Last updated on September 14th, 2022 at 01:11 pm

Changes in GSTR 3B

Analysis of changes in Table 4 of GSTR 3B and its reporting explained with an example

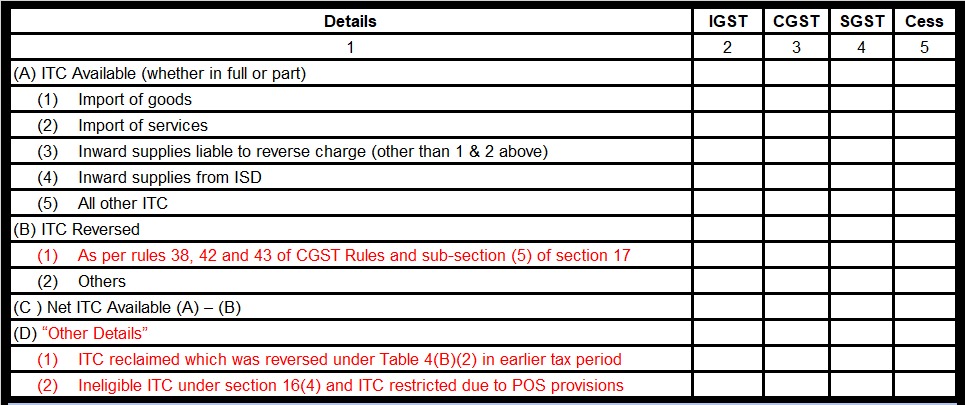

Recently following changes have been made in Table 4 (ITC) of Form GSTR – 3B vide a CGST notification no. 14/2022 dated 05th July 2022. Taxpayers are now expected to correctly report the availment of ITC, reversal of ITC, and ineligible ITC as the same has been incorporated on GST Portal for GSTR 3B of August 2022 i.e 01.09.2022 onwards. Changes are highlighted in Red color: –

Table 4 of GSTR 3B – Eligible ITC

Major changes & corresponding clarifications in an advisory issued by GSTN

As the above-mentioned changes have been incorporated in Form GSTR 3B,

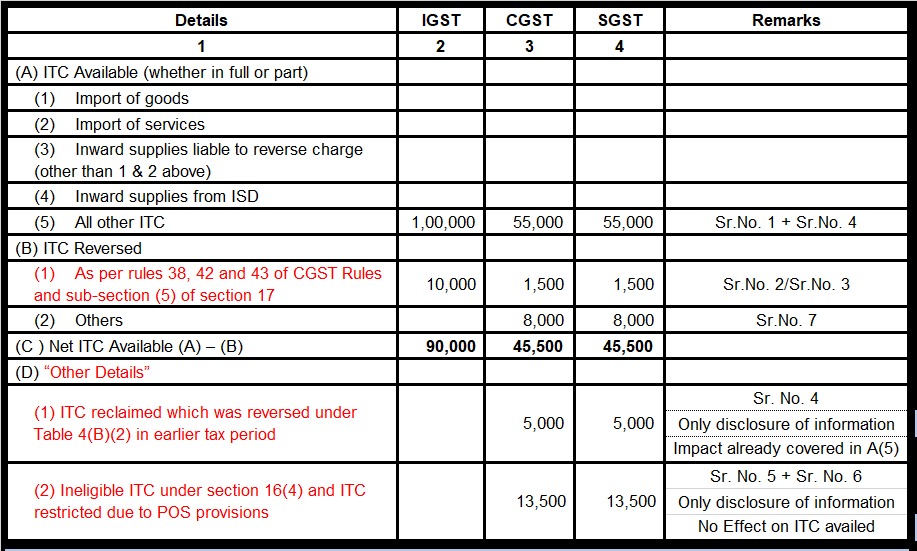

⊗ Table 4(A)(1) t0 (5)– Total ITC appearing in GSTR-2B (assuming 2B does not contain any absurd/ irrelevant entries) has to be availed.

⊗ Table 4(B)(1) -All the non-reclaimable reversals of ITC are to be reported. – ITC that is blocked as per section 17(5) or ITC to be reversed as per Rule 38,42 and 43.

- Rule 38 – 50% ITC for Banking Company.

- Rule 42 – Inputs/Services being partly for business/partly for personal purpose.

- Rule 43 – Capital Goods being used partly used for business/partly for other purposes or partly for effecting taxable/zero-rated and partly for effecting exempt supplies/non-GST supplies.

⊗ Table 4(B)(2) – All the reclaimable reversals of ITC are to be reported in Table 4(B)(2). – Any ITC availed inadvertently in Table 4(A) in previous tax periods due to clerical mistakes or some other inadvertent mistake may be reversed here.

⊗ Table 4(D) – Other details are only for the purpose of disclosure of required information and do not have any +/- effect on ITC availed in GSTR-3B

- Table 4(D)(1) -Reclaimable ITC reversals to be reported 4(B)(2). To be reclaimed in 4(A)(5) at an appropriate time and to be disclosed in 4(D)(1) of the same return.

- Table 4(D)(2) – ITC mentioned in GSTR-2B but ineligible due to section 16(4) – Cut-off date or due to provisions relating to place of supply. A relevant remark is mentioned against such entries in GSTR-2B.

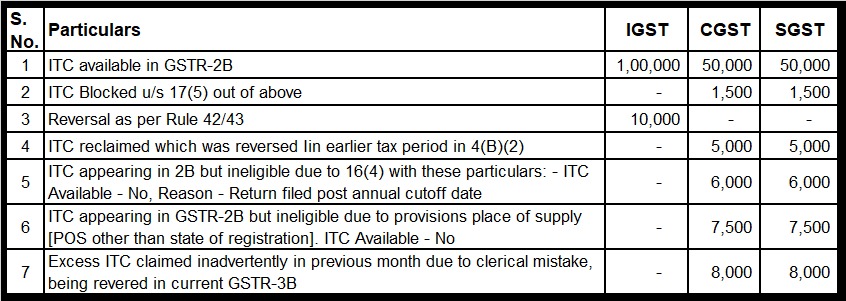

Example explaining changes in Table 4 of GSTR 3B

How to report the above in Table 4 of GSTR 3B?

Apart from the above changes, CBIC has proposed a list of comprehensive changes in FORM GSTR-3B

- Auto-population of values from GTSR-1 into GSTR-3B

- Provision for allowing amendment in GSTR-3B

- Allowing negative values in GSTR-3B

- Streamlining the process of settlement of IGST revenues.

Related Posts

- Guidelines for filing & revising Tran-1 & Tran-2 - 10/09/2022

- Changes in GSTR 3B - 06/09/2022

- Clause 44 of Tax Audit Report - 24/08/2022

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Isn’t it a ‘good and simple tax”

There were advertisements claiming that GST: A Good and Simple Tax.