Last updated on July 16th, 2021 at 11:55 am

Tatva Pharma IPO-Fundamental Analysis

Key Financial Highlights of Tatva Pharma

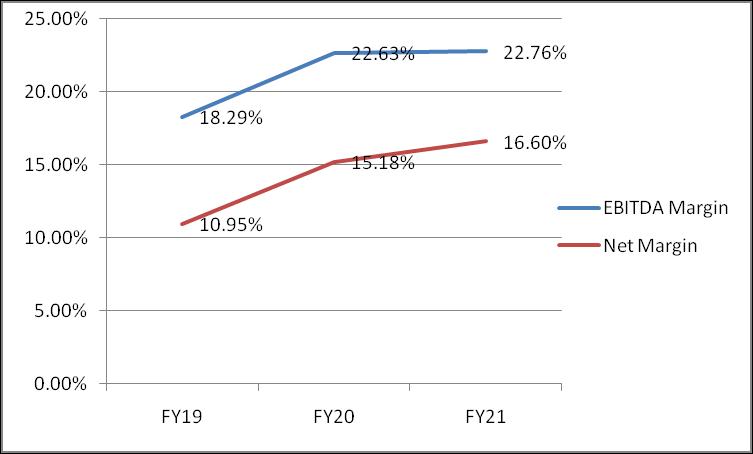

- Financial performance- Tatva Pharma has strong operating and net margins. The topline and the bottomline of the Issuer show an increasing trend and consistent growth.

- Total revenue for FY21 increased 15.75% to Rs 306.29 crore as against Rs 264.62 crore in FY20. The increase in total revenues in FY20 was 28% when compared to FY19.

- PAT showed an increase by 38% to Rs 52.26 crore for FY21, being Rs 37.79 crore for FY19. Profitability margins are plotted in the chart.

- Return on net worth was 31.49%, 32.11%, and 25.77 for FY21, FY20, and FY19 respectively.

- The debt to equity ratio is low, being 0.54 as of 31st March 2021.

- Return on capital employed is 27%, 33%, and 34% for FY19, FY20, and FY21 respectively.

Tatva Pharma IPO-Offer Details

Profitability Margins chart

Valuation of Tatva Pharma IPO

The Issue is valued at 41.62 times its earnings at the higher price band of Rs 1083 per share and with EPS of 26.02 as on 31st March 21. Peer average P/E is 56.05x; hence the Issue is reasonably valued.

At NAV of Rs 82.62 per share as on 31st March 21, P/BV is 13.11x

Valuation parameters

[su_table]

| Valuation Parameters | EPS | P/E | NAV | P/BV |

| 26.02 | 41.62x | 82.62 | 13.11x |

[/su_table]

Peer Comparison

[su_table]

| Peers | Total Income (FY21 in INR crore) | EPS | P/E | RoNW |

| Aarti Ind | 4506.80 | 30.04 | 29.07 | 15.23% |

| Navin Fluorine | 1258.40 | 52.03 | 73.12 | 15.76% |

| Alkyles Amine | 1249.40 | 144.68 | 25.62 | 37.27% |

| Vinati Organics | 980.10 | 26.20 | 77.41 | 17.45% |

| Fine organics | 294.40 | 39.25 | 75.01 | 16.45% |

| Tatva Pharma | 306.30 | 26.02 | 41.62 | 31.49% |

[/su_table]

Investment Strategy/Summary

Tatva Pharma is a specialty chemical company and the companies in this sector have a niche product portfolio with high product customization which creates high entry barriers for the competitors in the form of vendor acquisition, lengthy and complex product approval, registration process, customer loyalty among others. Further, a distinguished and resilient business model is also a unique driver for the companies in this sector.

Tatva Pharma is the largest and only commercial manufacturer of SDAs for zeolites in India. The Issuer is one of the leading global producers of an entire range of PTCs in India and one of the key producers across the globe. SDA and PTC products have various applications in green chemistry, which is pertinent considering the growing focus on green and sustainable technologies. The rising demand and adoption of green chemistry in organic synthesis is expected to drive the growth of PTCs market across the globe. Hence looking at bright business prospects and strong financial profile; one might subscribe to the IPO.

- One MobiKwik Systems Limited, MobiKwik IPO - 14/10/2021

- Bharti Airtel Rights Issue- Should You Subscribe? - 07/10/2021

- How to Check your IPO Allotment status? - 28/09/2021

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment