Last updated on March 23rd, 2021 at 05:00 pm

Changes in E-way bill applicable from 1st October 2018

Overview

E- waybill is an electronic waybill that is required for the movement of goods valuing more than Rs.50,000 in a vehicle to be generated on the e-way bill Portal or through an SMS. A unique e-way bill no. EBN & a QR code will be assigned for the consignment to the supplier, recipient, and the transporter upon generation of e -waybill.

There are a few changes made in the E-way bill system which taxpayers & transporters need to abide by, for generating E-way bills from 1st October’2018.

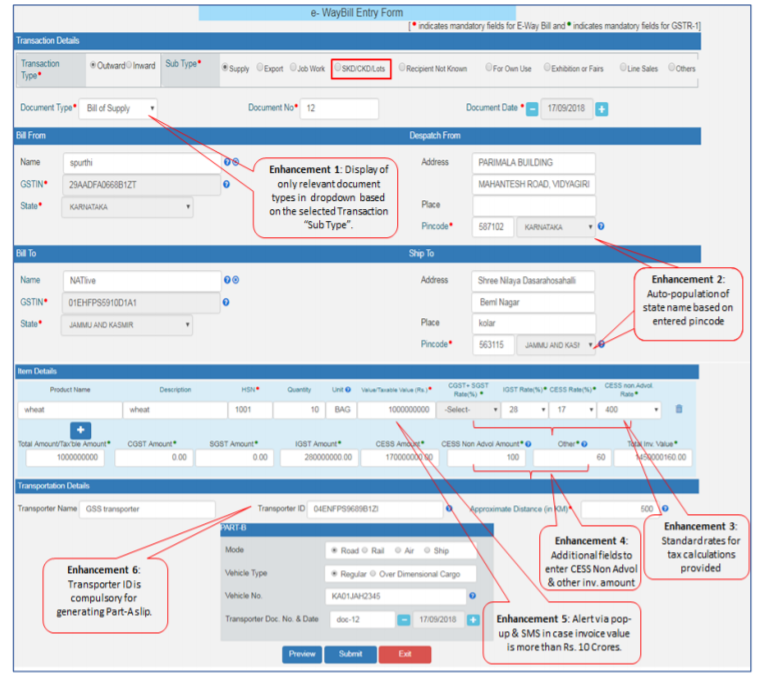

A few enhancements done in the E-way bill Generation form are:

DOCUMENT TYPE

Once “transaction type” & “sub-type” is selected; then for the “document type” section, only relevant documents will be displayed in the drop-down list based on the selection of transaction & sub-type.

This change/enhancement is done in order to make sure that taxpayers select only the correct document type applicable while generating the e-way bills.

STATE NAME

Once the taxpayer fills in the requisite details i.e. pin code in “Bill From” & “Bill To” sections (i.e at the consignor or consignee addresses), then state name will auto-populate based on the entered pin code.

In exceptional cases, if one pin code belongs to more than one state then the state name needs to select from the drop-down list.

If in case a particular pin code even after being valid is not being accepted, then the state needs to be manually selected from the drop-down list and proceed (or can raise an issue with the helpdesk for resolution and clarification.)

This change/enhancement is done in order to avoid the chances of errors by taxpayers while generating the e-way bill.

STANDARD RATE

Once the HSN code is entered, then the standard rate of tax (%) needs to be selected based on (intrastate/inter-state) transaction from the drop-down list which will auto-populate. After selecting the applicable rate, the system will calculate & the amount of tax will auto-populate in CGST, SGST, IGST & CESS etc.

Note: It is not mandatory to select the tax rates or to enter the tax amounts while generating the e-way bill. (source: New FAQs on e-way bill system)

This change/enhancement is done in order to avoid chances of errors in the applicable tax rates and to match the values in the invoice and e-way bill.

CESS NON-ADVOL & OTHER VALUE

The amount needs to be calculated for “CESS Non-Advol” and manually entered in the additional field provided. And if there is any discount or any other charges mentioned in the invoice, the same can be entered in the “Other Value” field.

CESS Non-Advol amount depends upon the quantity and unit. (CESS Non-Advol explained in detail)

If the total invoice value > sum total of taxable value plus applicable taxes plus/minus charges

- then the system will alert the user through a pop-up and but the user can ignore this and proceed further with the generation of the e-way bill.

If the total invoice value < sum total of taxable value plus applicable taxes plus/minus charges

- then the system will alert the user and also not allow the user to proceed further without correcting the invoice value.

- Note Difference to the extent of Rs. 2 is the maximum that will be ignored by the system.

This enhancement/change is done in order to match the “total invoice value” with “total taxable value including applicable taxes and charges” for which the e-waybill is being generated.

- Click here to download the “Enhancements in E-Way Bill System from 1st October 2018” issued on the e-way bill portal

- Click here to understand the process of moving the consignment of one e-way bill in multiple vehicles from the transshipment place to reach the destination

- Click here to understand the process of issuing bulk e way bill

INVOICE VALUE > 10 crores

If the invoice value entered is more than 10 crores then just as a precautionary measure,

Pop up will be displayed at the same time

SMS will be sent on the registered mobile number

And additional pop up will also be displayed at the time of submission of the e-way bill entry form

If the amount entered in the “invoice value” section is correct, then the pop up/SMS can be ignored to proceed further. But if it was an error then corrective actions can be taken.

Note: this facility of pop-up and SMS is only there if the incorrect invoice value entered is above 10 crores.

This enhancement/change is done in order to assist/alert generator of e waybill to correct/cancel in case of higher invoice value if it has been entered wrong or there is a typo error.

Transporter ID

A taxpayer while generating the e-way bill (i.e Part A) needs to also enter the details in Part -B. As per rule 138(3) taxpayer needs to mandatory enter the transporter’s ID, this only enables the transporter to fill up the details in Part B and complete the generation of an e-way bill.

Note: Part-A will not be generated without details of transport’s ID in Part-B.

This change/enhancement is done in order to enable the taxpayer to generate Part-A only when the transporter has been finalized.

Related Posts

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment