Last updated on January 11th, 2023 at 02:00 pm

GSTR 1 Late Fees

Notice for GSTR 1 Late fees

Snapshots from a notice levying late fees for delay in furnishing the return in Form GSTR 1 is being widely circulated over social media. Questions are being raised why is the Government levying late fees now after a period of 5 years?? Why Government did not send a notice or auto-populate the late fees at the time of filing returns?? The below post is compiled as a ready reference to understand when was the late fees rationalized. when was the maximum late fees capped? This would help you to understand the calculation of late fees by the Government if a notice is issued to you.

Note: Notices for late fees for GSTR 1 are being issued as a part of the department GST Audit or other proceedings. We have not come across any cases where the GST portal levies the late fees for GSTR 1 directly or notices are issued to taxpayers for payment of late fees.

GSTR 1 Late Fees

⊗ Taxpayers who are registered under GST are required to furnish prescribed GST returns within the notified due dates for the tax period.

⊗ Provisions of section 47 are invoked when registered taxpayers fail to furnish the applicable GST returns within the stipulated time frame. (What is the due date for the current month/quarter for GSTR 1?)

⊗ Provision of section 128 confers the power to the Government to waive or reduce the late fee referred to u/s 47 for mitigating the circumstances based on the recommendations of the Council.

⊗ Delay in furnishing Nil GSTR 1 will also attract late fees u/s 47.

⊗ Late fees is always to be deposited through an electronic cash ledger only. It can not be set off against the balance in the electronic credit ledger.

Amendment in Section 47

Section 47 was substituted by section 108 of the Finance Act 2022. Substituted section 47 was notified vide CGST Notification no. 18/2022 dated 28th September 2022 to be effective retrospectively from 1st July 2017.

After Amendment from 1st Oct 222

Section 47(1) – Any registered person who fails to furnish the details of outward supplies required under section 37 or returns required under section 39 or section 45 or section 52 by the due date shall pay a late fee of one hundred rupees for every day during which such failure continues subject to a maximum amount of five thousand rupees.

Before Amendment from 1st Jul 2017 to 30th Sep 2022

Section 47(1) – Any registered person who fails to furnish the details of outward supplies or inward supplies required under section 37 or section 38 or returns required under section 39 or section 45 by the due date shall pay a late fee of one hundred rupees for every day during which such failure continues subject to a maximum amount of five thousand rupees.

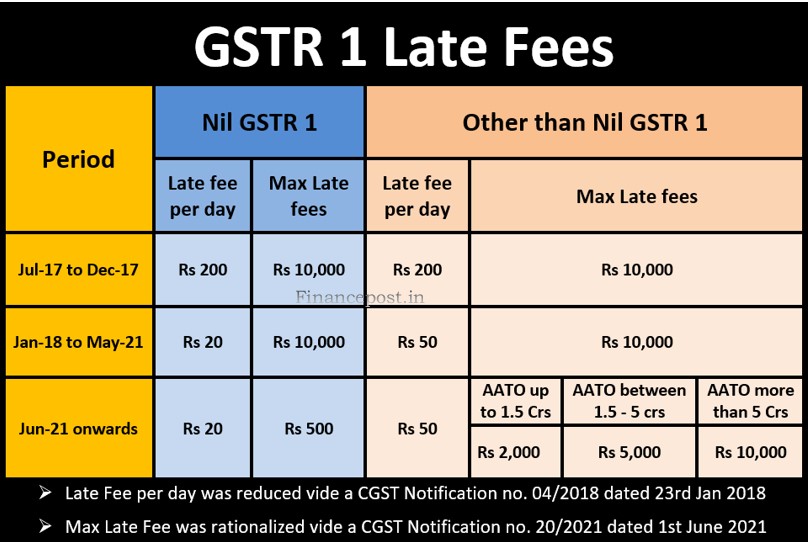

Rationalization of late fees for GSTR 1

GST council took the decision in the 43rd GST Council Meeting dated 28th May 2021 to cap the maximum late fees for delay in furnishing the GSTR-1. The government used the powers conferred u/s 128 to notify the maximum late fees for different classes of taxpayers filing GSTR 1 by issuing a CGST Notification no. 20/2021 dated 1st June 2021.

[su_table]

|

Return |

Late Fees per day |

Maximum Late Fees |

|

|

Nil GSTR 1 |

Rs. 20 per day (SGST + CGST) |

Irrespective of the turnover |

Rs 500 (SGST+CGST) |

|

Other than Nil GSTR 1

|

Rs. 50 per day (SGST+CGST) |

If AATO in the preceding year is less than Rs. 1.5 Crores |

Rs 2,000 (SGST+CGST) |

|

If AATO in the preceding year above Rs 1.5 Crores less than Rs. 5 Crores |

Rs 5,000 (SGST+CGST) | ||

| If AATO in the preceding year is above Rs. 5 Crores |

Rs 10,000 (SGST+CGST) |

||

[/su_table]

Note: Rationalised late fees will be applicable for the month of June 2021 and onwards.

Note: Late Fees for taxpayers having AATO exceeding Rs 5 Crores in the preceding financial year were not rationalized in the 43rd GST Council Meeting. So, the earlier upper cap of Rs. 10,000/- would apply.

Waiver of late fees due to COVID-19 for GSTR 1

Considering the COVID-19 pandemic, the Government used the powers conferred u/s 128 to waive the late fee for all taxpayers if the return of outward supplies in Form GSTR 1 was filed within the prescribed due date.

CGST notification no. 53/2020 dated 24th June 2020

|

Period |

Late Fees waived if GSTR 1 will be filed up to |

| Mar 2020 |

10th Jul 2020 |

|

Apr 2020 |

24th Jul 2020 |

| May 2020 |

28th Jul 2020 |

|

Jun 2020 |

5th Aug 2020 |

| Jan-Mar 2020 |

17th Jul 2020 |

|

Apr-Jun 2020 |

3rd Aug 2020 |

CGST notification no. 33/2020 dated 3rd April 2020

|

Period |

Late Fees waived if GSTR 1 will be filed up to |

| March 2020 |

30th Jun 2020 |

|

April 2020 |

30th Jun 2020 |

| May 2020 |

30th Jun 2020 |

|

Jan – Mar 2020 |

30th Jun 2020 |

Second GST Amnesty Scheme for GSTR 1

GST council took the decision in the 38th GST Council Meeting dated 18th December 2019 to waive off the late fees for non-filers of GST return for the months of July 2017 to November 2019.

⇒ Return – Form GSTR 1 (Monthly GST Return and Quarterly GST Return)

⇒ Taxpayer – All the registered taxpayers who were required to furnish GSTR 1 monthly/quarterly

⇒ Tax Period for which waiver – July 2017 to November 2019 (29 months)

⇒ Period of Filing – 19th December 2019 to 10th January 2020.

⇒ Notification – CGST Notification no 74/2019 dated 26thDecmeber 2019.

⇒ Extended Period of Filing – 19th December 2019 to 17th January 2020.

⇒ Notification for extension – CGST Notification no. 04/2020 dated 10th January 2020

Note: The due date of furnishing GSTR 1 was not extended, it was only a waiver from late fees.

First GST Amnesty Scheme for GSTR 1

GST council took the decision in the 31st GST council meeting held on 22nd December 2018 to waive off the late fees for non-filers of GST returns for the months of July 2017 to September 2018.

⇒ Return – Form GSTR 1 (Monthly GST Return and Quarterly GST Return)

⇒ Taxpayer – All the registered taxpayers who were required to furnish GSTR 1 monthly/quarterly

⇒ Tax Period for which waiver – July 2017 to September 2018 (15 months)

⇒ Period of Filing – 22nd December 2018 to 31st March 2019.

⇒ Notification – CGST notification no. 75/2018 dated 31st December 2018

Note: The due date of furnishing GSTR 1 was not extended, it was only a waiver from late fees.

Reduction of late fees for GSTR 1

Considering the plight of taxpayers, the Government using the powers conferred u/s 128 reduced the late fees per day leviable u/s 47 for the delay in furnishing the GST return in Form GSTR 1 by issuing a CGST Notification no. 4/2018 dated 23rd January 2018

|

Return |

Late Fees |

| Nil GSTR 1 |

Rs. 20 per day (SGST + CGST) |

|

Other than Nil GSTR 1 |

Rs. 50 per day (SGST+CGST) |

|

Max late fees can be Rs. 10,000/- (SGST+CGST) |

|

Late Fees as per section 47 of CGST Act 2017

A taxpayer who fails to furnish the return of outward supplies in Form GSTR 1 within the prescribed due dates will be levied late fees of Rs 100 per day towards CGST and Rs. 100 per day towards SGST/UTGST up to the period of default subject to a maximum of Rs 10,000/-

|

Return |

Late Fees |

| GSTR 1 |

Rs. 200 per day (SGST + CGST) |

|

Max late fees can be Rs. 10,000/- (SGST+CGST) |

|

Author’s Note

Late fees for delay in furnishing GSTR 1 neither auto-populate while furnishing the return in Form GSTR 1 nor in Form GSTR 3B. Unlike the late fees for delay in furnishing Form GSTR 3B which is auto-calculated and populates while furnishing the return in Form GSTR 3B.

So practically most of the taxpayers have not made the payment for the late fees. But as a prudent practice, auditors and taxpayers should voluntarily pay the late fees while filing GSTR 3B for the delay in filing GSTR 1.

Related Posts

None found

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment