Last updated on May 15th, 2021 at 10:03 pm

Hurry up!!! Last chance to avail the input tax credit

Overview

As per section 16(4) of CGST Act 2017, a registered taxpayer can avail the input tax credit on the invoices or debit notes for the supply of goods or services or both of the previous financial years on or before the due date of furnishing the return(GSTR -3B) for the month of September following the end of the financial year or furnishing of the relevant annual return, whichever is earlier.

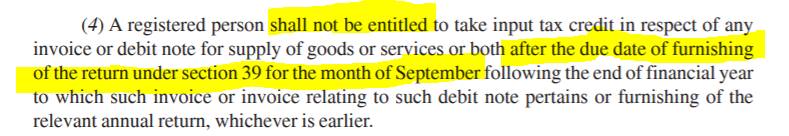

Section 16(4) for your reference

What all needs to be verified or reconciled before filing returns (GSTR-1 and GSTR-3B) for the month of September?

-

Reconciliation of ITC availed in GSTR-3B with the books or corresponding invoices/ bills /documents

If due to some human or system error recording of any invoice was left. Then the registered taxpayer has the last chance to avail the input tax credit for the same by recording the same in GSTR -3B of September Month.

It is possible that an invoice has been raised by a vendor but it has not been received by the purchaser/ receiver due to any reason, then in such cases a follow up with the vendor and get the invoices and then avail ITC within the time.

-

Reconciliation of input tax credit availed in GSTR-3B with input tax credit as per GSTR-2A

One needs to verify whether only the credit which was available as per GSTR-2A/GSTR-2B has been availed in GSTR-3B. If the taxpayer has failed to avail any ITC as per GSTR-2A/GSTR-2B then the same shall be availed now. There can be many reasons for the difference between the credit available as per GSTR-2A/GSTR-2B and credit availed in GSTR-3B.

-

- Non -filing of GSTR-3B,

- Incorrect GSTIN was entered so credit is not reflecting,

- A clerical error may lead to the incorrect amount of credit available,

- A seller might have recorded it as a B2C transaction instead of B2B, etc.

- Verify whether the ITC on bank charges have been availed in GSTR-3B or not

Banks are liable to pay tax on the income they earn by way of bank charges from customers etc. The said tax paid by the bank will be an input tax credit for the customer. But it is possible that the invoice for the same has not been received by the customer from the bank, so a follow-up with the bank is needed to get the invoices and then avail ITC within the time.

-

Verify whether any transaction has been recorded as B2C instead of B2B

It is possible that the GSTIN number was not provided initially to the vendor and this has resulted in the issuance of the wrong invoice i.e. supply to an unregistered person (B2C). In such cases, it is the last opportunity to get those invoices amended from the vendor as B2B and then avail the ITC for the same. You must also make sure that the vendor further rectifies the same in his GSTR-1 not later than GSTR-1 for the month of September.

-

Inter-company transactions/ Inter-organization transactions

It is possible that certain administration/ business support services (like Tax/HR/Legal/Finance Team) are provided by one of the units/branches/subsidiary etc to the other unit/branch/head office/parent company etc. It may have different GSTIN based on location or business etc. so it would be counted as a distinct person under GST. And the supply of services to such a distinct person would call for payment of GST for providing a service. Generally, the cost for the services may be apportioned between the different units but it is possible that GST was not charged for the same which would lead to non-compliance. So it is advised to check such transactions and the provider(one unit) of such service makes the GST payment first and then it is availed by the receiver(other units) of service.

- Credit notes relating to invoices of the financial year

To reduce the GST liability to the extent of credit notes issued relating to invoices of the financial year, such credit notes need to be mandatorily uploaded on or before filing GSTR-1 for the month of September after the end of the financial year.

- Debit notes relating to invoices of the financial year

Input tax credit on all the debit notes which are issued by the supplier/vendor within 6 months from the financial year which pertains to original invoices raised in the financial year has to be availed before the due date of filing GSTR-3B for the month of September.

-

Verification of ITC available for distribution by Input Service Distributor

All the recipient units should avail of the input tax credit based on the invoices issued by an input service distributor of the financial year . It is advised that all such ITC distributed on ISD invoices should be availed on or before the due date of the return(GSTR-3B) for the month of September.

Related Posts

None found

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment