Last updated on May 9th, 2021 at 01:09 pm

How Yes Bank FPO spoiled the party for its existing shareholders

The Issue

Yes Bank launched follow on public offer (FPO) of an issue size of Rs 15000 crore out of which Rs 200 Crore was reserved for eligible employees. The equity shares offered for the fresh issue had a face value of Rs 2 each with a price band of Rs 12-Rs 13. The issue was open from 15th-17th July. The FPO fell short of 100% subscription and raised Rs 14267 crore.

Fundamental weaknesses analyzed

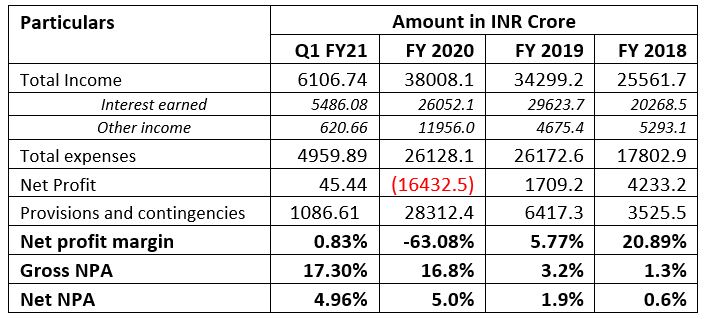

- Latest financial performance in Q1 FY 2021– Net profits fell to Rs 45.4 crore for Q1 FY 2021 as against profits of Rs 113.76 crore in the corresponding quarter last year. Total provisions for Q1 FY 2021 stood at Rs 1087 crore; gross NPAs increased to 17.3% for the quarter.

- Significant NPAs and losses in FY 2020 – Significant gross NPAs of 16.8% and net NPA of 5% in FY 2020. There is a net loss of Rs (16432.1) crore in FY 2020 as against a profit of Rs 1709.2 crore in FY 2019 due to NPA of Rs 32877.5 crore in FY 2020 (NPA being Rs7882.5 in FY 2019)

- Declining Deposits – Deposits have reduced significantly by 53.7% to Rs 105311.1 crore in FY 2020 from Rs 227557.0 crore in FY 2019 which shows lower confidence among depositors leading to deposit withdrawals.

- Reduction in core interest income – Total income has increased to Rs 38,008.1 crore in FY 2020 but it can be seen from the table that interest earned has decreased by 12% to Rs 26052.1crore from Rs 29623.7 crore in FY 2019. This decrease is due to a rise in NPA’s and a reduction in interest income from investments.

- Increase in provisions and contingencies – Provisions and contingencies have significantly increased to Rs 28312.4 crore in FY 2020.

Table 1 – Financials and Ratios

How the share price tumbled?

The price band for the FPO fixed at Rs 12 – Rs 13 was half than its closing market price of Rs 25.5 prior to its launch. Further one can see a downward trend since the FPO was launched. The heavy discount offer in FPO seems to reveal the real value of Yes bank share and thus spoiled the sentiments for its existing investors. The stock is currently quoting even below its FPO price at Rs 11.9 on 28th July 2020! Fluctuations in the share price can be seen from the chart below.

Future Prospects

Weaker net profit margins, reducing deposits, and interest income point towards deteriorating fundamentals (can be seen from table 1 of financials and ratios). NPAs are at high levels and shall increase further once the moratorium period is over for Yes Bank and NBFC sector as a whole. Further, already bad and risky assets would continue to be impacted due to COVID and overall economic stagnancy. Hence, one might continue to see more pressure on the stock in the near future.

Related Posts

- One MobiKwik Systems Limited, MobiKwik IPO - 14/10/2021

- Bharti Airtel Rights Issue- Should You Subscribe? - 07/10/2021

- How to Check your IPO Allotment status? - 28/09/2021

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment