Last updated on March 7th, 2023 at 05:49 pm

GST on GTA

Which exemptions from the services of GTA have been withdrawn?

If consideration charged by GTA for a single carriage did not exceed Rs 750 – it was exempt up to 17th July 2022. [This exemption has been withdrawn w.e.f. 18th July 2022]

⊗ If consideration charged by GTA for a consignment in a single carriage did not exceed Rs 1500 – it was exempt up to 17th July 2022. [This exemption has been withdrawn w.e.f. 18th July 2022]

Relevant Notifications

- CGST(Rate) Notification no. 12/2017 dated 28th June 2017

- CGST(Rate) Notification no. 04/2022 dated 13th July 2022

When GTA is not required to obtain GST registration?

If a GTA provides transportation services exclusively to the recipients where total tax liability is discharged on the reverse charge basis as per section 9(3) by the recipient of service. Then irrespective of the turnover, GTA will be exempted from obtaining registration u/s 23(2) of the CGST Act,2017.

Relevant Notifications

[Note: Section 23 has been substituted retrospectively w.e.f 1st July 2017 in Union Budget 2023. Whenever substituted section 23 will be notified, a fresh notification amending CGST Notification 5/2017 will be issued as the powers which were conferred for exempting a specified category of taxpayers u/s 23(2) have been substituted u/s 23(b)]

What is the GST rate applicable to GTA?

From 18th July 2022, GTAs will have to choose from two options whether

They will pay GST for services supplied by them @ 5% or 12%

OR

They will not pay GST for services supplied by them @ 5%

Relevant Notifications

- CGST(Rate) Notification no. 11/2017 dated 28th June 2017

- CGST(Rate) Notification no. 03/2022 dated 13th July 2022

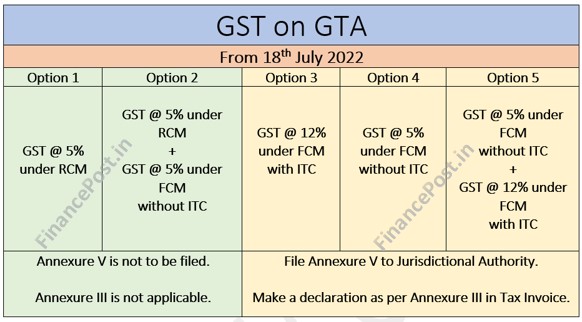

Gist of GST on Goods Transport Agency w.e.f. 18th July 2022

Option 1 – If GTA is providing services to registered persons where recipients pay GST @ 5% under RCM.

Option 2 – If GTA provides services to registered persons as well as services to unregistered persons.

- In the case of services to a registered person, the recipient will pay GST @ 5% under RCM.

- In case service is provided to an unregistered person, GTA will have to pay GST @5% under FCM without ITC. [Unregistered person who is required to pay under RCM for availing services of a GTA but doesn’t take registration and pays the same then to be on safer side GTA should pay GST@5% on FCM basis on such invoices raised by them.]

Option 3 – If GTA opts to pay GST under FCM and at 12% only. Then GTA will pay GST @ 12% under FCM and avail of the input tax credit.

Option 4 – If GTA opts to pay GST under FCM and at 5% only. Then GTA will pay GST @ 5% under FCM without availing the credit for taxes paid.

Option 5 – If GTA opts to pay GST under FCM but switches between 5% and 12%.

- GTA will pay GST @ 5% under FCM without availing the credit for taxes paid.

- GTA will pay GST @ 12% under FCM by availing the proportionate credit for taxes paid.

Is GTA required to file a declaration with Jurisdictional Authority?

Yes. If a GTA selects the option to pay GST on a forward charge basis then a declaration as specified in Annexure V needs to be filed with the Jurisdictional Officer before the commencement of the financial year. [Read in detail about Annexure V to be filed by GTA]

No. If a GTA selects the option not to pay GST on a forward charge basis then the declaration as specified in Annexure V need not be filed by GTA.

Relevant notification

Is GTA required to make any declaration in the tax invoice w.e.f. 18th July 2022?

Yes a declaration as per Annexure III is to be added to the tax invoice – If GTA opts to pay GST on the forward charge basis and has filed the declaration in Annexure V with Jurisdictional Authority.

No declaration as per Annexure III is not required. – If GTA does not opt to pay GST on the forward charge basis and does not file the declaration in Annexure V with Jurisdictional Authority.

Specimen of Declaration – Annexure III

|

Declaration I/we have taken registration under the CGST Act, 2017 and have exercised the option to pay tax on services of GTA in relation to transport of goods supplied by us during the Financial Year _____ under the forward charge. |

Relevant Notifications

Excerpts from GST Notifications applicable to GTA

GST Rate Notification no. 11/2017 dated 28.06.2017 (Amended from time to time)

|

Sr. No. |

HSN/ SAC | Description of Services | Rate (%) | Condition | |

| (1) | (2) | (3) | (4) |

(5) |

|

| Notification 11/2017 dated 28.06.2017 – To notify the rates for supply of services under the CGST Act,2017 | |||||

|

9. |

Heading 9965 (Goods transport services) [Ntf 03/2022] |

(iii) Services of Goods Transport Agency (GTA) in relation to transportation of goods (including used household goods for personal use) supplied by a GTA where, |

(a) GTA does not exercise the option to itself pay GST on the services supplied by it |

2.5 |

The credit of input tax charged on goods and services used in supplying the service has not been taken. [Please refer to Explanation no. (iv)] |

|

(b) GTA exercises the option to itself pay GST on services supplied by it |

2.5 |

(1) In respect of supplies on which GTA pays tax at the rate of 2.5%, GTA shall not take credit of input tax charged on goods and services used in supplying the service. [Please refer to Explanation no. (iv)] (2) The option by GTA to itself pay GST on the services supplied by it during a Financial Year shall be exercised by making a declaration in Annexure V on or before the 15th March of the preceding Financial Year Provided that the option for the Financial Year 2022-2023 shall be exercised on or before the 16th August 2022: Provided further that invoice for supply of the service charging Central tax at the rates as applicable to clause(b) may be issued during the period from the 18th July 2022 to 16th August 2022 before exercising the option for the financial year 2022-2023 but in such a case the supplier shall exercise the option to pay GST on its supplies on or before the 16th August 2022. |

|||

|

OR |

|||||

|

6 |

|||||

| Explanation (iv) Wherever a rate has been prescribed in this notification subject to the condition that credit of input tax charged on goods or services used in supplying the service has not been taken, it shall mean that,-(a) credit of input tax charged on goods or services used exclusively in supplying such service has not been taken; and(b) credit of input tax charged on goods or services used partly for supplying such service and partly for effecting other supplies eligible for input tax credits is reversed as if the supply of such service is an exempt supply and attracts provisions of sub-section (2) of section 17 of the Central Goods and Services Tax Act, 2017 and the rules made thereunder. | |||||

GST Exemption Notification no. 12/2017 dated 28.06.2017 (Amended from time to time)

|

Sr. No. |

HSN/SAC | Description of services | Rate | Condition | |

| (1) | (2) | (3) | (4) |

(5) |

|

|

Notification 12/2017 dated 28.06.2017 – To notify the exemptions on supply of services under CGST Act – exempts the intra-State supply of services |

|||||

|

21 |

Heading 9965 or Heading 9967 (Ntf 12/2017) (Ntf 04/2022) |

Services provided by a goods transport agency, by way of transport in a goods carriage of –

(a) agricultural produce; (b) goods, where consideration charged for the transportation of goods on a consignment transported in a single carriage does not exceed one thousand five hundred rupees; [Withdrawn w.e.f. 18.07.2022] (c) goods, where consideration charged for transportation of all such goods for a single consignee does not exceed rupees seven hundred and fifty; [Withdrawn w.e.f. 18.07.2022] (d) milk, salt, and food grain including flour, pulses, and rice; (e) organic manure; (f) newspaper or magazines registered with the Registrar of Newspapers; (g) relief materials meant for victims of natural or man-made disasters, calamities, accidents or mishaps; or (h) defense or military equipment. |

Nil |

Nil |

|

|

21A |

Heading 9965 or Heading 9967 (Ntf 32/2017) |

Services provided by a goods transport agency to an unregistered person, including an unregistered casual taxable person, other than the following recipients, namely: –

(a) any factory registered under or governed by the Factories Act, 1948(63 of 1948); or (b) any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any other law for the time being in force in any part of India; or (c) any Co-operative Society established by or under any law for the time being in force; or (d) any body corporate established, by or under any law for the time being in force; or (e) any partnership firm whether registered or not under any law including association of persons; (f) any casual taxable person registered under the Central Goods and Services Tax Act or the Integrated Goods and Services Tax Act or the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act |

Nil |

Nil |

|

|

21B |

Heading 9965 or Heading 9967 (Ntf 28/2018) |

Services provided by a goods transport agency, by way of transport of goods in a goods carriage, to, –

(a) a Department or Establishment of the Central Government or State Government or Union territory; or (b) local authority; or (c) Governmental agencies, which has taken registration under the Central Goods and Services TaxAct, 2017 (12 of 2017) only for the purpose of deducting tax under Section 51 and not for making a taxable supply of goods or service |

Nil |

Nil |

|

GST RCM Notification no. 13/2017 dated 28.06.2017 (Amended from time to time)

|

Sr. No. |

Category of Supply of Services | Supplier of service | Recipient of Service |

| (1) | (2) | (3) |

(4) |

|

Notification 13/2017 dated 28.06.2017 – To notify the categories of services on which tax will be payable under the reverse charge mechanism under the CGST Act |

|||

|

1 ( Ntf 12/2017) ( Ntf 22/2017) ( Ntf 29/2018) (Ntf 05/2022) |

Supply of Services by a goods transport agency (GTA) who has not paid central tax at the rate of 6% in respect of transportation of goods by road to-

(a) any factory registered under or governed by the Factories Act, 1948(63 of 1948); or (b) any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any other law for the time being in force in any part of India; or (c) any co-operative society established by or under any law; or (d) any person registered under the Central Goods and Services Tax Act or the Integrated Goods and Services Tax Act or the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act; or (e) any body corporate established, by or under any law; or (f) any partnership firm whether registered or not under any law including association of persons; or (g) any casual taxable person Provided that nothing contained in this entry shall apply to services provided by a goods transport agency, by way of transport of goods in a goods carriage by road, to, –(a) a Department or Establishment of the Central Government or State Government or Union territory; or (b) local authority; or (c) Governmental agencies, which has taken registration under the Central Goods and Services Tax Act, 2017 (12 of 2017) only for the purpose of deducting tax under section 51 and not for making a taxable supply of goods or services. Provided further that nothing contained in this entry shall apply where –i. The supplier has taken registration under the CGST Act, 2017 and exercised the option to pay tax on the services of GTA in relation to transport of goods supplied by him under the forward charge; and ii. The supplier has issued a tax invoice to the recipient charging Central Tax at the applicable rates and has made a declaration as prescribed in Annexure III on such invoice issued by him. |

Goods Transport Agency (GTA) | (a) any factory registered under or governed by the Factories Act, 1948(63 of 1948);or (b) any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any other law for the time being in force in any part of India; or (c) any co-operative society established by or under any law; or (d) any person registered under the Central Goods and Services Tax Act or the Integrated Goods and Services Tax Act or the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act; or (e) any body corporate established, by or under any law; or (f) any partnership firm whether registered or not under any law including association of persons; or (g) any casual taxable person located in the taxable territory |

Who is GTA? | What is GTA? | Explain Goods Transport Agency

Goods Transport Agency means any person who provides service in relation to transport of goods by road and issues consignment note, by whatever name called.

Relevant Notifications

- CGST(Rate) Notification no. 11/2017 dated 28th June 2017

- CGST(Rate) Notification no. 03/2022 dated 13th July 2022

What is a consignment note?

A consignment note means

- serially numbered document

- issued by a GTA

- for the purpose of transportation of goods

- by road in a goods carriage

Contents of Consignment Note

- Name of Consignor

- Name of Consignee

- Place of origin

- Place of destination

- Details of Goods transported

- Registration no. of vehicle

- Person liable to pay GST whether it is consignor/consignee/GTA

Is it mandatory for a GTA to obtain registration under GST?

NO. It is not mandatory for a GTA to obtain registration under GST.

- If all the services supplied by a GTA are covered under the reverse charge as per section 9 (3).

- If GTA is solely involved in transporting the exempted goods specified vide CGST(Rate) Notification no. 12/2017 dated 28th June 2017.

- If the aggregate turnover of a GTA does not exceed Rs 20 Lakhs (Rs 10 Lakhs in specified states).

Who is liable to pay GST in the case of used household goods for personal use?

If GTA is providing the service of transportation of used household goods for personal use to

- The specified category of the person notified then the specified person will pay under reverse charge.

- Any person other than the specified category of person then the transaction will be exempt from GST.

For eg. XYZ (GTA) provides transportation services for moving household goods from Delhi to Mumbai. Case 1 – If (XYZ) GTA has been hired by ABC (Registered Company) for the transportation of goods of their employee (Mr. K- unregistered under GST) then GST will be applicable. Case 2 – If (XYZ) GTA has been hired by Mr.K (Unregistered under GST) for the transportation of goods for himself then GST will not be applicable.

Which GTA services are specifically exempted?

Following services provided by a GTA will be exempt from payment of tax

If the following goods transported by road by a GTA are

- Agricultural produce

- Milk, salt, and food grains including flour, pulses, and rice

- Organic manure

- Newspapers or magazines registered with the Registrar of Newspapers

- Relief materials meant for victims of natural or man-made disasters, calamities, accidents, or mishaps

- Defense or military equipment

- If consideration charged for transportation of goods from a single consignee does not exceed Rs 750/-. [Withdrawn w.e.f. 18th July 2022]

- If consideration charged for transportation of goods on a consignment in a single carriage does not exceed Rs 1500/-. [Withdrawn w.e.f. 18th July 2022]

(Services from GTA which are specifically exempted were notified vide a CGST(Rate) Notification no. 12/2017 dated 28th June 2017)

Is e-invoicing applicable to GTA?

