Last updated on April 2nd, 2022 at 01:17 pm

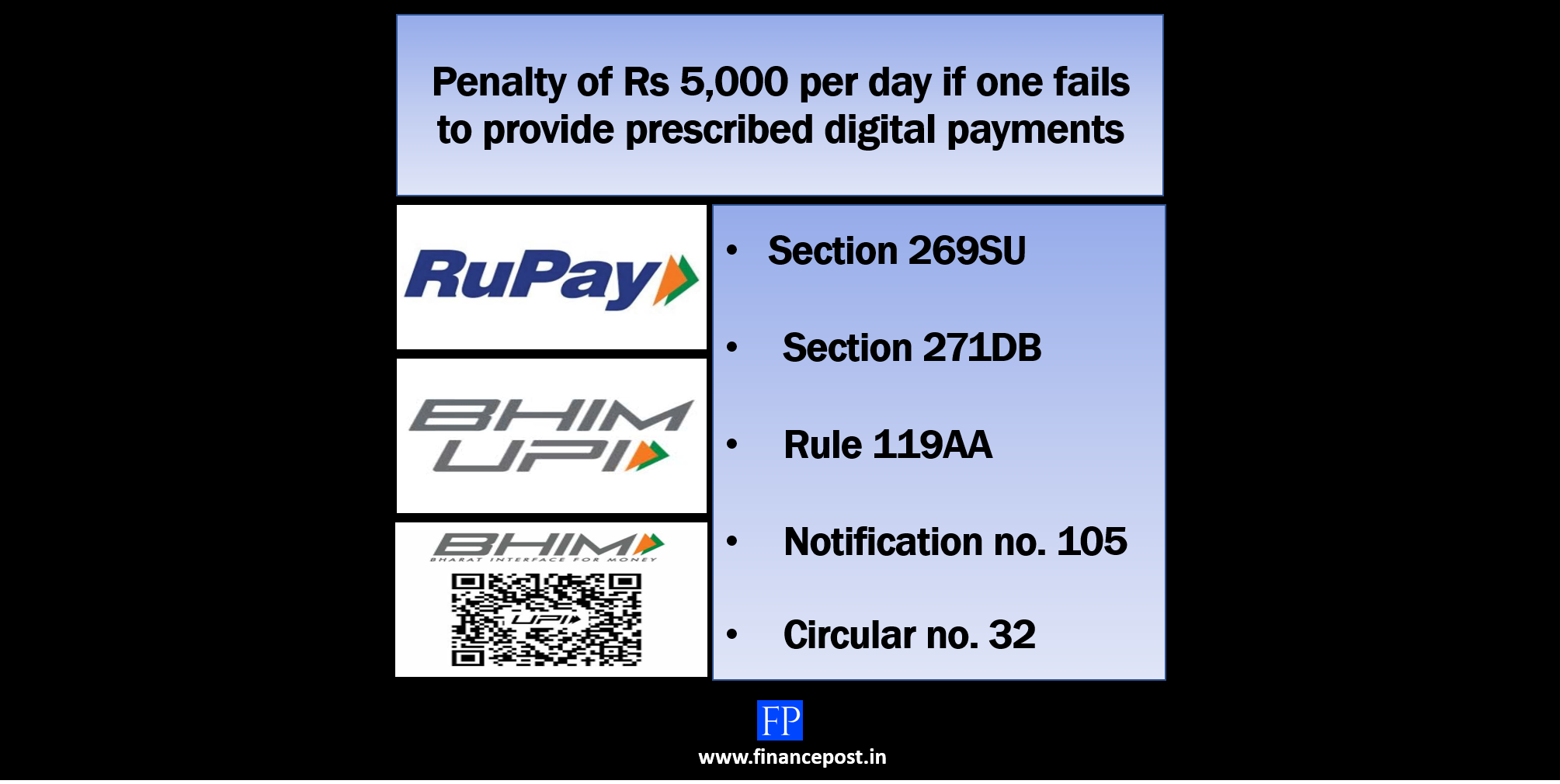

Penalty of Rs 5000 per day for non-compliance with section 269SU by 31st January 2020

Businesses having a turnover of more than Rs. 50 cr. in the immediately preceding previous year are mandatorily required to provide the facility of digital payments. When section 269SU was made effective on 1st November 2019, it was mentioned that certain digital payment modes will be prescribed. Three digital payment modes are prescribed by inserting a Rule 119AA for compliance section 269SU of the Income-tax Act 1961. Click here to understand which businesses will fall under the criteria of section 269SU.

Which are the mandatory digital payment facility required as per section 269SU?

Modes of payment for the purpose of section 269SU are referred to in newly inserted Rule 119AA of Income Tax Rules.

Notification no.105 was issued on 31.12.2019 to amend the Income-tax (16th Amendment) Rules, 2019.

A person, carrying on a business having a turnover of more than fifty crore rupees during the immediately preceding previous year shall mandatorily provide the following facilities for accepting the payment through the following electronic modes, in addition to the facility for other electronic modes of payment.

Mandatory three facilities of digital payment are required:-

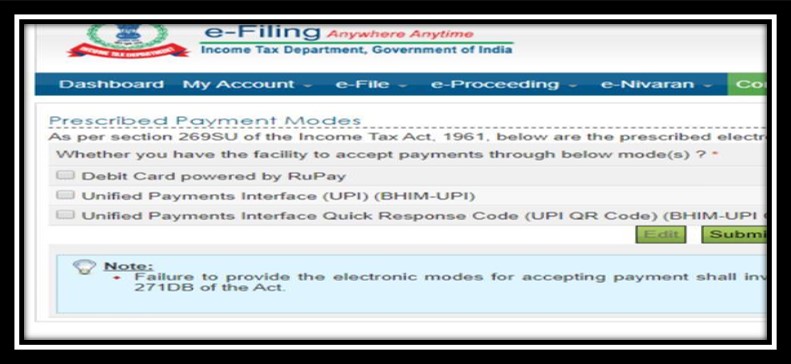

- Debit Card powered by RuPay;

- Unified Payments Interface (UPI) (BHIM-UPI); and

- Unified Payments Interface Quick Response Code (UPI QR Code) (BHIM-UPI QR Code).

Note: Just setting up the facility for accepting the payments through these prescribed digital modes alone will not suffice. The same is required to be confirmed on the Income-tax portal.

How to confirm the compliance of section 269SU on the Income-tax Portal?

Step 1: Login on the Income-tax Portal with your login ID credentials and password.

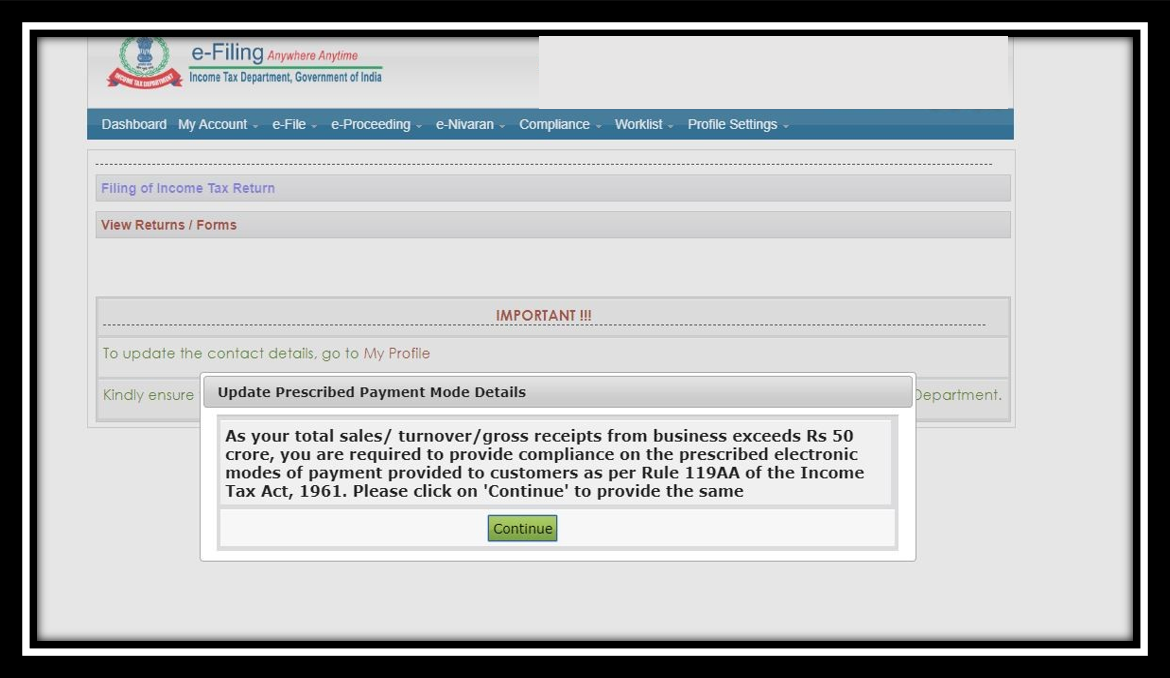

Step 2: It will automatically pop up to confirm whether prescribed payment mode details as per Rule 119AA are updated or not. Click continue to confirm.

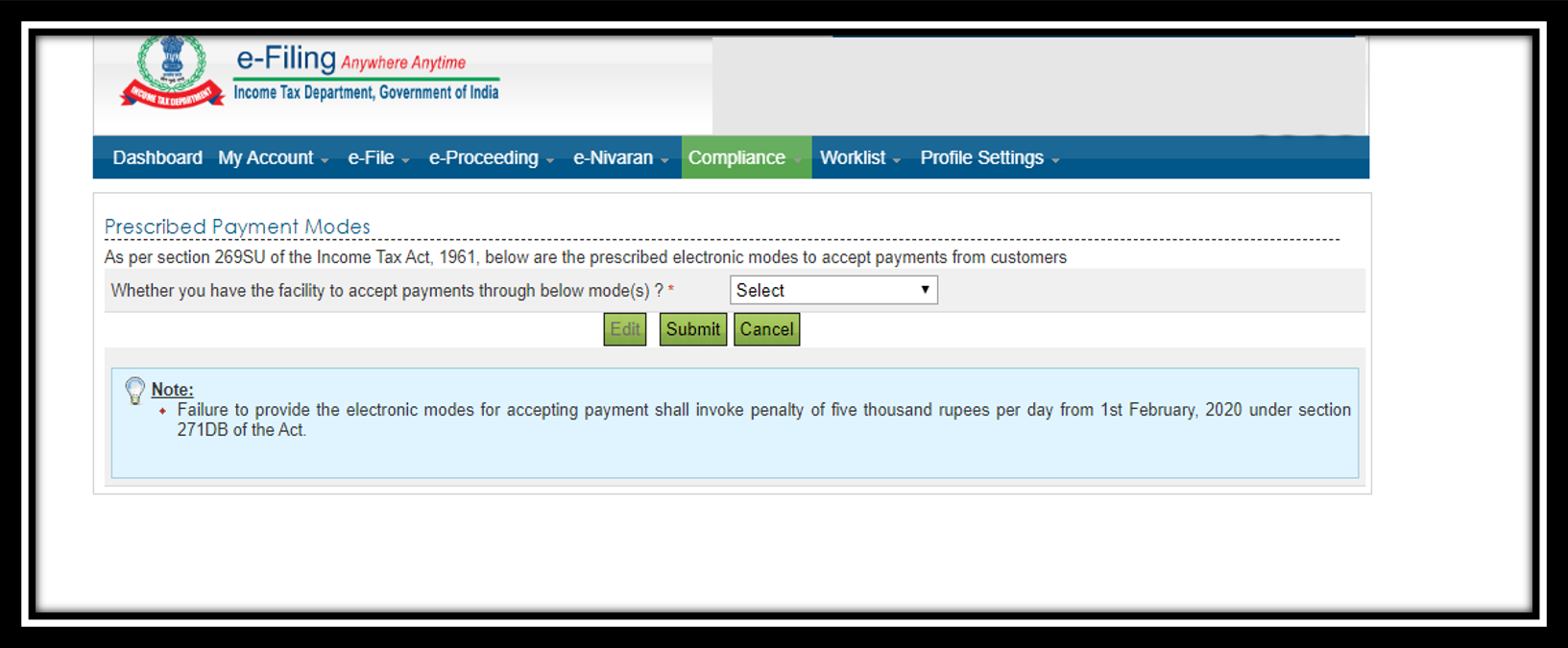

Step 3: Once you click on “continue” in step 2 it will redirect you to the page shown below, you have to select “yes” or “no”. If you select “no” penalty u/s 271DB will be applicable to you. So you should select “yes”.

Step 4: Once you select “yes” in step 3 it will redirect you to this page where you have to tick mark the digital payment facilities one provides and click on submit. And the compliance u/s 269SU is finished.

What is the penalty for non-compliance with section 269SU?

As per penal provisions of section 271DB of the Income Tax Act – Businesses that do not have the provision to accept the payments in digital modes as required by section 269SU will be penalized with a penalty of Rs 5000/- per day for the period of default.

Note: Relief from penal provisions will be provided if there was sufficient cause for such failure.

A circular no. 32 to clarify prescribed electronic modes dated 30th December 2019 was issued for the benefit of the eligible assessees as per section 269SU of the Income Tax Act that the prescribed digital payment facility as per Rule 119AA are installed and made operational on or before 31st January 2020 for accepting the payment.

Note: There is no maximum limit specified for this penalty. Hence, the total penalty will be equivalent to Rs 5000 multiply by the number of days the failure continues.

Difference in penalty section 271DB and Circular no. 32

- As per circular no. 32, if the specified person (businesses having turnover of more than Rs. 50 crores in preceding previous year ) fails to comply with provisions of section 269SU then the penalty of Rs 5000 per day will be levied from 1st February 2020.

- As per section 271DB(2) states that the penalty specified in section 271DB(1) can only be imposed only by the Joint Commissioner of Income-tax.

Related Posts

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment