Last updated on December 1st, 2022 at 01:48 pm

GST Annual Return is optional for taxpayers whose AATO<Rs 2 Crores

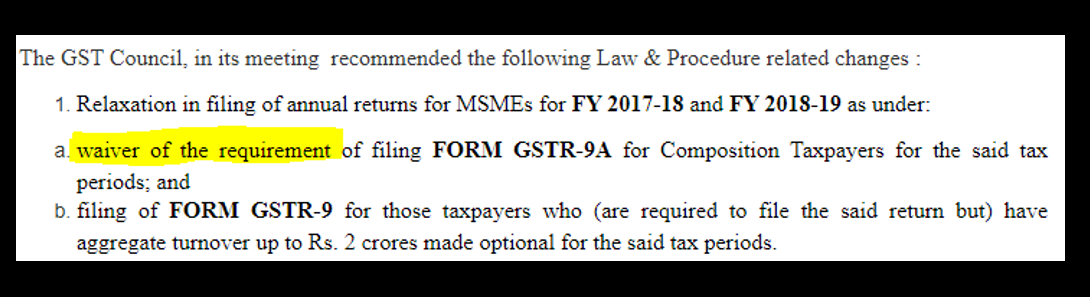

In order to provide relief, a decision was taken in the 37th GST Council meeting that the registered persons whose aggregate turnover in the financial year does not exceed Rs. 2 crores. It will not be mandatory to furnish the GST Annual Return (GSTR 9/GSTR 9A) in respect of FY 2017-18 and FY 2018-19.

GST Annual Return filing u/s 44 (1) of CGST Act for F.Y. 2017-18 and 2018-19 is made optional for taxpayers whose aggregate turnover is less than Rs 2 crores.

A CGST Notification no. 47/2019 dated 9th October 2019 was issued by CBIC to give effect to the decision taken in the GST Council Meeting.

The notification also stated that if the return is not furnished before the due date it shall be deemed to be furnished on the due date.

For whom the furnishing the GST Annual Return is optional?

⇒ Furnishing GSTR 9 for a regular taxpayer whose aggregate turnover is up to Rs. 2 crores in a financial year is optional for financial years 2017-18 and 2018-19.

⇒ Furnishing GSTR 9A for a composition taxpayer is optional for financial years 2017-18 and 2018-19.

Note: The press release issued for the 37th GST Council meeting stated that there is a waiver of the requirement of filing FORM GSTR-9A for Composition Taxpayers for the said tax periods. Whereas the notification states that it is optional for the taxpayers having an aggregate turnover in a financial year that does not exceed two crore rupees.

What is the due date for GST Annual Return?

Check the updated due dates of GST Annual Returns

| Financial Year |

Due Date |

| FY 2017-18 |

05/07.02.2020 |

| FY 2018-19 |

31.12.2020 |

| FY 2019-20 |

31.03.2021 |

| FY 2020-21 |

28.02.2022 |

| FY 2021-22 |

31.12.2022 |

| FY 2022-23 |

31.12.2023 |

Related Posts

None found

Chartered Accountant in practice, DipIFRS (from ACCA, UK), Post Graduate in Commerce, Certified Independent Director (from IICA), and holds a certification in Forex and Treasury Management course (by ICAI).

She can be contacted at info.financepost@gmail.com

Latest posts by CA Ankita Khetan

(see all)

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below