GTA has been specifically kept out of the ambit of issuing e-invoices. But in the case where the annual aggregate turnover of a GTA exceeds the threshold limit which is required for generating e-invoices then a declaration in the invoice has been made mandatory w.e.f. 5th July 2022 [ Insertion of sub-clause (s) in Rule 46]. Relevant Notifications

- CGST Notification no. 14/2022 dated 5th July 2022

- CGST Notification no. 13/2020 dated 21st March 2020

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Well done my dear.

Thank you Sir

IF GTA SERVICES PROVED TO UNREGISTER(CUSTUMER) WHEN GST CAPABLE (II)IF GTA HIRE VEHICASL REGISTED AND UN REGISTED PERSON GST CAPABLE NO YES

When GTA services are provided to unregistered customers. GST will not be levied on RCM or forward charge.

What is the Meaning of Hire in perticular this explanation

Sir if you could elabroate your query we would be able to address the query.

Excellent article ma’am. Request you to clarify these doubts for me.

If a GTA is exclusively making taxable supplies on which GST is payable under RCM – he is not liable to obtain regn. irrespective of turnover.

1) What if he is exclusively involved in making exempt supplies? i.e. to unregistered individuals and TDS deductors and also exempted goods like Milk, agricultural produce etc.

2) What if he is doing both i.e RCM + Exempt Supplies?

Thank you. Glad you found the article useful.

If a GTA is providing services to registered or unregistered persons who deal in taxable supplies who pay tax under RCM. – YES GTA is not required to obtain registration irrespective of the turnover.

If a GTA is providing services of transporting exempt supplies/ unregistered individuals – YES GTA is not required to obtain registration irrespective of the turnover.

If a GTA is providing services of transporting exempt supplies/unregistered individuals AND services to registered or unregistered persons who deal in taxable supplies who pay tax under RCM – YES GTA is not required to obtain registration irrespective of the turnover.

Sorry for pestering you again, ma’am!! Can you please elaborate on the Option 2 opted by a GTA? i.e. both, RCM @ 5% payable by a RP and FCM @ 5% payable by a GTA on interstate supplies to URPs? The RCM part is perfectly fine. But Not able to get the FCM part. Why does the GTA have to pay GST under FCM on interstate supplies to URPs?

There was a slight typo error which has been corrected in Option 2. Hope it will be easy for you to understand now.

Bang On ma’am!! Thank you so much ma’am, for your swift response. Had all my doubts resolved w.r.t one of the trickiest topics in GST.

Finally, one last doubt in continuation to my above query, so, when does the need to check the aggregate turnover for a GTA arises, ma’am?

You are welcome. Glad I am able to clear your doubts.

If a GTA provides services that are covered by RCM then you need not check aggregate turnover at all for registration.

If a GTA provides services that are not covered by RCM then just like any other service provider you have to check at 20 lacs.

Thank you so much ma’am! Perfectly put together..

URPs such as Factories, body corporates, partnership firms, co-op societies, societies – Even if they are liable to be registered and pay GST under RCM.

But if They don’t do so, to avoid complications, the GTA itself is required to pay GST @ 5% under FCM.. Legally they’re bound to pay under RCM. However, from a practical POV, they wouldn’t.

You’ve covered both of them.. Now I’m able to understand ma’am.

If GTA services are provided to other URPs such as unregistered casual taxable persons and other unregistered individuals, that one is exempt too. So, got a little confused with the URPs part earlier.

Great article!! Really really helpful for students like me.

Thank you again ma’am for the article and also for your time and patience to reply!!

You are welcome. Glad I was able to help in sorting out your doubts.

Got it ma’am! Thank you.. This is one of the most comprehensive articles, that covers every nook and corner of the GTA provisions and also a one stop solution for resolving all the doubts that would normally arise while going through the provisions.. Really fortunate for having found this one..

Thank You, ma’am!!

Thank you so much

R/sir I am registered GTA opted forward charge (FCM) .we provide service to cement industries @12%gst we are also providing exempted services to govt for transportation of agriculture products wheat and paddy .sir we have taken itc on purchase of truck. Sir can we avail 100% ITC either we have to reverse ITC for part of transportation of agriculture products

You will have to take proportionate ITC only. You cant take 100%

Ma’am, please suggest the SAC and GST rate in case when one GTA provide the goods transport vehicle on hire basis to another GTA. Thank you

SAC Code is 996511 and GST rate is NIL when one GTA provide the goods transport vehicle on hire basis to another GTA.