Income Tax

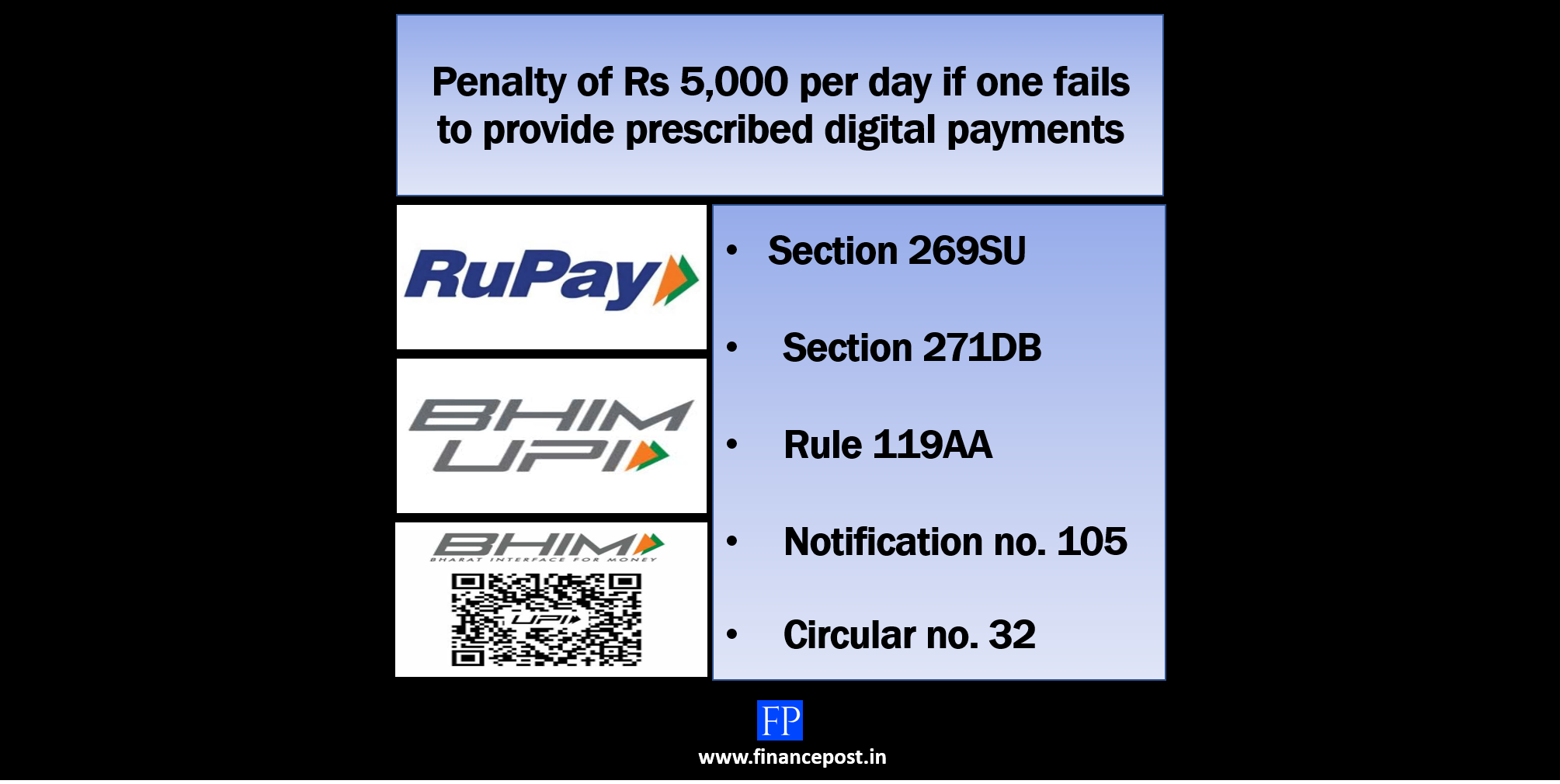

Penalty of Rs 5000 per day for non-compliance with section 269SU by 31st January 2020

Last updated on April 2nd, 2022 at 01:17 pmPenalty of Rs 5000 per day for non-compliance with section 269SU by 31st January 2020 Businesses having a turnover of more than Rs. 50 cr. in the […]