Last updated on August 29th, 2022 at 07:19 pm

Taxation of Speculative Income

What is a Speculative transaction / Speculation Business?

Speculation refers to trading in a financial instrument with high risk and high rewards. In other words, speculation refers to taking maximum advantage of the fluctuations prevailing in the market, especially in the price movement of securities. Due to the highly volatile market, the price fluctuations prevailing in the market are significant and tend to create significant gains/losses.

Speculative Transaction as per Income Tax Act

Section 43(5) of the Income Tax Act, 1961, defines “speculative transaction” as “a transaction in which a contract for the purchase or sale of any commodity, including stocks and shares, is periodically or ultimately settled otherwise than by the actual delivery or transfer of the commodity or scrips. “

Generally, when the delivery is not taken while trading in shares/commodities, then it is called a speculative transaction.

Which Transactions are excluded from the definition of “Speculative Transaction”?

Section 43 (5) of the Income Tax Act specifically excludes the following transactions from the definition of Speculative Transactions.

A hedging contract for raw materials/merchandise:

A derivative contract entered in respect of raw materials or merchandise as a hedge to safeguard the loss through future price fluctuations in respect of the contracts for actual delivery of goods manufactured or merchandise sold by a merchant are excluded from Speculative transactions. In other words, when a merchant who is expecting future delivery of a raw material enters into a hedge to avoid loss from future price fluctuations, then that hedge is not a speculative transaction. Hence the income derived from such a hedge will not be called as speculative income.

A hedging contract for in respect of shares/stocks:

A derivative contract in respect of stocks and shares entered into by a dealer or investor as a hedge. When a trader or an investor enters into a hedge/derivative to guard against loss in his current holdings of stocks and shares due to price fluctuations are excluded from the definition of Speculative Transaction. (Taxation of options & futures)

Forward Contract

Any forward contract entered into by a member of a forward market or stock exchange in the course of any transaction in the nature of jobbing or arbitrage, as a hedge to guard against loss that may arise in the ordinary course of his business. Generally, there is a reasonably certain future delivery while a person enters into a forward contract. Hence, the same is excluded from Speculative Transactions.

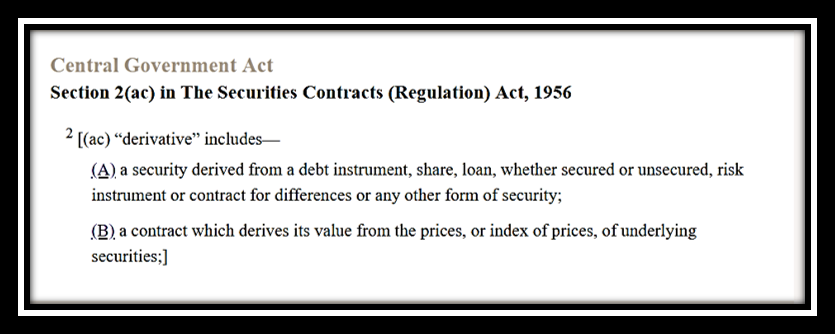

Trading in Derivatives

An eligible transaction in respect of trading in derivatives referred to in clause (ac) of section 2 of the Securities Contracts (Regulation) Act, 1956 (42 of 1956) carried out in a recognized stock exchange; is excluded from the Speculative transactions. Hence Futures and Options (F&O) contracts carried out on a recognized are excluded from Speculative transactions.

Trading in Commodity Derivatives:

An eligible transaction in respect of trading in commodity derivatives carried out in a recognized association, which is chargeable to commodities transaction tax under Chapter VII of the Finance Act, 2013 (17 of 2013) is excluded from the Speculative Transactions.

Intra-day trading – Speculative Transaction

Based on the definition and exceptions listed above, we can say that the Intra-day share trading activities will be considered as “Speculative Transaction”, as there is no actual delivery involved and the shares enter and exit from the trading account on the same day without entering into the DEMAT account at all.

How is income from Speculative Transactions accounted for Tax purposes?

Explanation 2 to section 28 of the Income Tax Act, 1961 specifically provides that where an assessee carries on speculative business, that business of the assessee must be deemed as distinct and separate from any other business

So, Income Tax perspective, the income from speculative transactions is considered a distinct “Business Income“.

For Example, A cloth merchant derives “Business Income” from trading in fabrics. At the same time, if he also enters into “intraday” stock trading, then the income generated from “intraday stock trading” will also be considered as “Business Income” but will be separate from his income from the cloth business. The income from Intra-day activities is his “Business Income from Speculative Activities”.

A special treatment to the Loss from Speculative Business

- How to do a transaction in Digital Rupee (CBDC-R)? – A Step by step Guide - 10/12/2022

- Can you rectify your 26AS? - 20/09/2022

- Tax implications on Cashback - 09/09/2022

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Can a trading in derivatives to a limited extent can be considered as capital gain?

Or it should only be treated as non speculative business income