How to register for Income tax e-filing?

Last updated on July 24th, 2022 at 08:04 pmHow to register for Income tax e-filing? It is mandatory for all citizens to file their income tax returns in prescribed ITR forms once during the year […]

Last updated on July 24th, 2022 at 08:04 pmHow to register for Income tax e-filing? It is mandatory for all citizens to file their income tax returns in prescribed ITR forms once during the year […]

Last updated on July 24th, 2021 at 04:53 pmNBFC scare: What exactly is the issue? What is NBFC / HFC? and How they are different from banks? NBFC or Non-banking financial companies (NBFCs) are financial […]

Last updated on May 15th, 2021 at 09:25 pmThe U.S. may remove India from Currency Monitoring List What is Currency Monitoring List? U.S. Treasury Department releases a bi-annual report in which it lists the counties […]

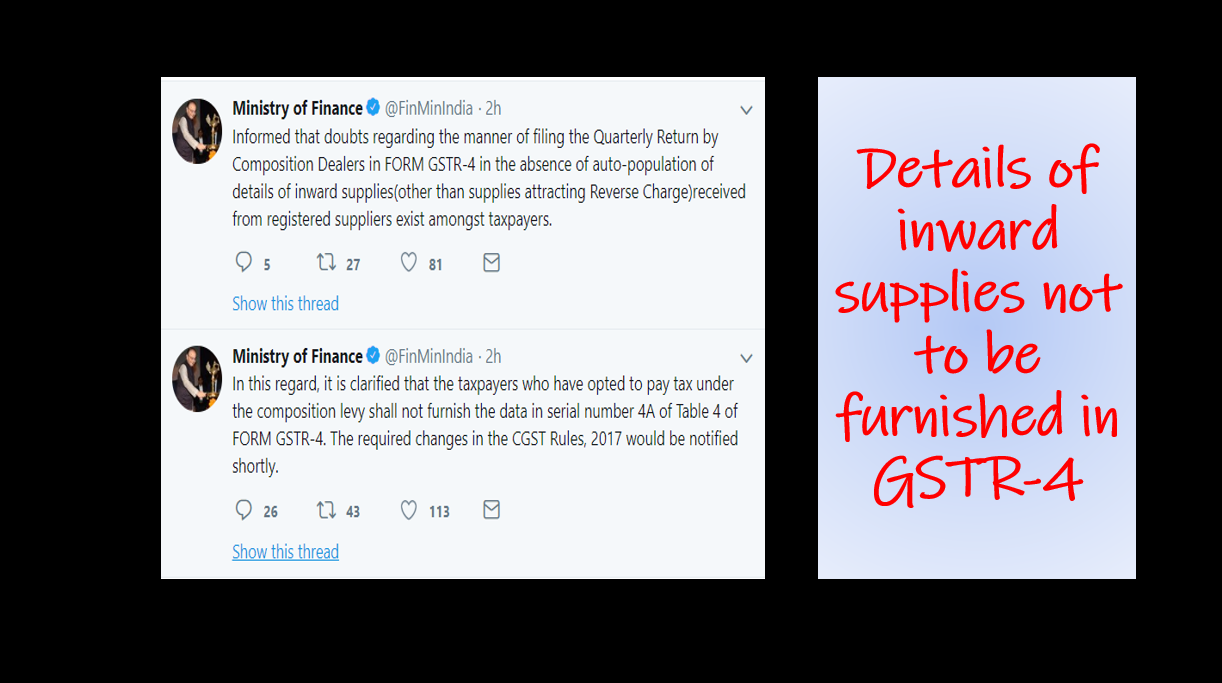

Last updated on September 17th, 2022 at 04:14 pmDetails of inward supplies not to be furnished in GSTR-4 Note: The exemption details discussed in this article were provided by CBIC for GSTR 4(quarterly return) which […]

Last updated on May 9th, 2021 at 04:54 pmHow to demat your shares? We saw in our earlier post, “FAQs on Demat of Shares: Is it mandatory to demat shares“, what is dematerialization or demat […]

Last updated on July 19th, 2022 at 08:50 amIs it mandatory to Demat shares FAQs on Demat of Shares Ministry of Corporate Affairs (MCA), as well as the Securities Exchange Board of India (SEBI), has […]

Last updated on July 24th, 2022 at 08:01 pmJudgement – Assembly activity would amount to manufacture ITO vs. Sudarshan R. Kharbanda (2018) (ITAT Mumbai) Whether:- An ‘assembly’ activity amount to ‘manufacture’ for the purpose of […]

Last updated on May 9th, 2021 at 12:10 pmConsolidated Financial Statements Financial Statements which contains the information relating to assets, liabilities, equity, income, expenses and cash flows of the parent undertaking as well as its subsidiaries as a single entity. […]

Last updated on May 15th, 2021 at 09:25 pmWhat are Sanctions and how do they affect USA, Iran and India? In the global financial world, “sanction” has gained significant importance. Especially, with the news of […]

Last updated on March 22nd, 2021 at 08:15 pmSome important clarifications on TDS under GST TDS under the GST mechanism has been made mandatory from 1st October 2018. Registration as a TDS deductor ⇒ Deductor […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes