Last updated on July 7th, 2021 at 12:33 pm

Fundamental Analysis- GR Infraprojects IPO

Key Financial Highlights of GR Infraprojects IPO

- Total revenue for FY21 rose by 23% to Rs 7906.94 crore from Rs 6423 crore for FY20.

- PAT is showing an increasing trend throughout the last three fiscals FY18-FY20.

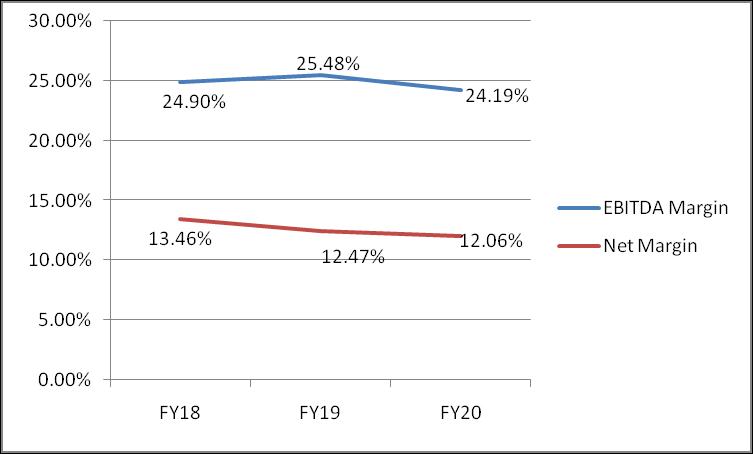

- EBITDA and the Net Margins are plotted in the chart below. Some pressure can be seen in the margins as it shows a slight decline over the last three fiscals.

- Total debt is Rs 4758 crore and debt to equity is 1.2x for FY21.

- Return on net worth is 23.95% for FY21.

Check out GR Infraprojects IPO Offer Details and Business Analysis here

Valuation parameters

The valuation figures are as of 31st March 2021. The Issue is priced at 8.5 times its earnings which is well below its peers and thus the Issue appears to be reasonably priced. The P/BV is 2.03x calculated at the upper price band of Rs 837 per share.

| Valuation Parameters | EPS | P/E | NAV | P/BV |

| 98.31 | 8.51 | 411.63 | 2.03 |

Key financial parameters of the peers

| Listed Peers | P/E | RoNW | EPS |

| KNR | 15.2 | 20.79% | 14.49 |

| PNC | 12.9 | 16.28% | 19.37 |

| HG Infra | 10.58 | 22.27% | 36.31 |

| Dilip Buildcon | 17.42 | 7.84% | 31.92 |

| Ashoka Buildcon | 10.61 | 44.60% | 9.84 |

| IRB | 48.74 | 1.70% | 3.33 |

| Sadbhav | 1.65 | 49.53% | 46.21 |

Conclusion

The infrastructure sector in India has a huge scope of improvement; only 24% of the national highway network in India is four-lane. India is expected to become the world’s third-largest construction market and huge investments would be required. Though, it can take a longer time for this sustainable development of the infrastructure.

GR Infra is focused more on EPC activities i.e. road projects and has a track record of timely completion through its in-house integrated model. The Issue is reasonably valued and has consistent financial performance with strong gross margins. Hence, an investor may subscribe for the long term. RHP

RHP

https://www.sebi.gov.in/filings/public-issues/jun-2021/g-r-infraprojects-limited_50742.html

- One MobiKwik Systems Limited, MobiKwik IPO - 14/10/2021

- Bharti Airtel Rights Issue- Should You Subscribe? - 07/10/2021

- How to Check your IPO Allotment status? - 28/09/2021

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment