Last updated on July 27th, 2021 at 07:19 pm

GSTR 4

Taxpayers who have opted for composition scheme u/s 10 have to furnish a yearly return from the financial year 2019-20 onwards vide a CGST Notification no. 21 dated 23rd April 2019.

Service providers who had opted for paying tax @ 6% vide a CGST(R) Notification no. 2/2019 dated 07.03.2019 were to furnish a yearly return (Form GSTR 4) from FY 2019-20 & FY 2020-21.

Note: For the above taxpayers making quarterly payments in Form CMP 08 and yearly return in Form GSTR 4 has been withdrawn on 10th November 2020. (Click here to refer to the impact on a service provider with the amendment made on 10.11.2020)

GSTR 4 needs to be filed by the person who was registered as a composition taxpayer for any period (even for a single day) during the financial year.

- If you register (new) under a composition scheme during the year.

- If you were registered under a composition scheme from the beginning of the year and dint opt-out during the year.

- If you were registered under a composition scheme from the beginning of the year but opted out during the year.

Form GSTR 4 (Annual Return) is a summary return that will give details regarding the outward supplies, inward supplies, import of services, and inward supplies attracting reverse charge, tax payable, etc.

The due date for Form GSTR 4 for the financial year 2020-21 was extended to 31st July 2021.

Form GSTR 4 (Annual Return) cannot be revised once it is filed.

Form GSTR 4 can be filed using the online as well as offline utility.

Who can file a NIL Form GSTR 4?

A composition taxpayer will be allowed to file a NIL Annual Return in Form GSTR 4 if

- There was NO outward supply during the financial year.

- There was NO inward supply of goods or services during the financial year.

- NIL Form CMP 08 for all the relevant quarters has already been filed.

- There is NO other tax liability to report for the financial year.

- Form GSTR 4 is being filed within the prescribed due date and hence NO late fees are to be paid.

How to file NIL GSTR 4?

- Login on GST Portal with valid credentials.

- Then select the option “Annual Return” by following this path: Services > Returns > Annual Return.

- Select the Financial Year from the drop-down list.

- Select the option “Prepare Online” from the two options available.

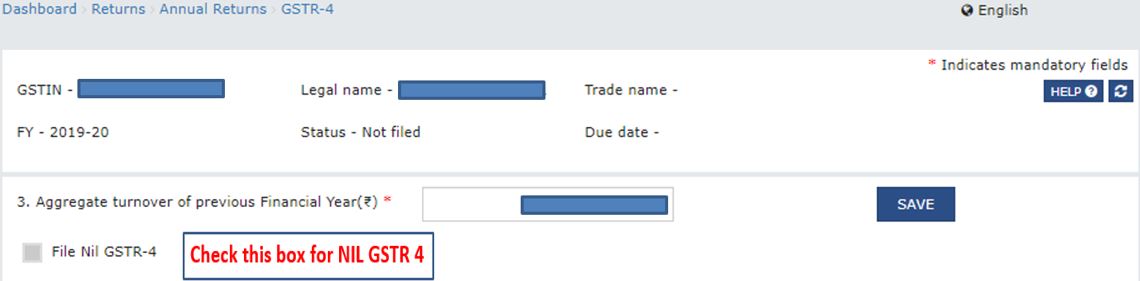

- Verify the GSTIN, legal name, trade name, and financial year.

- Enter the value in the aggregate turnover of the previous financial year. Click on “Save” to proceed.

(Note It is mandatory to enter the value here even “zero” is allowed.)

- Once you click on “SAVE” the system will display a message “save request acknowledged”.

- Then to file NIL GSTR 4, it needs to be checked out/selected.

- And click on the tab “Proceed to file”.

- Then a preview of Form GSTR-4 will be available, verify all the figures will be “zero”, then click on the tab “Continue”

- As it is a NIL return there will no requirement of creating any challan, then select the declaration checkbox.

- From the dropdown list select the Authorized Signatory.

- Click on the tab “File GSTR-4”.

- Click the tab “YES” when the warning appears for if you wish to continue.

- . On clicking “Yes”, File return/statement page will be displayed where you can file the return by selecting either of the options.

- File with DSC or

- File with EVC.

- On the successful filing of Form GSTR-4 using DSC/EVC, an ARN will be generated which will be sent on the registered mobile number and registered email address.

Related Posts

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment