Last updated on January 23rd, 2022 at 05:23 pm

Changes in Provident Fund – BUDGET 2021

Employees Provident Fund – Background

Provident Fund is a retirement benefits scheme. Under this scheme, an employee contributes a certain amount towards the fund and usually, the employer also contributes the same amount to the employee provident fund. Interest is earned by the employee on such contributions.

An employee has the following in the credit balance of the provident fund account: –

- Employee Contribution to Provident Fund.

- Interest earned on Employee Contribution.

- Employer Contribution to Provident Fund.

- Interest earned on Employer Contribution.

The employee receives such an amount at the time of retirement/ resignation.

There are 4 types of Provident Funds: –

- Statutory Provident Fund

- Recognized Provident Fund

- Unrecognized Provident Fund

- Public Provident Fund

The amount received at the time of retirement is exempt from tax in the case of the Statutory and Recognized Provident Fund. This rule has been proposed to be changed in the BUDGET 2021.

Changes in Taxability of Employee Provident Fund

(Clause 5 of Finance Bill, 2021)

Clause 11 and 12 of Section 10 of Income Tax Act, 1961 provides for exemption from tax on Interest that is earned on Employee as well as Employer portion of the contribution made to the Provident Fund.

This had earlier led to tax planning of Individuals drawing salaries in Crores of rupees. They would contribute more than the statutory limit of 12% to the provident fund and would earn interest on the same. This interest would be exempt at the time of retirement and hence they would be able to generate a huge amount of corpus/tax-free income. This tax planning has been partially plucked by the government in this Finance Bill, 2021.

Now, a proviso has been proposed to be added to Clause 11 and 12 to Section 10.

The proviso shall provide that the Interest accrued on the amount of contribution made by that person of more than 2.5 L in any previous year shall be made taxable which shall be computed as per the rules prescribed.

A brief analysis of the proviso means that the interest that is earned on the contribution made by the employee during the year of more than 2,50,000/- will be taxable. The rules for determining the tax liability will be prescribed later.

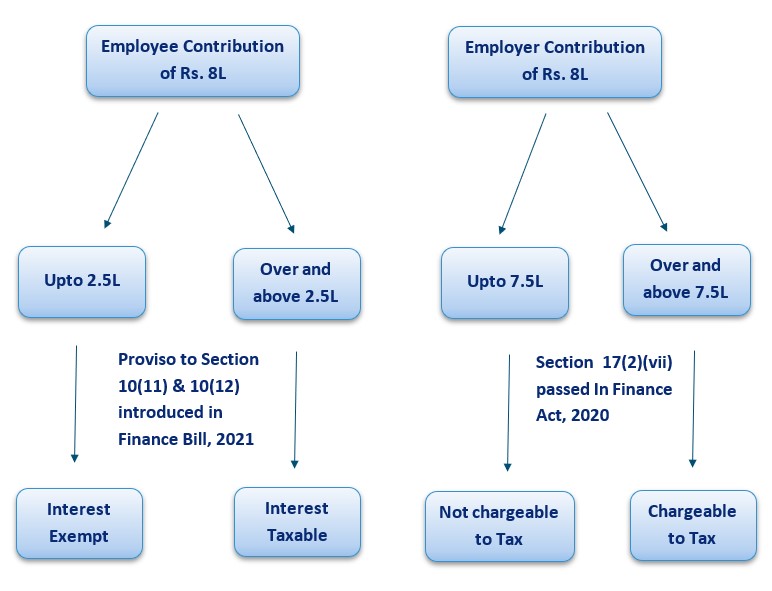

Let us understand by way of chart

Let us say that, Employee and Employer contribution to PF is Rs. 8 lacs p.a.

Changes in Allowance of PF/ ESI/ Other Funds in hands of Employer

(Clause 9 of Finance Bill, 2021)

There was a constant talk about the addition of late payment of Employees’ Contribution to Provident Fund.

There are 2 components of Provident Fund Contributions: –

- Employees’ portion

- Employer’s portion

The employer’s part is allowed as a deduction on a payment basis as per Section 43B(b). As per this provision, if the PF payment was made on or before the due date of filing of ITR u/s 139(1), the employer’s part was allowed as a deduction in the previous year.

The employee’s part is governed by Section 36(1)(va) read with Section 2(24)(x). As per these provisions, if the payment of PF is not made on or before the Due Date of respective acts, then the employees’ portion will be added to the income of the employer.

This was a point where different High Courts have given different judgments. Many judgments were favorable and many judgments were against the interest of the assessees.

The ambiguity was of the interpretation of the word “Due Date”.

Decision favorable to an assessee

Courts held that the due date here referred to in Section 36(1)(va) is the due date as referred in Section 43B i.e. the due date of filing of ITR u/s 139(1). Hence, after these judgments, even if the employer pays the amount after the due date under relevant acts but before the filing of ITR, they were not adding it to their income.

[CIT v. AIMIL Ltd (Del), CIT v. Rajasthan State Ganganagar Sugar Mills Ltd. (Raj), CIT v. Kichha Sugar Co. Ltd (Uttarakhand), CIT v. Hemla Embroidery Mill P Ltd (Punj & Har), Spectrum Consultants India P Ltd (Kar), Sadbhav Engg. Ltd. V. CIT (Ahd.), Bihar State Warehousing Corp. Ltd v. CIT (Pat.)]

Decision against the assessee

Courts held that Section 43B is not applicable to employees’ contribution to PF and therefore even if the amount is paid before filing the ITR then also the amount will be added to the income of the employer.

[CIT v. South India Corp. Ltd(Ker.), Unifac Management Services India P Ltd v. CIT (Mad.)]

Problems faced while processing of ITR

The employees’ contribution to various funds has to be reported in Clause 20(b) of the Tax Audit report. The Central Processing Cell (CPC) of the Income Tax department automatically adds the amount paid after the due date of respective acts to the income of the assessee. This was causing an increase in litigation in many cases.

Therefore, a new explanation has been inserted in Finance Bill, 2021 in Section 36(1)(va) that the provisions of Section 43B shall not apply for the purposes of determining “Due Date”.

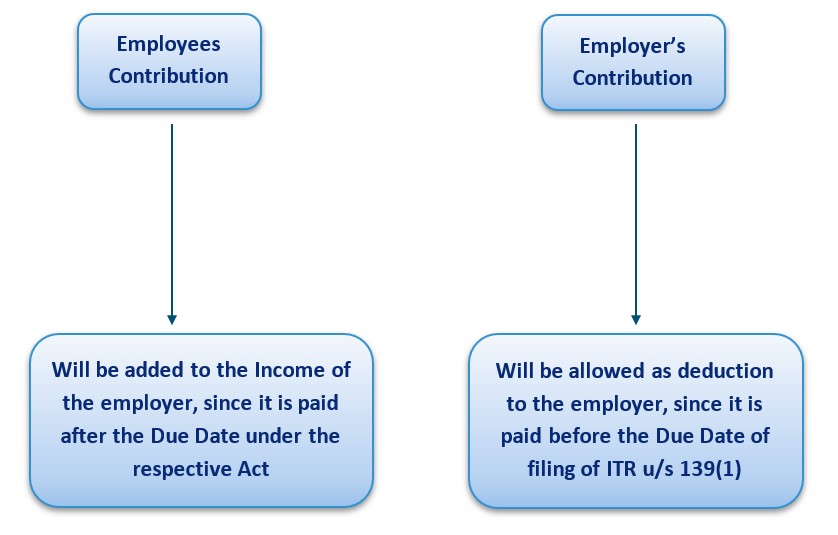

Chart explaining the situation after considering the amendment vide Finance Bill, 2021.

Let us say, that the Due Date of payment of PF for the month of January 2022 is 15th February 2022 (As per PF Act). But the actual payment of Employee, as well as Employer contribution, was made on 10th April 2022.

Related Posts

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment