Last updated on March 22nd, 2021 at 07:50 pm

34th GST Council Meeting Updates

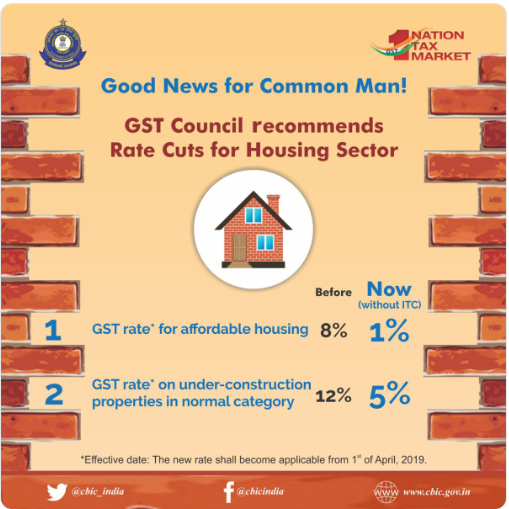

34th GST Council Meeting was held today i.e 19th March 2019 under the Chairmanship of the Union Minister of Finance & Corporate Affairs, Shri Arun Jaitley(via video conferencing) at Vigyan Bhawan, New Delhi. In the previous i.e 33rd GST Council Meeting which was held on 24th February 2019, major decisions were taken regarding GST rate on real estate sector. GST rates were slashed to 1% in case of affordable housing projects and 5% on the construction of houses other than the affordable housing projects.

[su_table]

| Meeting | 34th GST Council Meeting |

| Date | Tuesday, 19th March 2019 |

| Chairperson | Finance Minister Arun Jaitley |

| Venue | Vigyan Bhawan, New Delhi |

| Attendees | Finance Ministers of all the states |

[/su_table]

Key takeaways from 34th GST Council Meeting are :

In today’s meeting mainly the operational details for implementation of the recommendations which were made in 33rd GST Council Meeting were discussed. Following decisions have been taken

What is considered as affordable houses as per GST?

Following will be considered as affordable houses under the provisions of GST

- For Metro cities – all the houses upto 60 sqm in area & upto Rs. 45 lakhs in value and which also meets the definition of affordable houses as decided by GST Council

- For Non-Metro cities – all the houses upto 90 sqm in area and which also meets the definition of affordable houses as decided by GST Council.

- Houses which are being constructed in ongoing projects under the existing central and state housing schemes which are presently eligible for concessional rate of 8% GST (after 1/3rd land abatement).

What is considered as houses other than affordable houses?

Following will be considered as houses other than affordable houses under the provisions of GST

- For NEW & ONGOING projects

All the houses other than affordable houses.

- For COMMERCIAL APARTMENTS

For commercial units like shops offices etc in a residential real estate project (RREP) in which the carpet area of commercial apartments is not more than 15% of total carpet area of all apartments.

What is the new tax rates that will be applicable to affordable houses?

What is the new tax rates that will be applicable to affordable houses?

A new rate of 1% without input tax credit (ITC) will be applicable to the construction of affordable houses. (Old rate 8% with ITC)

What is the new tax rates that will be applicable to houses other than affordable houses?

A new rate of 5% without input tax credit (ITC) will be applicable to the construction to all the houses other than affordable houses. (Old rate 12% with ITC).

Note: All the houses other than affordable houses which will be booked after 1st April 2019(in an ongoing project) then new rate shall be applicable from the date of purchase.

Note : For all the houses other than affordable houses which were booked prior to 01.04.2019(in an ongoing project) for those houses new rate shall be available only on installments that are payable on or after 1st April 2019.

What are the conditions for using the new lowered tax rate?

Following conditions needs to be followed for availing the benefit of lower GST rate

- As GST rates have been reduced, builders/ promoters will not be allowed to claim the benefit of the Input tax credit over and above the slashed rates.

- As the new lowered tax rate is without the input tax credit, it is possible that builders would prefer to purchase from unregistered persons to save on cost. So, Govt. makes it clear that to avail the benefit of slashed rates, 80% of inputs and input services (other than capital goods, TDR/ JDA, FSI, long term lease (premiums)) should be purchased from registered persons only.

- In cases of the shortfall from 80% of inputs and input services (other than capital goods, TDR/ JDA, FSI, long term lease (premiums)), then the builder shall be liable to pay the tax @ 18% on RCM basis.

- If capital goods from an unregistered person then tax at the applicable rate on RCM basis.

- If cement is purchased from an unregistered person then tax at the rate of 28% on RCM basis

Is it compulsory to opt for new GST rate without ITC in the real estate sector for ongoing/ under construction projects?

NO, It is not compulsory.

Promoters have the option to either exercise the option latest by 20th May 2019 and continue to pay tax at the existing rates i.e 8% with ITC or 12% with ITC.

OR

Pay at slashed new rates i.e 1% without ITC or 5% without ITC. (If the option to pay at old rates is not exercised in the prescribed time frame i.e. 20th May 2019).

Note: This option is available only for the ongoing projects which will not be completed by 31.03.2019 and booking for the same has already started before 01.04.2019.

Related Posts

- Can you buy Immovable Property outside India? - 18/09/2022

- Major Highlights of the Union Budget 2022 - 23/02/2022

- Availing Instant Loans made easy - 05/10/2021

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment