Last updated on January 18th, 2023 at 08:54 pm

GST : Advance Ruling

Overview

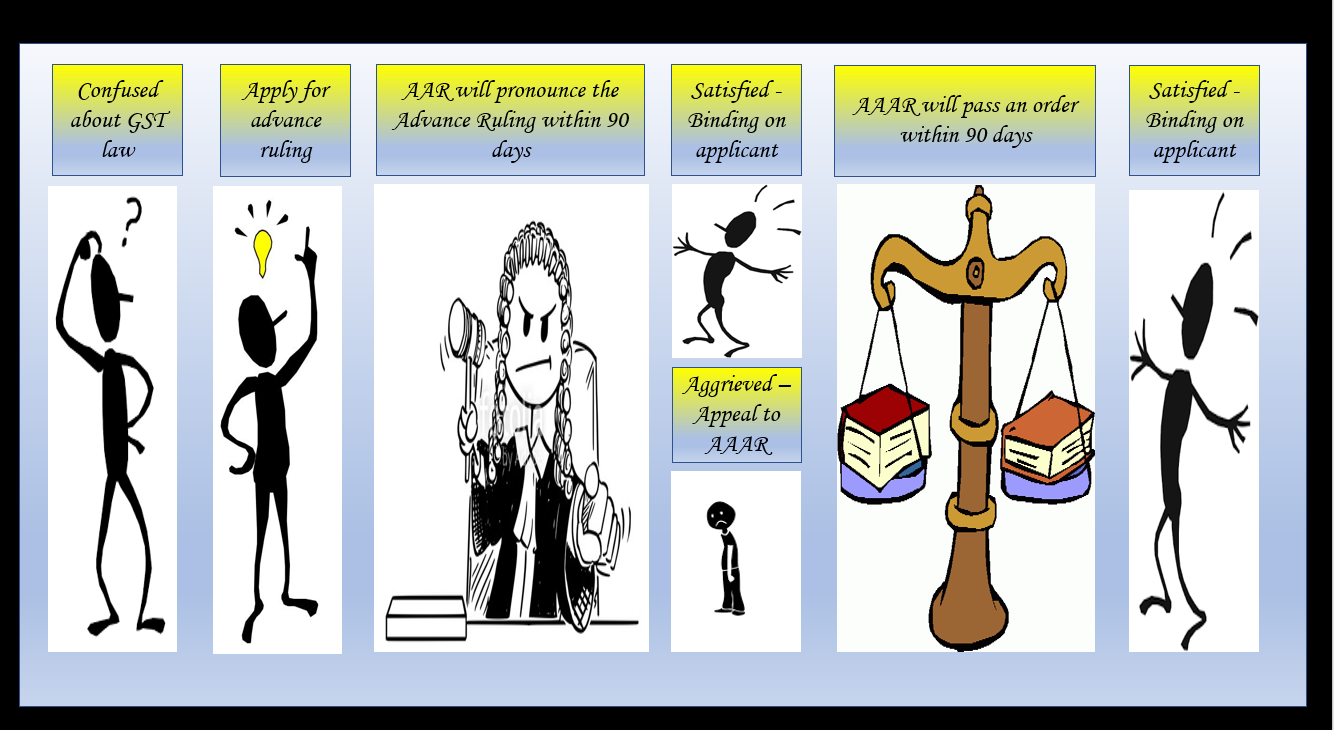

An advance ruling is a written decision/interpretation of the law (called advance ruling) given by the Authorities of Advance Ruling to an applicant on questions/matters relating to the supply of goods or services under GST.

An advance ruling will help the taxpayers to understand the provisions of law better when in doubt and avoid unnecessary litigation in the future.

It will provide certainty to the taxpayer as the decision(advance ruling) given by the Authority will be binding on the applicant as well as Government authorities.

Definitions

Advance ruling u/s 95(a) of CGST Act means

- A written decision/clarification/interpretation of the law

- Issued by the Authority or the Appellate Authority on application

- Where the applicant is confused or is not clear about the applicability of certain provisions of law.

Note: Advance ruling can be requested only for matters or questions specified under section 97(2) or section 100(1).

Note: An applicant may apply for an advance ruling for the supply of goods or services either for a proposed transaction or for a transaction that is already undertaken. It will be effective prospectively and not retrospectively.

Section 95 of CGST Act 2017 is attached for reference

Application for Advance Ruling to Authority

- An application u/s 97(1) for advance ruling can be made in Form GST ARA-01 to AAR along with a prescribed fee u/s 49 of Rs. 5000/- under the SGST head.

- An appeal against the advance ruling shall be filed in Form GST ARA-02 to AAAR along with a prescribed fee u/s 49 of Rs. 10000/-.

- The question on which the advance ruling is sought shall be clearly stated in the application.

- It is not mandatory for Authority to accept each application made for advance ruling. Authority has the right to either accept or reject the application.

- Advance ruling can be sought only for a fresh subject matter. If an application is made for a subject that is already decided earlier or is under consideration then such applications will not be admitted.

- Authority may accept the application and pass the order/decision within 90 days from the receipt of the application. Before giving any decision the applicant or his authorized representative as well as the jurisdictional officers shall be given an opportunity of being heard.

- Authority may reject the application and record the reasons for rejection in writing. Before rejecting the application, the applicant shall be given an opportunity of being heard.

What can be a subject matter for an advance ruling?

The following are the grounds/subject matter for which an application can be made for advance ruling :

As per section 97(2) of the CGST Act, 2017

- If there is ambiguity in the classification of any goods or services or both

- If one is not sure whether a GST Notification will be applicable or not.

- To determine the time and value of supply of goods or services or both;

- To determine the liability of tax to be paid on any goods or services or both;

- To check whether the tax paid or deemed to have been paid will be admissible as an input tax credit or not.

- For verifying whether the applicant is required to be registered or not;

- To verify whether a particular thing done with respect to any goods or services or both would be considered as supply of goods or services or both or not.

As per section 100(1) of the CGST Act, 2017

When an applicant, officer, or jurisdictional officer is aggrieved by the advance ruling/decision pronounced by the AAR (Authority for Advance Ruling) then an appeal may be filed with the AAAR(Appellate Authority of Advance Ruling).

Applicability of advance ruling u/s 103 of CGST Act,2017

- The advance ruling pronounced by the Authority will be binding on the applicant as well as Government authorities(concerned officer or the jurisdictional officer).

- The decision pronounced has limited applicability i.e only applicable to the person who has applied for it.

- It is interesting to note that an advance ruling once sought will be a binding lifetime if the law, facts, or circumstances supporting the original advance ruling continue to prevail and do not change.

This means advance ruling will not be binding upon similarly placed other taxable persons. (reference GST e flyer published by CBIC). In my view, an advance ruling pronounced by AAR can be relied upon for similar cases if there is no contrary view.

Is it possible to revise an Advance Ruling to rectify any mistakes?

Yes, It is possible to rectify the mistake within 6 months from the date of the order. It can be revised by the authority on its own or if it’s brought to notice by the applicant or the Jurisdictional Officer. But, if such rectification of mistake would lead to enhancement of the tax liability or reduction of ITC, the applicant should be granted an opportunity for a hearing.

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment