Last updated on May 15th, 2021 at 09:18 pm

UDIN will be mandatory for GST & Tax Audit Reports from 1st April 19

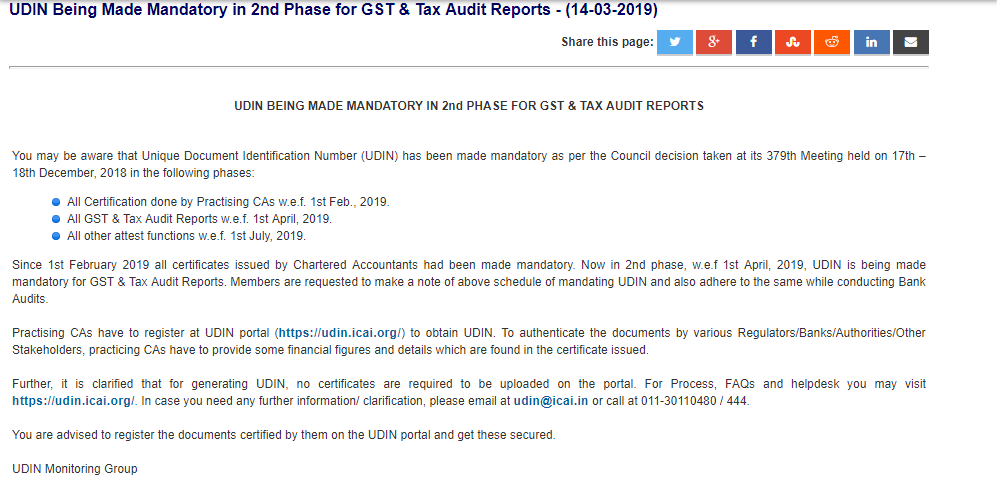

UDIN ( Unique Document Identification Number) was made mandatory after the decision was taken in 379th Council Meeting held on 17th & 18th December 2018.

Click here to know more about UDIN, why and how to register or generate UDIN.

Phased Implementation

ICAI planned the implementation of UDIN generation in a phased manner – in 3 phases.

1st Phase w.e.f. 1st February 2019

It is mandatory for a Chartered Accountant to generate a UDIN for all the certificates issued on and after 1st February 2019. Click here to see the illustrative list of certificates for which UDIN was mandatory in this phase.

2nd Phase w.e.f. 1st April 2019

ICAI today announced that it will be mandatory for a Chartered Accountant to generate a UDIN for GST Audit Reports & Tax Audit Reports on and after 1st April 2019.

ICAI has clarified that this would also be applicable for Bank Audits too. Hence, Chartered Accountants are requested to adhere to the same while conducting Bank Audits too.

3rd Phase w.e.f. 1st July 2019

It will be mandatory for a Chartered Accountant to generate a UDIN for all other attesting functions carried out by a CA other than mentioned in Phase 1 & Phase 2.

(Click here to read more about the certificates omitted from UDIN in phase 1 )

Related Posts

- Can you buy Immovable Property outside India? - 18/09/2022

- Major Highlights of the Union Budget 2022 - 23/02/2022

- Availing Instant Loans made easy - 05/10/2021

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment