Section 112A of the Income Tax Act

Last updated on July 24th, 2022 at 08:09 pmSection 112A of the Income Tax Act The Finance Bill 2018, introduced a new section, Section 112A of the Income Tax Act, The section deals with the […]

Last updated on July 24th, 2022 at 08:09 pmSection 112A of the Income Tax Act The Finance Bill 2018, introduced a new section, Section 112A of the Income Tax Act, The section deals with the […]

Last updated on May 9th, 2021 at 12:05 pmULIPs or Mutual Funds? Where to invest? ULIPs or Mutual Funds? This is an age-old question and the answers to it are different depending on the market […]

Last updated on May 15th, 2021 at 09:19 pmPCA framework: RBI’s tool to tackle Financial Stability Introduction Prompt Corrective Action (PCA) framework is a structured way of resolution for banks which are under-capitalized or are […]

Last updated on May 15th, 2021 at 09:25 pmCrude Oil vs. Brent Crude Oil Crude Oil or “Black Gold” as it is called, has gained a lot of importance in an economy. Changes in Crude […]

Last updated on July 24th, 2022 at 08:07 pmSection 80-IC: Deduction in respect of certain undertakings or enterprises in certain special category states History This Section was introduced by Finance Act, 2003, and will be […]

Last updated on July 24th, 2022 at 08:04 pmHow to register for Income tax e-filing? It is mandatory for all citizens to file their income tax returns in prescribed ITR forms once during the year […]

Last updated on July 24th, 2021 at 04:53 pmNBFC scare: What exactly is the issue? What is NBFC / HFC? and How they are different from banks? NBFC or Non-banking financial companies (NBFCs) are financial […]

Last updated on May 15th, 2021 at 09:25 pmThe U.S. may remove India from Currency Monitoring List What is Currency Monitoring List? U.S. Treasury Department releases a bi-annual report in which it lists the counties […]

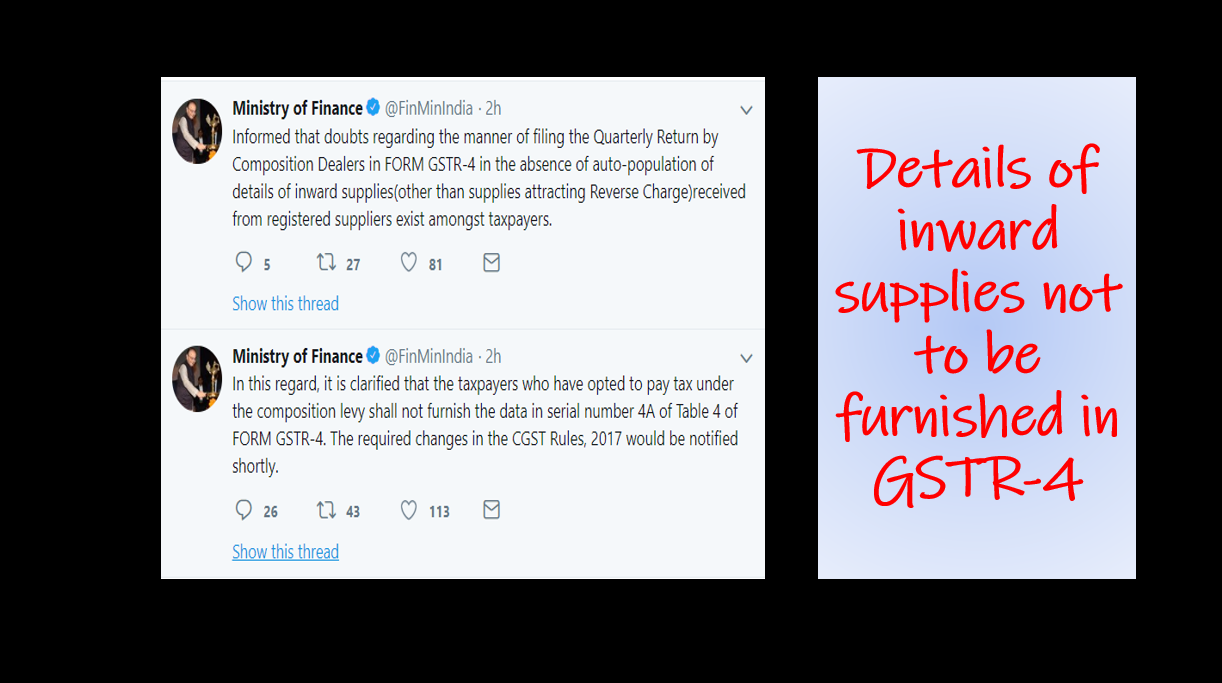

Last updated on September 17th, 2022 at 04:14 pmDetails of inward supplies not to be furnished in GSTR-4 Note: The exemption details discussed in this article were provided by CBIC for GSTR 4(quarterly return) which […]

Last updated on May 9th, 2021 at 04:54 pmHow to demat your shares? We saw in our earlier post, “FAQs on Demat of Shares: Is it mandatory to demat shares“, what is dematerialization or demat […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes