Last updated on July 24th, 2022 at 07:44 pm

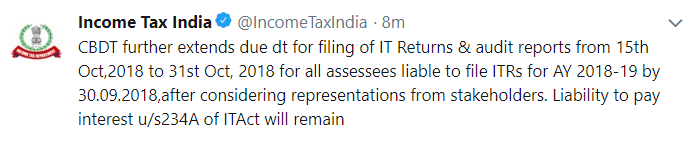

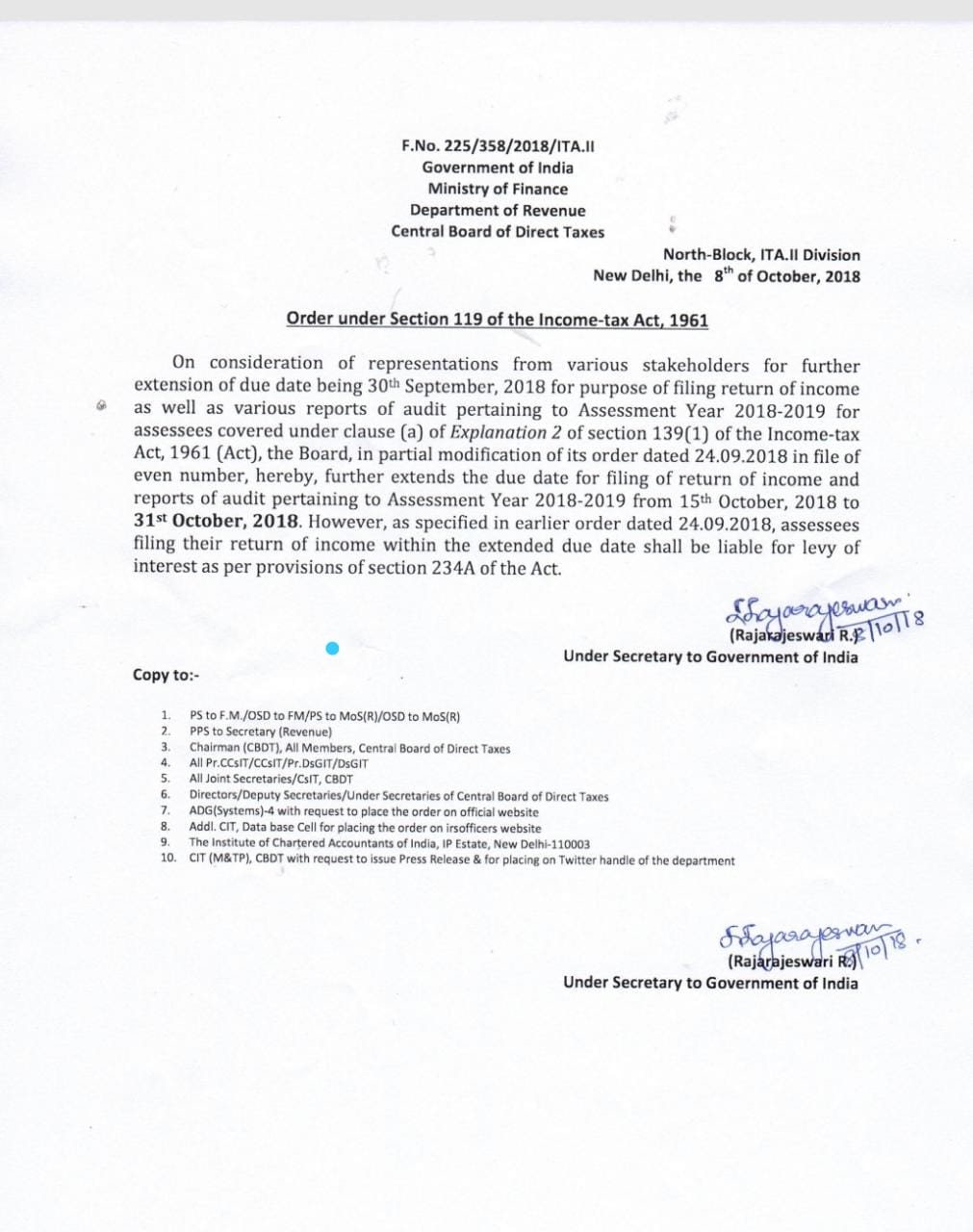

Due date for tax audit for AY 2018-19 extended to 31st October’2018

Due date After taking into consideration various representations made by stakeholders and ICAI the due date has been further extended by 15 days from 15th October 2018 to 31st October 2018. Deadline for filing the tax audit for Financial Year 2017-18 and Assessment Year 2018-19 which was 30th September 2018 has been further extended by 15 days to 31st October 2018.

Interest u/s 234A

It is important to note that extension of the due date will not have any effect on interest u/s 234A which is to be paid for delay in defaults of furnishing the return. The assessee shall continue to remain liable for payment of interest as per provisions of sec ion 234A of the Act. However, to save the excess payment for interest u/s 234A, an assessee is advised to make the payments for the taxes due till 30.09.2018 and file the return and tax audit report till 31.10.2018.

Late Fees u/s 234F

There will be no levy of late fees of Rs. 1000/5000 as per section 234F if the return is filed within the extended due date 31.10.2018.

Carry forward of losses

Losses from the head ” Profit & gains from business & profession as well as losses from the head “Capital Gains” will be permitted to be carried forward if the return is filed within the extended due date 31.10.2018.

Section 43B

Expenses which are allowed based on payment as per section 43B will be allowed as deduction if the same is paid on or before the filing of the return (return should be filed within the extended due date 31.10.2018).

Deduction u/s 80-IA to 80-IE & 10AA

Deductions under the above-mentioned sections will be allowed if the return is filed within the extended due date i.e. 31.10.2018.

Tax Deducted at Source

There will be no disallowance (100% or 30% of Expense) of expenses if the TDS for the same was deducted within the stipulated date i.e 31.03.2018 and also the payment for TDS is made on or before the filing of the return (Return should be filed within the extended due date 31.10.2018).

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment