Last updated on April 14th, 2021 at 05:23 pm

35th GST Council Meeting Updates

Finance Minister Nirmala Sitharaman took over the reins of Finance Ministry from Arun Jaitley on 31st May 2019 and chaired the 35th GST Council Meeting yesterday. It was her first GST Council Meeting. The last GST Council Meeting i.e. 34th Meeting which was held via video conferencing was held almost 3 months back on 19th March 2019. GST Council comprises of Union Finance Ministers and State Finance Ministers which is the federal decision-making body for the matters of GST.

[su_table]

| Meeting | 35th GST Council Meeting |

| Date | Friday, 21st June 2019 |

| Chairperson | Finance Minister Nirmala Sitharaman |

| Venue | Vigyan Bhawan, New Delhi |

| Attendees | Finance Ministers of all the states except 3 states |

[/su_table]

Major outcomes from 35th GST Council Meeting held are

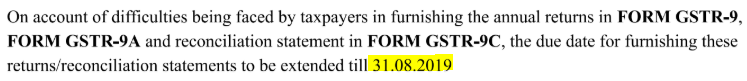

⊗ The due date for GST Annual Return extended to 31st August 2019 35th GST Council Meeting Updates

GST council has extended the deadline for filing Annual Return GSTR 9, GSTR 9A, and Annual Audit Report GSTR 9C by two months.

Click here to understand in detail the extension of due dates for the financial year 2017-18.

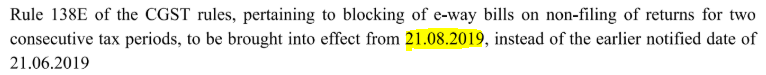

⊗ The due date for blocking the generation of e way bill extended to 21st August 2019

To curb tax evasion, the Government was to impose restrictions (Rule 138E of the CGST rules) starting from today on the generation of e way bill if the return for two consecutive periods was not filed. Considering the taxpayer’s plea, this also has been extended by two months and will be effective from 21.08.19.

⊗ The due date for taxpayers who want to opt for a composition scheme for service providers extended to 31st July 2019

The taxpayers who wished to opt for the composition scheme for service providers under notification No. 2/2019-Central Tax (Rate) dated 07.03.2019 were to file an intimation on the GSTN portal up to 30th April 2019. The due date to file an intimation in FORM GST CMP-02 has been extended to 31.07.2019. 35th GST Council Meeting Updates

Click here to understand in detail the composition scheme of the service provider.

Click here to understand the procedure to opt for a composition levy by a service provider.

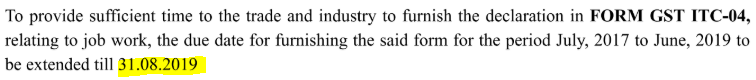

⊗ The due date for FORM GST ITC 04 for job work extended to 31st August 2019

To furnish the details relating to an input tax credit on job work which needs to be filed in FORM GST ITC-04. The form is to be submitted by the principal and it should include the details of

– Goods dispatched to a job worker

– Goods received from a job worker

– Goods sent from one job worker to another.

The due date filing the FORM GST ITC-04 for the period beginning from July 2017 to June 2019 has been extended from 30.06.19 to 31.08.19.

⊗ Ease of GST Registration

Until now various documents were required to be scanned and submitted for obtaining a GST Number. But today the announcement was made that any person who wants to register may apply using an Aadhar number and authenticate using a one-time-password and get a GST registration number.

⊗ Implementation of new return filing system in a phased manner

FORMS GSTR 1 AND GSTR 3B will be completely phased out from January 2020.

New forms like GST RET 01, GST PMT 08, GST ANX 01, GST ANX 02 to be furnished will be introduced in a phased manner to ease compliance.

Click here to understand the complete new GST return filing system and its phased implementation.

⊗ Introduction of the electronic invoicing system in a phased manner

E-invoicing system is the next big agenda which Government plans to take as an anti-evasion measure. Government plans the issuance of e-invoices business-to-business (B2B) sales on a Centralized Government Portal for the businesses whose annual turnover is Rs. 50 crore and above. Initially, the system of e-invoices will be implemented for B2B transactions only. But as e-ticketing is being made mandatory for multiplexes which is a B2C transaction in most cases, the day is not far when it would be implemented for B2C segments as well. Most tax evasion and leakage happen in B2C transactions only as cash is paid and transactions are not accounted for fully.

The first phase of implementation of proposed e-invoicing will roll out in January 2020 on a voluntary basis. GST Council is of the view that it will make it difficult for the taxpayer to evade tax and at the same time, it helps the tax authorities in combating the menace. It would benefit the taxpayers as it will automate and integrate with e way bill system and GSTN portal for return filing.

⊗ Mandatory e-ticketing for Multiplexes

In order to curb black money, it is made mandatory for multiplexes to issue electronic tickets. It is expected that the same would be extended to single-screen cinemas also. This would be the beginning of the e-voicing system for B2C transactions which may be extended to the sectors in the future.

⊗ Tenure of the Anti-Profiteering Authority (NAA)

The government had set up Anti-Profiteering Authority (NAA) on 30th November 2017 for a period of 2 years. It was formed for dealing with complaints against companies that do not pass on the benefits of reduction of GST rate to consumers. Considering the current market scenario and the number of complaints/cases which have been flowing in, Council has extended the tenure by a further two years to 30th November 2020.

Penalty provisions for the companies that have defaulted are made more stringent. If the company fails to deposit the anti-profiteering amount within 30 days then a penalty of 10% will be levied over and above this.

⊗ Setting up of GST Appellate Tribunal (GSTAT)

The government will set up a National Bench of Appellate Tribunal which will be a common forum for the second appeal in GST laws and the first common forum of dispute resolution between Centre and States/Union Territories. If any of the party to dispute are not satisfied with the decisions of GSTAT can approach High Court and the Supreme Court.

A decision regarding the location of the State and the Area Benches for the GSTAT for various States and Union Territories was taken.

A common State Bench for the States of Sikkim, Nagaland, Manipur, and Arunachal Pradesh will be set up. It was left to States to decide the number of GSTAT required by them, this may result in more than one tribunals in a single state.

⊗ The decision on changes in GST rates of goods & services will be taken in 36th GST Council Meeting

GST Council discussed regarding reduction in GST rates for Electric vehicles and their chargers and valuation of goods and services in a Solar Power Generating System and Wind Turbine. But the decision for the above could not be taken and it is expected in the next GST council meeting after the recommendations from Fitment Committee.

GST Council also discussed the report submitted by the Group of Ministers (GoM) on issues relating to rates and destination principle in case of the lottery. But the final decision could not be taken as it would require a legal opinion of the Learned Attorney General.

Related Posts

None found

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment