Last updated on September 17th, 2022 at 04:14 pm

Details of inward supplies not to be furnished in GSTR-4

Note: The exemption details discussed in this article were provided by CBIC for GSTR 4(quarterly return) which was applicable for FY 17-18 & FY 18-19.

Now GSTR 4 (Annual Return) is a yearly return to be filed by composition taxpayers>>>Due Dates, late fees Interest of GSTR 4 (Annual Return)

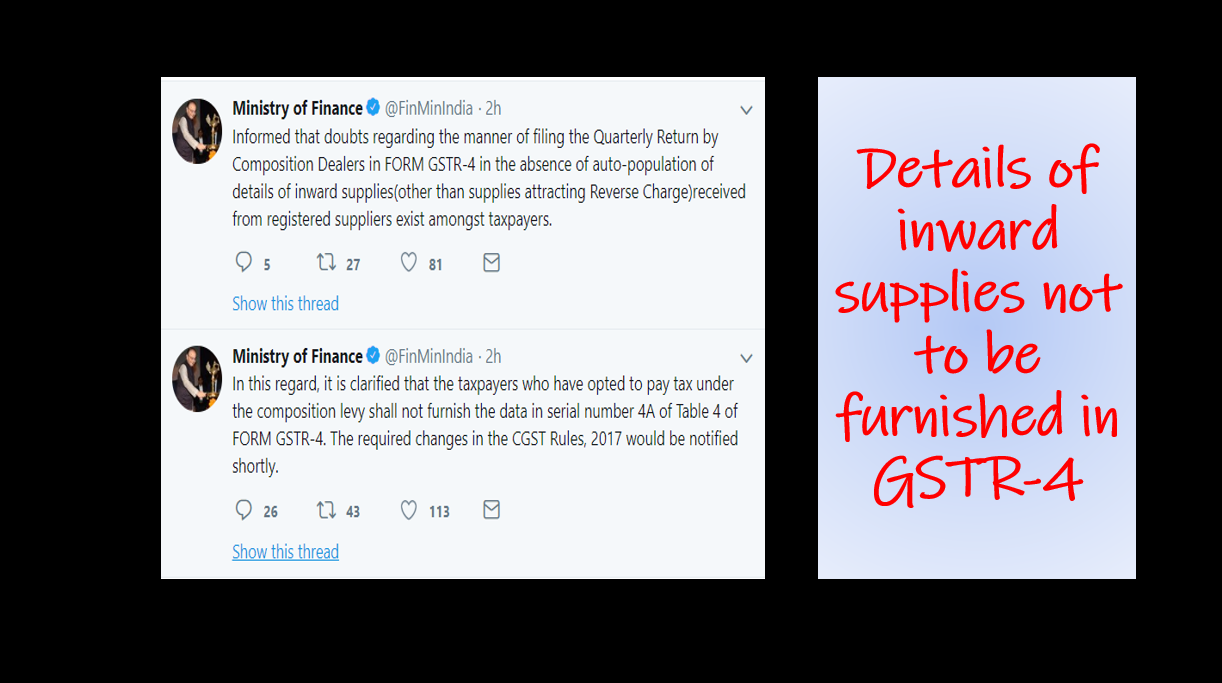

Composition dealers may note that information to be furnished in serial number 4A of Table 4 of FORM GSTR-4 is not required. Taxpayers who have opted for a composition levy may be informed that while filing the quarterly return GSTR-4 for the quarter ended September 2018, may not file the details of inward supplies (other than supplies attracting Reverse Charge Mechanism) in the absence of the auto-population feature on GST portal. Details of inward supplies not to be furnished in GSTR-4- press release on 18th Oct’18

It may be noted that the due date for filing GSTR-4 for the quarter ended September’2018 is 18th October 2018.

Click > For FY 2022-23 – Is it mandatory to furnish details of inward supplies in GSTR 4(Annual Return)?

PRESS RELEASE/NOTIFICATION for the same was published on 18th October’2018 by the GOVERNMENT. Click here to download the press release for the same

It was tweeted on the official Twitter handle Ministry of Finance around 4 pm on 17th October’18

As per section 16(4) of CGST Act,2017, A registered taxpayer has to take the ITC for all the invoices and or debit notes for the supply of goods or services of the financial year ending March, it should be taken within the DUE DATE of furnishing the return u/s 39 for the month of September following the end of the financial year or furnishing of the relevant Annual Return, whichever is earlier.

Serial number 4A of Table 4 of FORM GSTR-4

4A. Inward Supplies received from a registered supplier(including supplies attracting reverse charge)

[su_table]

|

GSTIN of supplier |

Invoice No. | Invoice Date | Invoice Value | Place of Supply | Reverse Charge | Invoice Type | Rate | Taxable Value | IGST | CGST | SGST/UT GST |

Cess |

|

(1) |

(2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) |

(13) |

[/su_table]

(Source: Offline Utility GSTR-4 from GST portal)

Related Posts

None found

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Very good excellent analysed 🙏👍👌🏻👌🏻👌🏻👌🏻👌🏻

Thank you for your appreciation