Finance

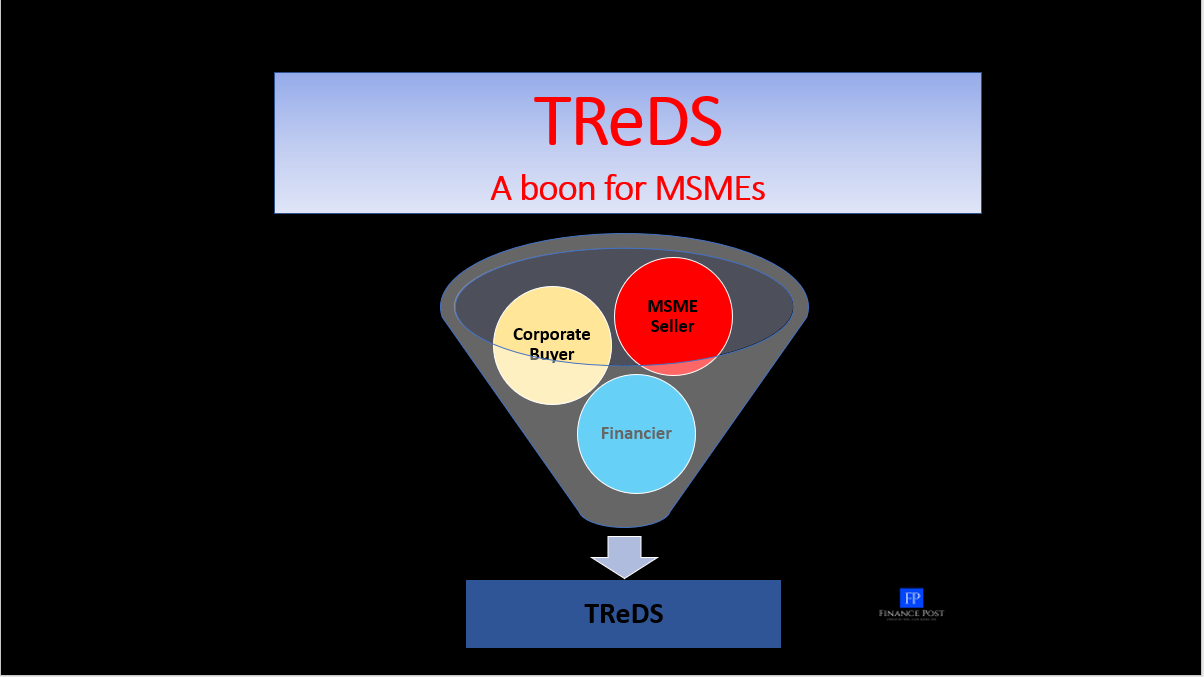

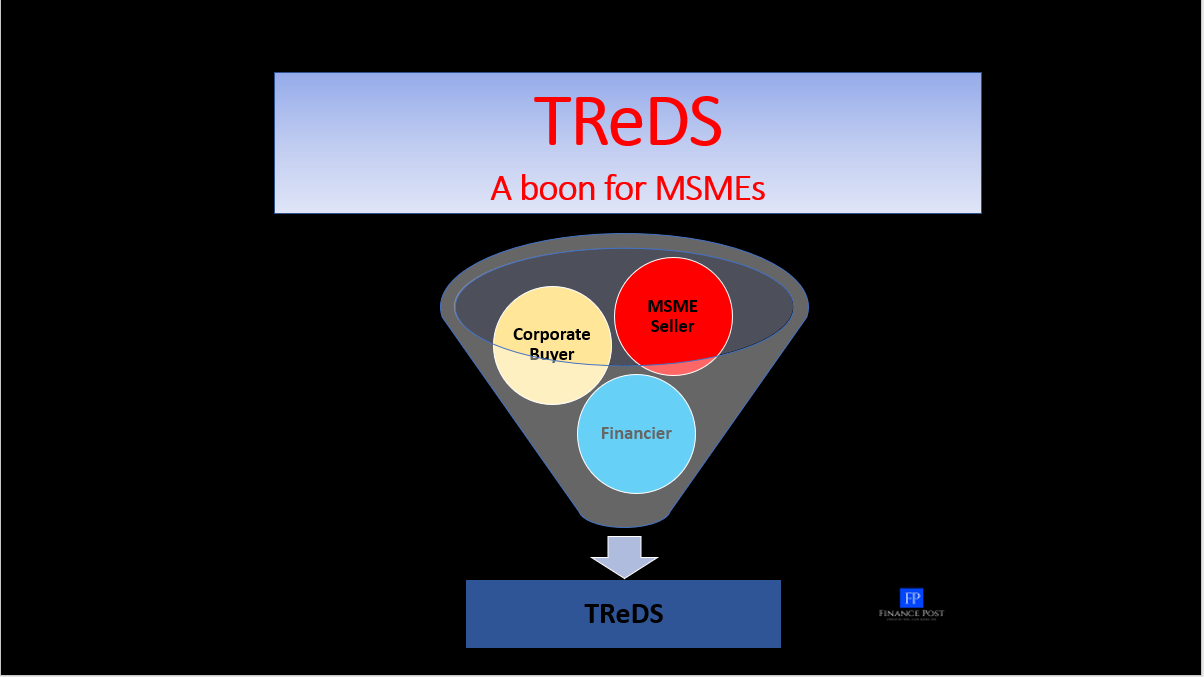

TReDS – A boon for MSMEs

Last updated on July 24th, 2021 at 04:57 pmTReDS – A boon for MSMEs Micro, Small, and Medium Enterprises (MSMEs) play an important role in the development and growth of the economy of the country. […]

Last updated on July 24th, 2021 at 04:57 pmTReDS – A boon for MSMEs Micro, Small, and Medium Enterprises (MSMEs) play an important role in the development and growth of the economy of the country. […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes