Last updated on May 10th, 2021 at 09:21 am

Digital Payment Facility must if Turnover exceeds 50 cr

We all might have come across a situation where the seller at malls /petrol pumps/restaurants/ hotels etc. etc. would have refused to accept the payment in electronic modes citing reasons like “We accept in cash only”, “We don’t use PAYTM”, “Debit card/credit card machine is not there or not working or network issues” etc., etc. To increase, promote digital payments, the Government has brought the businesses with a higher turnover to mandatorily provide the facility electronic mode of payment. Government plans to bring awareness to the public about the existence of low-cost digital modes of payment such as NEFT, RTGS, BHIM UPI, UPI-QR Code, Aadhaar Pay, PayTM, etc.

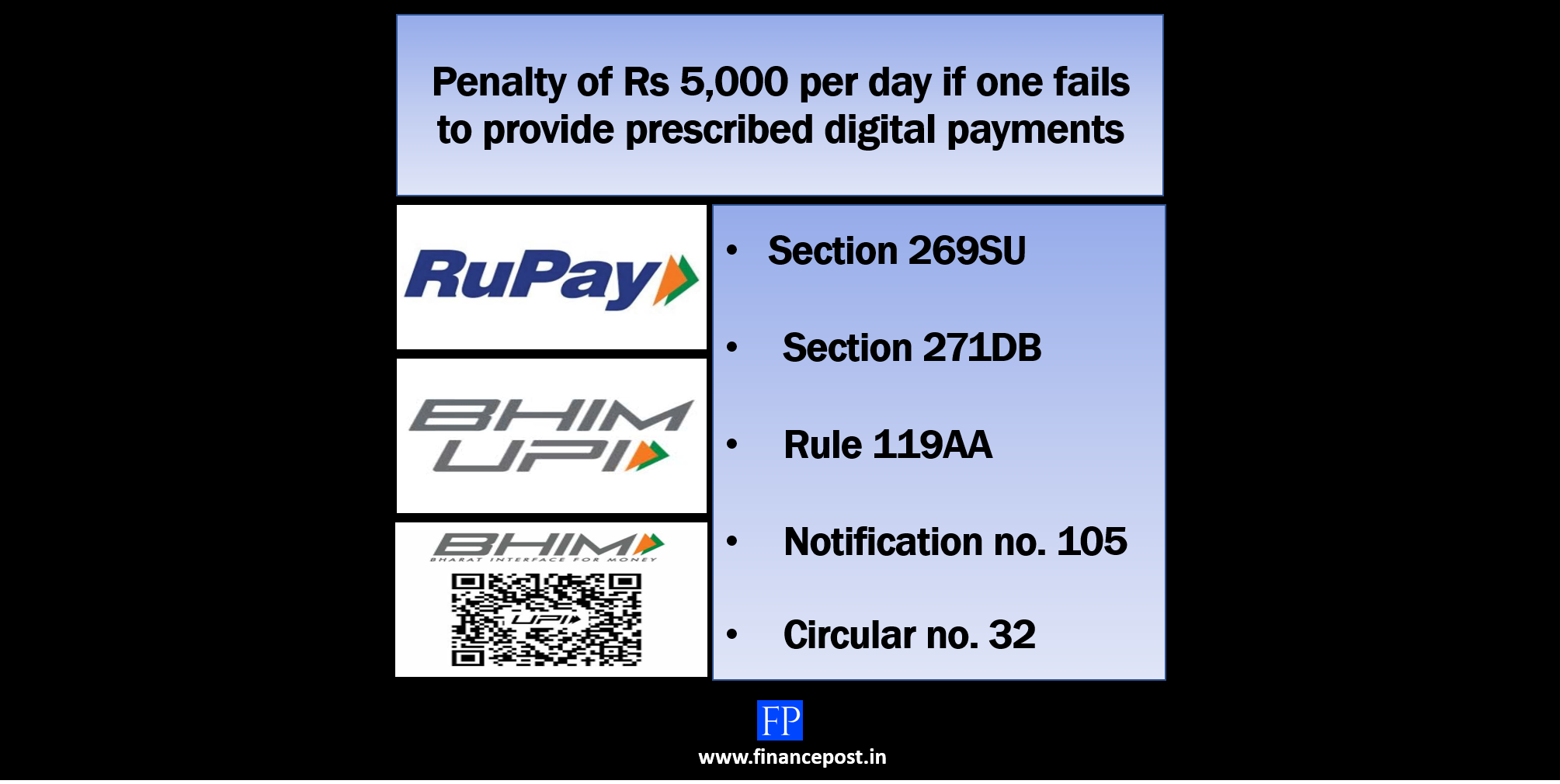

Who will be covered by the newly inserted sections 269SU & 271DB of the Income-tax Act,1961?

Any person who carries on a business and the total sales, turnover or gross receipts from the business exceeds fifty crore rupees during the immediately preceding previous year.

What needs to be done under section 269SU of the Income-tax Act?

With an intent to promote digital transactions and make India a less-cash economy, the Government has inserted section 269U in the Income Tax Act,1961 to make it mandatory w.e.f 1st November 2019 for the businesses whose turnover in FY 18-19 is more than Rs 50 crore shall mandatorily provide the facility of accepting the payments through prescribed electronic modes.

Note: Those prescribed electronic modes as per section 269SU have been notified in Rule 119AA. Click here to know the mandatory prescribed electronic modes one should have to accept the digital payments.

What happens if the provisions of section 269SU are not complied with?

To penalize the businesses for failure to comply with the provisions of section 269SU( i.e provide the facility to accept payments in digital modes) a new penal section 271DB has been inserted in the Income Tax Act,1961 which will impose a penalty of Rs five thousand per day for the period such failure continues.

But such a penalty will not be imposed if the person can prove that there were good and sufficient reasons for such failure.

Note: Penalty u/s 271DB can be imposed only by the Joint Commissioner of Income-tax.

How the Government plans to promote or encourage digital payments?

To promote digital payments, the Government has also inserted a new section 10A in The Payment and Settlement Systems Act, 2007 w.e.f 1st November 2019, that no banks or the providers of the digital payment system shall impose any charge upon anyone, either directly or indirectly, on a payer making a payment, or a beneficiary receiving payment” through electronic modes of payment prescribed under section 269SU of the Income-tax Act, 1961.

Unanswered Question

⊗ How will the government come to know that the facility for digital payment was not made available?

⊗ How will the service providers who provide the facility of electronic mode payment such as banks providing net banking, RTGS NEFT, credit cards/debit cards, PayTM, other wallets, UPI, etc. be aware that charges shall not be imposed upon the businesses as their turnover in the preceding financial year was more than Rs 50 Crores?

Related Posts

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment