Last updated on July 24th, 2022 at 08:09 pm

Section 112A of the Income Tax Act

The Finance Bill 2018, introduced a new section, Section 112A of the Income Tax Act, The section deals with the taxation of long-term capital gains on the sale of equities and certain securities. Long-term gains arising from the sale of listed equity shares were exempt u/s 10(38). This exemption has been withdrawn by the Finance Act,2018 w.e.f Assessment Year 2019-20. As per this new section 112A, long-term gains arising out of the sale of shares are taxable from the financial year 2018-19.

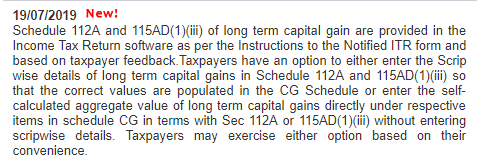

No need to enter Script wise details in ITR for LTCG – Clarifies IT Department

Based on taxpayers’ feedback, CBDT has given an option to the taxpayers to furnish the details of long term capital gain either script-wise or self-calculated aggregate value.

What does Sec 112A say? | Section 112A of the Income Tax Act

With effect from 1st April 2018 in case of an assessee

- whose income includes income chargeable under the head “Capital Gains”

- the capital gains arising from the transfer of a long-term capital asset being an equity share in a company or a unit of an equity oriented fund or a unit of a business trust and

- Securities Transaction tax has been paid on both acquisition and transfer of such capital asset

In such cases, tax payable on his total income shall be an aggregate of

Tax on long-term capital gains exceeding one lakh rupees at 10%; And

Tax on the total income as reduced by long-term capital gains as if the total income so reduced were the total income of the assessee

In short, Long-term capital gains arising on the sale of equity/equity-oriented funds, etc are taxable at 10% in excess of Rs. 1 lac.

The long-term capital gains are calculated without providing indexation benefit u/s 48.

What if a person’s total income comprises only LTCG from equity shares and the gain is less than Rs 2,50,000/-?

The section 112A clarifies that in case a person’s total income is below the taxable threshold and the assessee is individual or HUF where the total income as reduced by such long-term capital gains is below the maximum amount which is not chargeable to income-tax, then, the long-term capital gains shall be reduced by the amount by which the total income as so reduced falls short of the maximum amount which is not chargeable to income-tax.

Hence, the LTCG will not be chargeable to tax.

What is the Grandfathering provision?

For the computation of the Long-term Capital gains on equity shares after 31st March 2018, the grandfathering of all gains up to 31 January 2018 is allowed. This means that for computing long-term capital gains arising on transfer of equity shares, which were acquired by the assessee before 1 February 2018, the cost of acquisition shall be the fair market value of the asset as on 31st Jan 2018. Fair market value has been defined to mean the highest price of the capital asset quoted on any recognized stock exchange on 31 January 2018 or net asset value as on 31 January 2018, in case of a capital asset is a unit and not listed on a recognized stock exchange. Section 112A of the Income Tax Act

For instance, Mr A. buys 10,000 shares of company XYZ Ltd. as on 1st January 2018 for RS 100 each. The stock price of XYZ Ltd. on 31st Jan 2018 is Rs 250 per share. On 1st March 2019, he sells these 10,000 shares for Rs 300 each. In this case, to arrive at the capital gains, the grandfathering provision can be applied as that will be beneficial to Mr. A. Accordingly, the cost of shares will be considered as Rs 250 instead of Rs 100.

LTCG = Selling price – Purchase Price

LTCG = (10,000 x 300) – ( 10,000 x 250)

LTCG = Rs. 5,00,000

Related Posts

- How to do a transaction in Digital Rupee (CBDC-R)? – A Step by step Guide - 10/12/2022

- Can you rectify your 26AS? - 20/09/2022

- Tax implications on Cashback - 09/09/2022

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment