upon e-verification of the service request a “success message” will be displayed confirming the Refund Re-issue request submission.

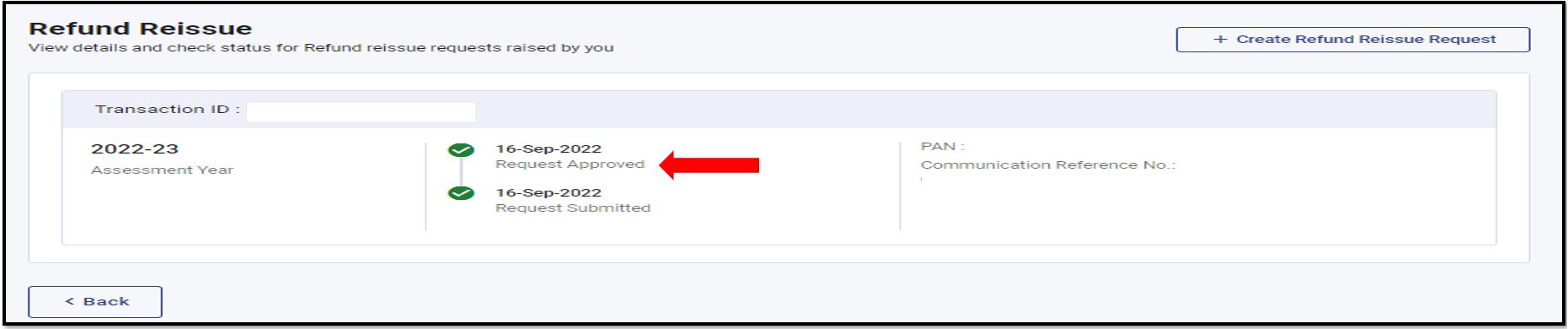

How do I know whether my refund re-issue request has been approved?

After submission of the service request(i.e refund re-issue request), you can check whether the same has been approved or not by CPC. Generally, it gets approved instantly, you can navigate to Dashboard>Services>Refund Reissue

Contact details of CPC

You may contact CPC, Bangalore on following contact numbers 18001030025 / 18004190025 or +91-80-46122000 / +91-80-61464700

Will I get interest on my income tax refund? |Interest on income tax refund

If the income tax refund is delayed then the taxpayer will get the amount of refund along with interest calculated as per the provisions of section 244A. Interest u/s 244A is calculated at 1/2% per month or part of the month.

The period for the calculation of interest will begin from

- From 1st April of the assessment year to the month in which refund is granted – If the refund is arising out of TDS, TCS, and advance tax.

- From the earlier date of self-assessment tax payment/ITR filing date to the month in which refund is granted – If the refund is arising out of self-assessment tax

What happens if an excess refund is granted to the taxpayer?

If an excess refund has been granted to the taxpayer, then the excess refund will be recovered from the taxpayer along with interest calculated as per section 234D. Interest u/s 234D is calculated at 1/2% per month or part of the month.

You may also like:

- Did you e-verify your ITR?

- How to pre-validate a bank account?

- Next installment of advance tax of income tax is due on 15th Sep 2022

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

I added representative assessee to deaceased assesses profile for claiming refund. But in the new site I’m unable to see any refund reissue request available. Though I contacted e filing several times they didn’t solve the problem

Refund Re-issue request can be made only when the refund has failed.

If the ITR is yet to be processed then the refund may be delayed.

If the ITR is processed and refund is awaited you can do nothing but wait for the refund.

You can raise a grievance and call the CPC to help stating the grievance number or ask if there is any correction required from your side.

Alternatively, CBDT and CBIC have been very active on twitter, you may try tweeting your concern tagging them it might help.

my pan no XXXXXXXXXXX SANTOSH DATE OF BIRTH XX XXX XXXX he is no come tds i know do not refund assemwnt year 2022 23

Devendraji, I have hidden the details of your PAN and DOB from the public domain. Please do not share personal details on any public forum.

Seems you have filed your return and refund has not been processed. Please verify whether your bank account is validated and nominated for refund. Alternatively you can seek help of a tax professional or write to us with more details on info.financepost@gmail.com