Last updated on April 14th, 2021 at 05:42 pm

How to unblock the GSTIN on EWB Portal?

For the implementation of Rule 138E of CGST Rules, 2017, a new feature has been developed on the E way bill portal. The new feature on the E-way Bill system will function in coordination with Common GST Portal. It will continuously communicate with the GST portal to figure out the GST return filing details of taxpayers.

Details of the new feature on the e way bill portal

- Blocked GSTIN will not be allowed to generate an e way bill i.e. if GST return (GSTR 3B ) is not filed for two consecutive months.

- Neither as a consignor nor as a consignee, the taxpayer will be allowed to generate an e way bill once the GSTIN is blocked.

- GSTIN can be unblocked to generate an e way bill, only upon the filing of the GST return(GSTR 3B) on the common portal.

- E way bill will automatically be updated within a day upon the filing of the GST Return (GSTR 3B).

Will the taxpayer be sent an alert message who has not filed GST returns?

Yes, an alert message with a cautionary message will pop-up while generating e-way bills in case of the taxpayers who have failed to file GST return (GSTR 3B) for the past 2 consecutive months.

But this alert message does not mean it will block or stop the taxpayer to generate an e way bill. But if the taxpayer fails to furnish the GST return after the lapse of the due date then from next month onwards, such taxpayers will be blocked.

How many days does it take to unblock a GSTIN on the E way bill portal?

As a standard procedure, GSTIN will be unblocked within a day on the E way bill portal. Once the taxpayer files the pending GST Returns (GSTR 3B) on the GST Portal. E way bill portal will automatically be updated and seamless generation of e-way bill will continue.

For e.g, If a taxpayer files the pending GST returns on say 1st December 2019, then the GSTIN will be unblocked on 2nd December 2019.

How can GSTIN be unblocked immediately upon filing the GST returns?

If a taxpayer intends to unblock it immediately after filing the GST returns then the following needs to be followed:-

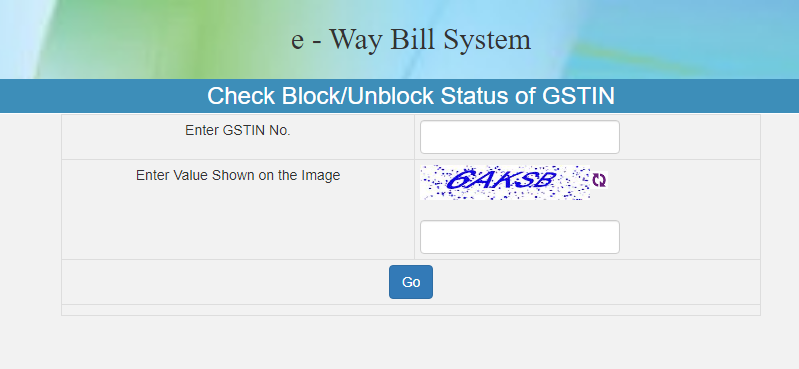

Step 1: Go to the E-way bill portal

Step 2: From the drop-down options of “Search” > Click on “Update Block Status”

Step 3: On this page “Check Unblock/ Unblock Status of GSTIN”

- Enter the GSTIN

- Enter the CAPTCHA shown in the image

- Click on “GO”

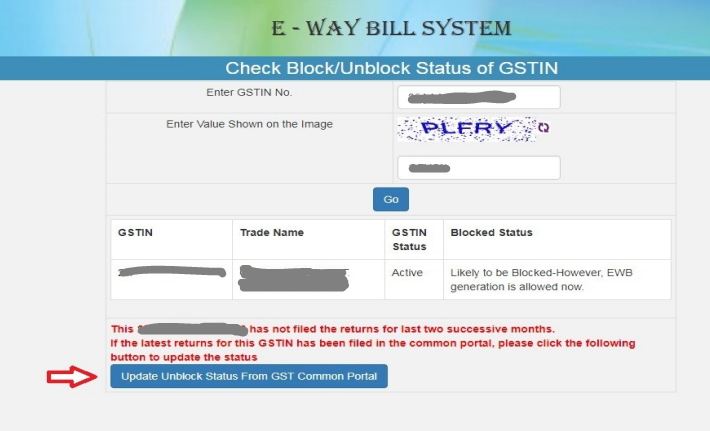

Step 4: After filing the above details and clicking on “Go” it will display the following details

- GSTIN status >“Active”

- Blocked Status > “Likely to be blocked. However, EWB generation is allowed now.”

In order to immediately unblock the status on the e-way bill portal, the taxpayer has to click on “Update Unblock Status from GST Common Portal” (as pending GST returns(GSTR 3B) are already filed but the system takes one day to update)

What if the GSTIN is still blocked, after filing the GST returns and also trying to update the GSTIN from the Common portal?

As a last resort, the taxpayer can raise a complaint about resolving the issue/case by contacting

- GST Help Desk: 0120-4888999 or

- State Specific Helpdesks or

- Grievance Redressal Portal for GST

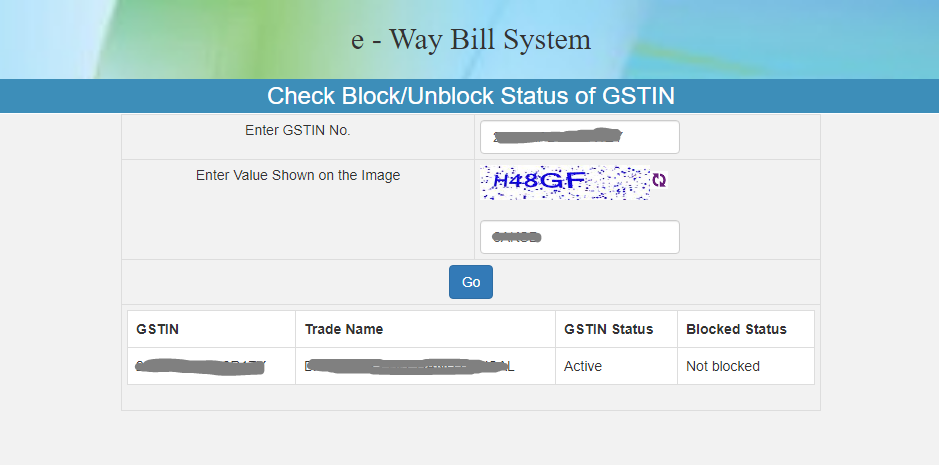

If the taxpayer has been regular and filed GST Returns for the last two consecutive months then upon checking the status of GSTIN in “Update Block Status” it will reflect like this

- GSTIN status >“Active”

- Blocked Status > “Not Blocked”

NIC has issued following in respect of Rule 138E (E-way Bill System)

- FAQs on Blocking/Unblocking of E-way Bills Generation

- Detailed explanation on Blocking/Unblocking of E-Way Bill generation issued on 12th Nov’19

- How to Unblock the GSTIN for the generation of e-waybill

Unanswered Question

Question 1: What if the composition taxpayer fails to furnish Form CMP-08 for two consecutive periods? Will the GSTIN of the composition taxpayer be blocked? (Or Rue 138E will be applicable only to the regular taxpayer?)

Question 2: From which date the defaulter/non-filer will be blocked from generating e way bills? Due date of GSTR 3B or some other date?

(As per my understanding from the FAQs issued, the effective date for blocking the GSTIN of a defaulter will be the next month from the consecutive default of two months)

Question 3: Why the implementation of Rule 138E requires the filing of GSTR 3B and not GSTR 1 for a regular taxpayer?

Question 4: As per my understanding from the statements published in “The Blocking/Unblocking of E-Way Bill generation” on 12.11.2019 by the National Informatics Centre. If the generation of e way bill is allowed to the defaulters/non-filers, then the whole purpose of blocking and implementation of Rue 138E will be defeated.

“In case the user hasn’t filed the Returns for the last two successive months and clicked on the update button, a pop-up message as shown below will appear.”

Whereas, my understanding regarding the implementation of Rule 138E is No GST Returns = No E way Bills.

Related Posts

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment