Last updated on October 3rd, 2021 at 06:28 pm

Last Opportunity to Invest in Sovereign Gold Bond- Series 6

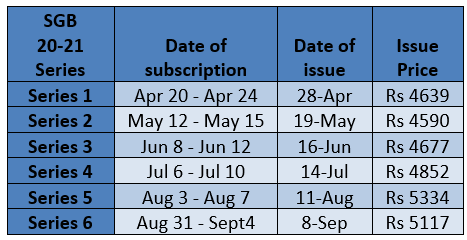

The sixth and the last tranche of Sovereign Gold Bond Scheme (Series VI) 2020-21 would be open from 31st August 2020 -4th September 2020. SGBs in VI tranche would have an issue price of Rs 5117 per gram and online applications will have an issue price of Rs 5067 per gram. (Rs 50 discount).

The government had already announced 6 tranches of SGBs in FY 21, five of them being already issued.

The Government fixes the price on the basis of a simple average closing price of 999 purity gold prices prevailing in the last three business days (rate as published by India Bullion and Jewellers Association, IBJA) of the subscription period.

What are Sovereign Gold Bonds?

SGBs are government securities denominated in grams of gold which allows investors to invest in gold without physical holding.

Sovereign Gold Bond 2020-21 Series

Key features of SGBs

Bonds are restricted for subscription by Resident Individuals, Hindu Undivided Families (HUFs), Trusts, Universities and Charitable Institutions.

The minimum permissible limit of investment is 1 gram and the maximum limit is 4kg for Individuals, 4 Kg for HUF, and 20 Kg for trusts and similar entities per fiscal year.

It has periodic interest payouts @ 2.5% p.a. paid semiannually.

Bonds are issued for a period of 8 years and can be withdrawn from 5th year.

Eliminates the risk of cost and storage.

Can be traded in the secondary market after 14 days from subscription date subject to the notice published by RBI (pls note that bonds should be in Demat form to be tradable).

SGBs would be redeemed on maturity in cash and redemption price is based on a simple average of the closing price of gold of 999 purity of the previous 3 business days from the date of repayment.

Interest on bonds would be taxable under Income from other sources as per Income Tax act 1961. Capital gain earned on the maturity of Bonds is tax-free. However, Bonds traded in the secondary market would attract tax on capital gains arising on its resale.

Whether to Subscribe?

Gold is considered as a safe haven for investments in India. Gold prices have shown an increasing trend since the last couple of months and had touched Rs 58000 in the beginning of August. Currently, it is quoting at Rs 53150 (MCX) and the spot rate is Rs 53000 approx (it varies statewide). The issue price of Rs 5067 is below the current market price (MCX) and at a discount of around 10% from the peak levels. Economic stagnancy during the pandemic and as a protection from uncertain economic environment and volatilities, Indian households prefer to invest in gold.

It is the last series and opportunity of the year; thus looking at the attractive price and multiple uses of the gold in Indian households, investors might invest some proportion in this SGB series.

Related Posts

- One MobiKwik Systems Limited, MobiKwik IPO - 14/10/2021

- Bharti Airtel Rights Issue- Should You Subscribe? - 07/10/2021

- How to Check your IPO Allotment status? - 28/09/2021

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment