Last updated on April 29th, 2022 at 08:53 pm

Exemption from furnishing details of inward supplies in GSTR 4(quarterly return) was given for FY 2017-18 and FY 2018-19.

What is the practical problem being faced by taxpayers while filing GSTR 4?

In cases where GSTR 1(regular taxpayer) & GSTR 5 (NRI taxpayer) are not filed by the respective taxpayers (suppliers), the details of inwards supplies i.e the purchases will not auto-populate in table 4A of GSTR 4.

Due to some technical glitches on the portal, the details of inwards supplies i.e the purchases are not correctly reflected in table 4A of GSTR 4 even after auto-population on account of returns were furnished by the taxpayers(seller).

This is making it a very lengthy, time-consuming and tedious task for the composition taxpayers to collate and manually fill the details of inward supplies for the quarter in Table 4A, 4B, 4C and 4D of GSTR 4.

Is it mandatory to furnish details of inward supplies in GSTR 4(Annual Return)?

Is it mandatory to furnish the inward supplies details in GSTR 4?

YES

- Invoice-wise details of inward supplies relating to both intra-state & interstate from registered and unregistered persons separately.

As per the instructions given below FORM GSTR-4 of CGST Rules, 2017 (Part B_Forms), the following information relating to inward supplies (rate-wise) needs to be provided

- Table 4A – Information will auto-populate relating to inward supplies from a registered supplier other than supplies where the reverse charge is applicable from the returns furnished by the suppliers in GSTR-1 and GSTR-5.

- Table 4B – Information will auto-populate relating to supplies from a registered supplier where the reverse charge is attracted from the returns furnished by the suppliers in GSTR-1.

- Table 4C – Information will auto-populate relating to inward supplies from an unregistered supplier.

- Table 4D – Information relating to the import of services.

What is the relief provided by the Government in this regard?

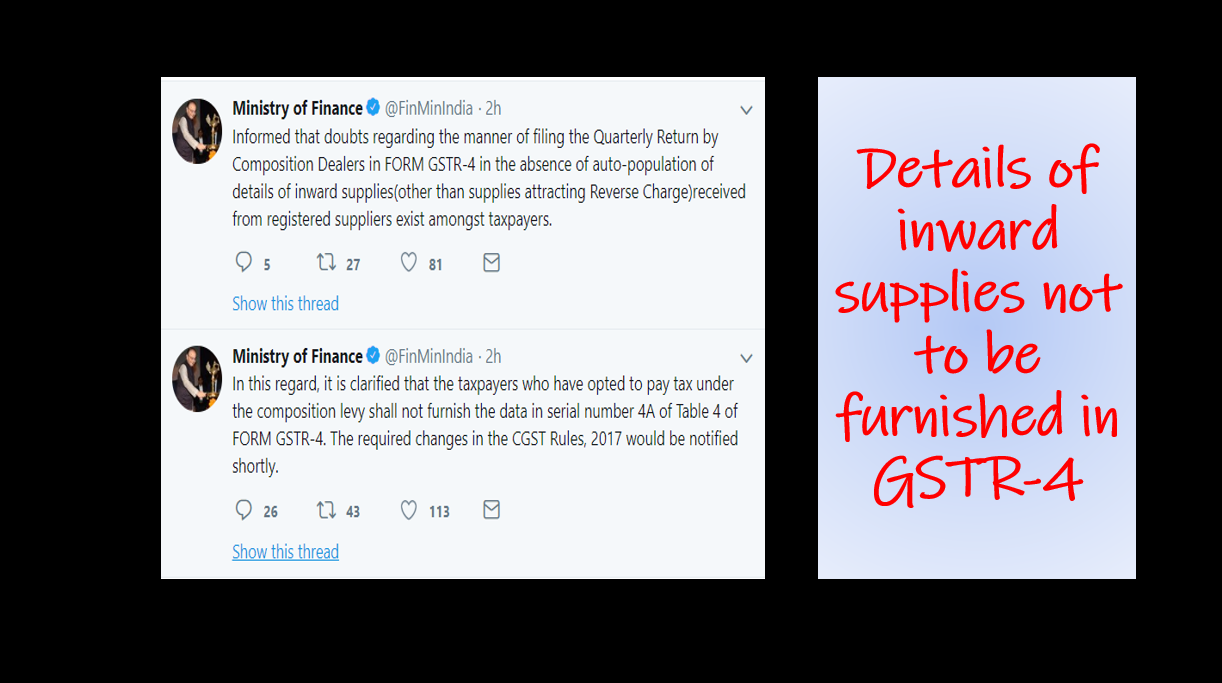

It was brought to the notice of the Government that in absence of auto-population of the details of inward supplies (other than supplies attracting reverse charge) received from registered suppliers, Composition taxpayers were having trouble and had doubts regarding the manner of filing the quarterly return FORM GSTR-4.

To clarify this doubt, the Finance Ministry issued a press release on 17th October 2018 stating that the taxpayers who have opted to pay tax under the composition levy shall not furnish the data of inward supplies from a registered dealer in Table 4A of Form GSTR – 4.

The government has also issued a CGST notification no. 60/2018 dated 30th October 2018 for the same & made an amendment (Thirteenth Amendment, 2018) in the CGST Rules, 2017.

Extract from Notification 60/2018 for reference

Conclusion

The above clarification has addressed the ambiguities which the composition dealers had regarding the disclosure requirement specifically relating to inward supplies when the auto-population feature which was available on the GST portal was not working. Reporting in table 4A of GSTR-4 is not mandatory.

Note: Only the details of inward supplies from a registered supplier(Table 4A) are not mandatory, but details of all other inward supplies like supplies attracting reverse charge (Table 4B), supplies from an unregistered supplier (Table 4C), and supplies relating to the import of services (Table 4D) are to be furnished while furnishing the quarterly return.

⇒ Press release clarifying the manner in which GSTR 4 is to be filed by Composition Dealers.

⇒ CGST Notification no. 60/2018 dated 30th October 2018.

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment