Last updated on December 9th, 2022 at 07:15 pm

GST sections amended in Finance Act 2022

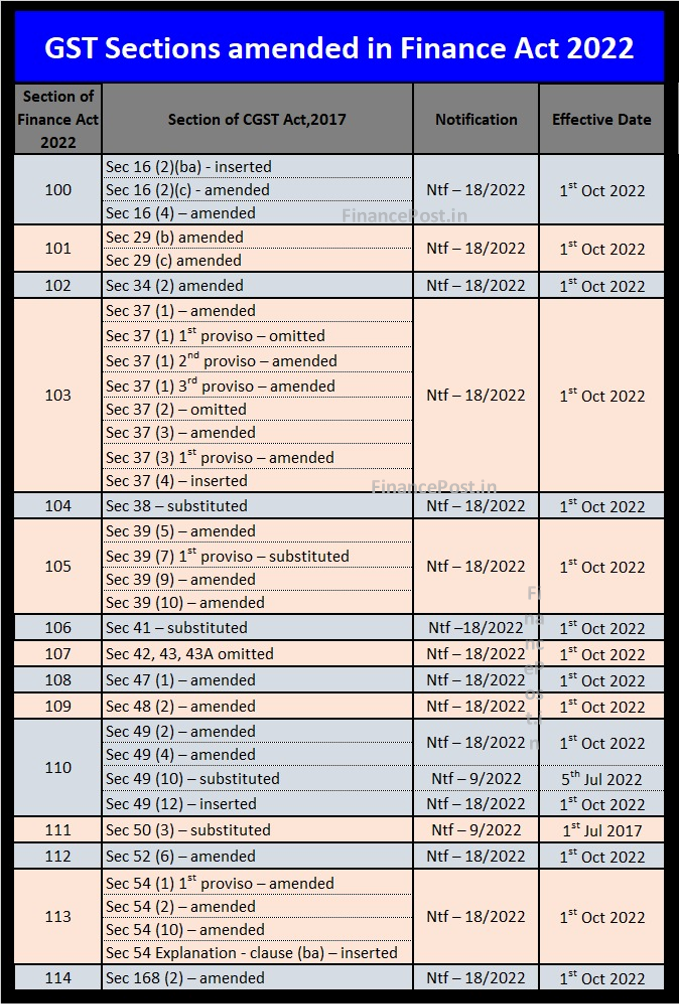

Finance Act 2022 made around fifteen amendments which include omissions, insertions, and substitutions made in the CGST Act 2017. They were covered by sections 100 to section 114 of the Finance Act, 2022 (6 of 2022). All the amendments made in the Finance Act, 2022 have been notified. The following notifications have been issued by the Ministry of Finance in order to notify the applicability and the effective date of the amended/introduced sections.

Notifications issued for the effective date of the sections of the Finance Act, 2022

|

Section of Finance Act 2022 |

Section of CGST Act,2017 | Notification | Effective Date |

| 100 | Sec 16(2)(ba) – inserted | Ntf – 18/2022 |

1st Oct 2022 |

|

Sec 16(2)(c) – amended |

|||

|

Sec 16(4) – amended |

|||

|

101 |

Sec 29(b) amended | Ntf – 18/2022 | 1st Oct 2022 |

|

Sec 29(c) amended |

|||

|

102 |

Sec 34(2) amended |

Ntf – 18/2022 |

1st Oct 2022 |

|

103 |

Sec 37(1) – amended | Ntf – 18/2022 | 1st Oct 2022 |

|

Sec 37(1) 1st proviso – omitted |

|||

|

Sec 37(1) 2nd proviso – amended |

|||

|

Sec 37(1) 3rd proviso – amended |

|||

|

Sec 37(2) – omitted |

|||

|

Sec 37(3) – amended |

|||

|

Sec 37(3) 1st proviso – amended |

|||

|

Sec 37(4) – inserted |

|||

|

104 |

Sec 38 – substituted |

Ntf – 18/2022 |

1st Oct 2022 |

|

105 |

Sec 39(5) – amended |

Ntf – 18/2022 |

1st Oct 2022 |

|

Sec 39(7) 1st proviso – substituted |

|||

|

Sec 39(9) – amended |

|||

|

Sec 39(10) – amended |

|||

|

106 |

Sec 41 – substituted |

Ntf –18/2022 |

1st Oct 2022 |

|

107 |

Sec 42,43, 43A omitted | Ntf – 18/2022 |

1st Oct 2022 |

|

108 |

Sec 47(1) – amended |

Ntf – 18/2022 |

1st Oct 2022 |

| 109 | Sec 48(2) – amended | Ntf – 18/2022 |

1st Oct 2022 |

|

110 |

Sec 49(2) – amended |

Ntf – 18/2022 |

1st Oct 2022 |

|

Sec 49(2) – amended |

|||

|

Sec 49(10) – substituted |

Ntf – 9/2022 |

5th July 2022 |

|

|

Sec 49(12) – inserted |

Ntf – 18/2022 |

1st Oct 2022 |

|

|

111 |

Sec 50(3) – substituted | Ntf – 9/2022 |

1st July 2017 |

|

112 |

Sec 52(6) – amended | Ntf – 18/2022 |

1st Oct 2022 |

|

113 |

Sec 54(1) 1st proviso – amended | Ntf – 18/2022 | 1st Oct 2022 |

|

Sec 54(2) – amended |

|||

|

Sec 54(10) – amended |

|||

|

Sec 54 Explanation clause (ba) – inserted |

|||

|

114 |

Sec 168(2) – amended | Ntf – 18/2022 |

1st Oct 2022 |

Snapshot of the above table for ready reference

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Sec 110 of Finance Act amends section 50(3) of GST Act. Above table and screen shot are erroneous.

The above article is compiled based on our understanding of the amendments made in the Finance Act 2022 and relevant notification issued in this regard.

You may take due care and expert advice before placing reliance on any content published on the website.

Sec 110 of Finance Act amends section 50(3) of GST Act. Above table and screen shot are erroneous.

Section 110 amends sub-sections of section 49

Section 111 amends sub-sections of section 50.

We believe you are referring to Finance Bill 2022 and not Finance Act 2022.

The link to download Finance Act and relevant notifications are attached to the article.

Alternatively, you can view the same from the GST portal – https://taxinformation.cbic.gov.in/explore-others

https://taxinformation.cbic.gov.in/explore-others

The article discusses the amendments made to the CGST Act 2017 by the Finance Act 2022 and provides details on the effective dates of these amendments through notifications issued by the Ministry of Finance. It appears to be a helpful resource for individuals or professionals in the field of taxation and finance who need to stay updated on regulatory changes.

Thank you